Stock tickers continue to gain momentum

On September 6, the benchmark VN-Index rose for the sixth consecutive session, reaching 1,245.5 points and creating a fresh new peak after a short correction round.

This means the VN-Index gained more than 200 points – equal to 19.3 per cent – compared to early 2023, and was up 375 points or 43 per cent compared to mid-November last year.

|

Statistics by VNDIRECT – a major Hanoi-based securities firm – show that listed securities companies saw a 64 per cent jump in their profits in the second quarter of this year, approximating $253 million, and were up 3.5-fold compared to Q4/2022.

This is also the second straight quarter where listed securities firms secured growth after languishing in the red in the second half of last year as the stock market fell from its peak of more than 1,500 points in early April to nearly 900 points in mid-November.

In H1/2023, BIDV Securities JSC (ticker BSI) soared by 182 per cent on-year to reach $11.64 million in net profit.

VIX Securities JSC (ticker VIX) raked in $24.3 million in net profit, up 76.4 per cent on-year.

| Some experts, however, noted that in the short term, securities tickers could lose their appeal after the recent spike in their prices. |

The equivalent figure for SSI (ticker SSI) in H1 stood at $22.15 million, climbing by 26 per cent, and Tien Phong Securities JSC (ticker ORS) hit $4.64 million, a rise of 19.5 per cent.

Saigon-Hanoi Securities JSC (ticker SHS) counted nearly $7.68 million in profit in H1, compared to the $2.87 million in losses it endured during the same period in 2022.

Similarly, Viet Dragon Securities (ticker VDS) pocketed around $6.8 million in net profit, compared to loosing $5.4 million one year ago.

Several unlisted securities firms have also eyed staggering business results, such as VPS, which posted $13.24 million in profit in H1, up 4.5-fold on-year.

Truong Quang Binh, deputy head of Institutional Research at Yuanta Vietnam, has attributed the rosy performance of securities tickers over the past months to three main factors.

Firstly, the stock market has rallied, leading to brighter outcomes for the self-trading business of securities firms, and secondly, increased liquidity has resulted in more income potential for these organisations.

Finally, the expectation that the Korea Exchange-developed stock trading system could be operational later this year, bringing a raft of fresh securities products and market opportunities, has prompted investors to pin their hopes on securities tickers.

“I believe the VN-Index can continue its growth momentum and securities tickers will have the impetus to extend their prices over the coming time,” said Binh.

Quynh Trang, a Hanoi-based securities investor said, "Over the year to date, the central bank has reduced the regulatory interest rates four times, leading to lower deposit and lending rates."

This has prompted part of the money flow to shift from deposit channels into securities, which was mirrored by the fact that more than 150,000 new accounts for stock trading were opened in July alone, setting an 11-month record.

“The interest rate is likely to be retained at a low level for the rest of this year, which is a positive sign for the stock market. The price trends seem to have regained momentum and securities tickers still have space for a continued surge,” said Trang.

The research team at Vietcombank Securities JSC recommends investors to splash an additional 20-30 per cent of their account funds into tickers belonging to the sectors that have seen upward trend in recent sessions, including securities stocks.

Some experts, however, noted that in the short term, securities tickers could lose their appeal after the recent spike in their prices.

Therefore, they suggest that investors select tickers from securities firms with a big market share in margin loans, high profits from brokerage services, and those with their own stories.

| Renewable energy policy needed to build momentum David Jacobs from International Energy Transition GmbH (IET) and Toby D. Couture (E3 analytics) have advised more than 50 governments worldwide on renewable energy policy and strategy, including over a dozen governments in the Asia Pacific Region, including Vietnam. |

| DHG expands growth momentum Leveraging sustainable development and a flexible strategy, DHG Pharmaceutical JSC has made a spectacular breakthrough in recent times, serving as a strong basis for the next growth step. |

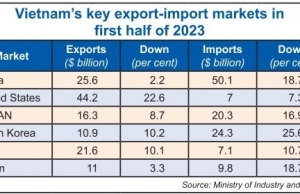

| Acceleration of export orders help create momentum for Vietnam’s trade landscape Vietnam’s export-import landscape is beginning to regain momentum on the back of some foreign markets gradually recovering. |

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- Raised ties reaffirm strategic trust (February 20, 2026 | 14:06)

- Sustained growth can translate into income gains (February 19, 2026 | 18:55)

- The vision to maintain a stable monetary policy (February 19, 2026 | 08:50)

- Banking sector faces data governance hurdles in AI transition (February 19, 2026 | 08:00)

- AI leading to shift in banking roles (February 18, 2026 | 19:54)

- Digital banking enters season of transformation (February 16, 2026 | 09:00)

- IFC to grant $150 million loan package for VPBank (February 13, 2026 | 09:00)

- Nam A Bank forms position as strategic member at VIFC through three key partnerships (February 12, 2026 | 16:39)

- Banks bolster risk buffers to safeguard asset quality amid credit expansion (February 12, 2026 | 11:00)

- VNPAY and NAPAS deepen cooperation on digital payments (February 11, 2026 | 18:21)

Tag:

Tag:

Mobile Version

Mobile Version