The facilitation of M&As in Vietnam’s logistics sector

The World Bank’s Logistics Performance Index (LPI) serves as a key measure to help economies identify and address issues within their logistics systems. While Vietnam’s GDP rankings have steadily improved over the years, its LPI rankings have fluctuated, reflecting the inconsistent growth of the sector.

|

| Le Minh Phieu, founder, LMP Lawyers |

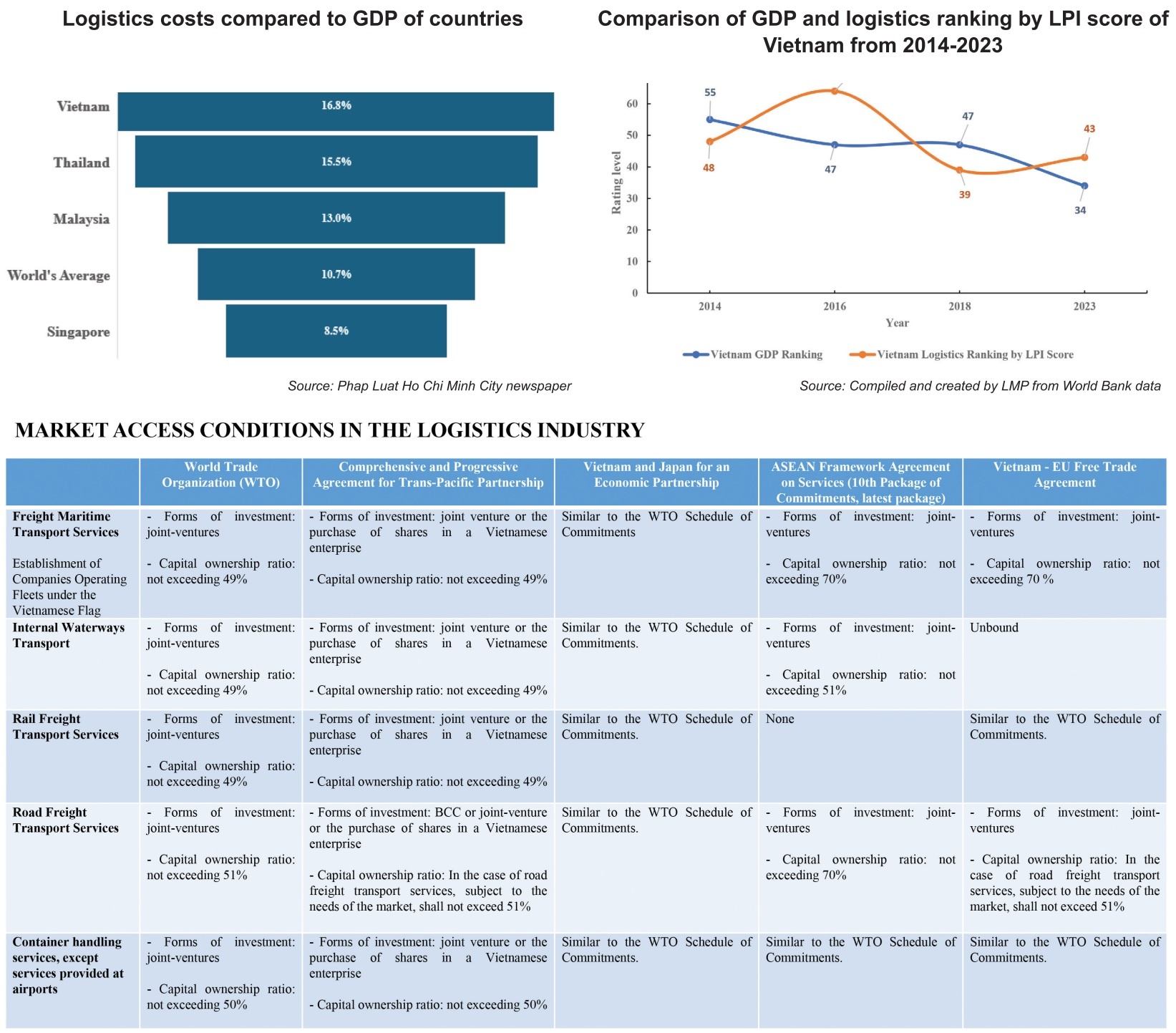

Examining the LPI rankings of various countries in 2014, 2016, 2018, and 2023, alongside Vietnam’s GDP rankings during the corresponding years, it becomes evident that while Vietnam’s GDP rankings have steadily improved over the years, its LPI rankings have shown inconsistent trends.

Vietnam’s GDP ranking has shown consistent and steady improvement over the years, climbing from 55th place in 2014 to 34th in 2023. In contrast, the country’s Logistics Performance Index (LPI) rankings have fluctuated. Starting at 48th place in 2014, Vietnam’s LPI ranking dropped to 64th in 2016, rose to 39th in 2018, and then fell again to 43rd in 2023. This volatility reflects the inconsistent growth of Vietnam’s logistics sector on a global scale.

