Support recovery for the steel sector

|

| Support recovery for the steel sector |

Trinh Khoi Nguyen, deputy chairman of the Vietnam Steel Association (VSA), said that although the unexpected pandemic made the situation tough for the steel industry, leaving many local producers struggling to achieve similar growth rates like in previous years, the situation has been improving as the government’s control of the health crisis and the drastic directions of the prime minister sped up public investment projects.

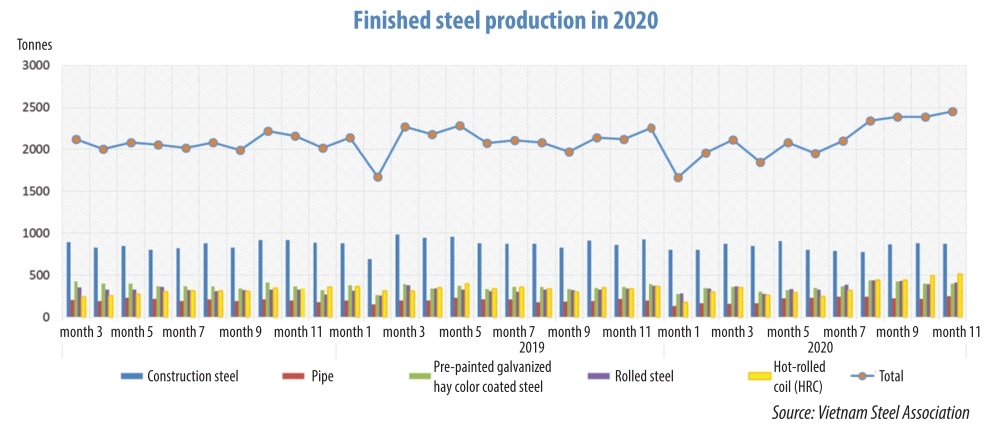

In November, steel production of all kinds reached 2.45 million tonnes, up 4.34 per cent on-month and 15.6 per cent on year. Sales also stood at 2.45 million tonnes, marking a sharp increase of 36.9 per cent compared to October. In the first 11 months of 2020, steel production of all kinds reached 23.33 million tonnes, according to the VSA.

Hoa Sen Group (HSG) and Hoa Phat Group (HPG), both listed in the Ho Chi Minh City Stock Exchange, recorded decent performances throughout the health crisis. In the fourth quarter of the fiscal year 2019-2020, Hoa Sen sold 525,277 tonnes of steel.

The company estimates that consolidated business results for the fiscal year 2019-2020 will reach an output of 1.62 million tonnes of steel, an increase of over 8 per cent on-year, with revenue expected to amount to VND27.5 trillion ($1.19 billion), completing 98.4 per cent of this year’s plan. Explaining the recovery, Hoa Sen’s representative said that the company made best use of its extensive system of nearly 600 stores in the market and export channels to 85 countries and territories.

In addition, the group is to receive support from the General Department of Customs for another three years as of August. This helps to shorten the clearance time for goods and saves costs on administrative procedures, contributing to increased Hoa Sen’s profits.

Meanwhile, Hoa Phat reached a sales volume of 95,000 tonnes in November, up 31.2 per cent over the same period last year. In addition, the company also provided 16,900 tonnes of galvanised coil to the market, up 135 per cent compared to last year’s same period.

To achieve these results, Ta Thanh Binh, sales manager of Hoa Phat, said that the end of the year marks the peak time for the completion of many construction projects, so the consumption of steel products is always high during this time. Along with that, the government’s public investment policies have been supporting the sector.

Binh added, “Another important reason is the global increase in raw material prices, which leads distributors, agents, and contractors to stocking up their warehouses to serve production and business plans.”

Currently, Hoa Phat is being traded at around VND36,000 ($1.56) per share. In the fourth quarter, steel businesses, even inefficient ones, are expected to achieve better business results.

A representative of Viet Y Steel JSC (VIS) said that in the first half of 2020, sales were delayed and capital recovery was difficult. As a result, the company lost VND16.4 billion ($713,000).

Many of the technical solutions applied by VIS have helped reduce the steel billet production costs which have led to reasonable level of production expenditures. These factors render VIS’ products more competitive than other similar products in the market. Thus, VIS expects that the year-end business results will be much improved compared to previous expectations.

Similarly, Dai Thien Loc JSC (DTL) recorded consolidated revenue of more than VND781 billion ($34 million), down VND90 billion ($3.9 million) over the same period last year. A major reason for this reduction is being cited as the increase of production costs while the company struggled to sell its finished products at higher prices.

Nguyen Thanh Nghia, general director of DTL, said that the supply of steel is exceeding the demand. Albeit a slightly increasing demand, changes were not significant enough and leave steel makers to compete fiercely to boost sales.

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Tag:

Tag:

Related Contents

Latest News

More News

- State corporations poised to drive 2026 growth (February 03, 2026 | 13:58)

- Why high-tech talent will define Vietnam’s growth (February 02, 2026 | 10:47)

- FMCG resilience amid varying storms (February 02, 2026 | 10:00)

- Customs reforms strengthen business confidence, support trade growth (February 01, 2026 | 08:20)

- Vietnam and US to launch sixth trade negotiation round (January 30, 2026 | 15:19)

- Digital publishing emerges as key growth driver in Vietnam (January 30, 2026 | 10:59)

- EVN signs key contract for Tri An hydropower expansion (January 30, 2026 | 10:57)

- Vietnam to lead trade growth in ASEAN (January 29, 2026 | 15:08)

- Carlsberg Vietnam delivers Lunar New Year support in central region (January 28, 2026 | 17:19)

- TikTok penalised $35,000 in Vietnam for consumer protection violations (January 28, 2026 | 17:15)

Mobile Version

Mobile Version