By 2023, while Vietnam’s economy was ranked 34th by the World Bank, its LPI ranking stood at 43rd – 10 places lower than its GDP ranking. This discrepancy indicates that the development of Vietnam’s logistics sector, as reflected in its LPI ranking, has not kept pace with the nation’s economic standing.

Vietnam’s logistics sector continues to face significant challenges in infrastructure development and policy frameworks. The lack of synchronised transportation infrastructure, particularly in logistics hubs, seaports, and airports, has resulted in high logistics costs compared to regional peers. According to the Vietnam Logistics Business Association, Vietnam’s logistics costs account for 16.8 per cent of GDP, compared to the global average of 10.7 per cent.

Within the ASEAN region, Vietnam’s logistics costs are notably higher than those of Singapore (8.5 per cent), Malaysia (13 per cent), and Thailand (15.5 per cent). Furthermore, Vietnam’s port infrastructure fails to meet export demands, necessitating the movement of goods through major ports in Ho Chi Minh City or Ba Ria-Vung Tau. This adds to the strain on transportation infrastructure and increases transportation costs.

However, Vietnam’s infrastructure is being heavily invested in: the highway system is being completed with many roads still under construction, the Long Thanh International Airport, the Can Gio international transshipment port project, and the North-South high-speed railway project are underway. Once completed, these infrastructure developments are expected to enhance the competitiveness of the logistics industry.

Additionally, the rapid growth of e-commerce has become a viable alternative to traditional trade. This is driving the logistics sector’s development in Vietnam, while also opening up new opportunities for logistics service companies to expand.

|

Supply exceeds demand

Recognising the potential and room for growth in Vietnam’s logistics industry, many logistics giants have sought to enter the Vietnamese market in recent years. Since Vietnam already has many local players, they have opted for mergers and acquisitions (M&As) to gain faster and more effective market entry. However, despite the high demand from investors, finding a suitable logistics company to acquire in Vietnam is not easy.

First, in terms of size, there are not many Vietnamese logistics companies that fit the scale required by investors. As a result, the pool of suitable target companies is limited.

Second, Vietnamese companies typically specialise in a single service area and do not have many multidisciplinary companies. Few companies that offer forwarding services also own warehouses, cold storage, high-tech storage, yards, or transport fleets. In contrast, foreign investors typically prefer to invest in multidisciplinary companies that own a wide range of assets to create a more integrated logistics chain.

Third, accounting practices in Vietnamese companies do not conform to international standards. This poses difficulties for investors during the due diligence process. For example, if an investor wishes to examine the detailed revenue of a forwarding company by country, the target company’s accounting software may not have this feature. This makes it difficult for investors to assess based on their criteria, ultimately preventing them from making an informed investment decision.

According to Vietnam’s commitments in trade agreements it has signed, the logistics sector is one of the industries with many restrictions for foreign investors.

Thus, we can see that depending on the country where the investors come from, in some logistics sectors, foreign investors are only allowed to hold 49-51 per cent of the equity or shares in logistics companies. Only investors from ASEAN or the EU are permitted to buy up to 70 per cent of the shares in Vietnamese companies within a limited number of sectors. This limits the options for foreign investors when entering the market or acquiring shares in logistics companies.

Additionally, the licensing procedures present a significant barrier for foreign investors. The process of investing in the logistics sector in Vietnam is quite complex and time-consuming, especially since each government agency in different localities may have different requirements for documentation and justification. This leads to inconsistencies in the process and increases costs for investors.

Furthermore, Vietnam’s legal policies still have many limitations regarding land use rights and ownership of land-attached assets by foreign-invested economic organisations. This also creates difficulties for investors when acquiring logistics companies that have land use rights or own factories, warehouses, and other such assets.

| Future trends and benefits in Vietnam’s logistics sector Vietnam’s logistics sector is experiencing rapid evolution, driven by its strategic geographical location, robust manufacturing capabilities, and more. Melissa Cyrill, an expert at Dezan Shira and Associates, covers Vietnam’s role in the global logistics ecosystem and how it is expanding. |

| Vietnam's logistics sector confronts new challenges Experts and business leaders looked at how Vietnam can overcome challenges and unlock the potential of its logistics sector at the Vietnam Logistics Summit 2024 on October 31. |

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- New rules ease foreign access to Vietnam equities (February 05, 2026 | 17:29)

- Vietnam’s IFC creates bigger stage for M&As (February 01, 2026 | 08:16)

- Game startup Panthera raises $1.5 million in seed funding (January 29, 2026 | 15:13)

- Cool Japan Fund transfers shares of CLK Cold Storage (January 28, 2026 | 17:16)

- Nissha acquires majority stake in Vietnam medical device maker (January 26, 2026 | 15:40)

- BJC to spend $723 million acquiring MM Mega Market Vietnam (January 22, 2026 | 20:29)

- NamiTech raises $4 million in funding (January 20, 2026 | 16:33)

- Livzon subsidiary seeks control of Imexpharm (January 17, 2026 | 15:54)

- Consumer deals drive Vietnam’s M&A rebound in December (January 16, 2026 | 16:08)

- Southeast Asia tech funding rebounds on late-stage deals (January 08, 2026 | 10:35)

Tag:

Tag:

Mobile Version

Mobile Version