Major bourses to hail raft of fresh supplies

On July 12, pharmaceutical firm Tipharco's DTG ticker was launched on the Hanoi Stock Exchange (HNX) at a reference price of $1.08 apiece.

Headquartered in Tien Giang province in the Mekong Delta, Tipharco mainly produces drugs and pharmaceutical products and materials.

During the five years to 2021, the company did not report remarkable growth in its net revenue and earnings, yet managed a stable performance.

|

Last year, however, saw Tipharco posting breakthrough growth after engaging in business restructuring, in which the company’s products were brought into modern distribution chains such as Long Chau and Pharmacity.

The company raked in nearly $13 million in revenue, showing a 46 per cent jump, and counted $787,000 in post-tax profit, up 19-fold compared to 2021 and setting a record since its establishment in 2006.

In 2023, Tipharco aims to reach $15.6 million in revenue and $1.3 million in post-tax profit. In the first quarter of this year, the company secured $3.9 million in revenue, up 25.5 per cent, and nearly $308,700 in post-tax profit, up 2.67-fold on-year.

After moving from UPCoM to HNX, Tipharco will also raise its chartered capital.

| The 2023 AGM season saw many firms mull over plans to move from UPCoM to HNX and HSX, with more additions in the pipeline from those that are yet to be listed. |

In light of a resolution issued at the company’s AGM 2023, Tipharco will make a public offering of its shares under a 1:3 ratio for more than 22.3 million stocks. It will also offer dividend payments to shareholders, including 5 per cent in cash and 15 per cent in stock.

In another case, on August 8, nearly 93 million shares of industrial real estate firm Saigon VGR Investment JSC (ticker SIP) are slated to be launched on the Ho Chi Minh City Stock Exchange (HSX).

After getting the nod to move from UPCoM to HSX, the ticker price currently fetches $5 apiece, nearly double compared to early 2023.

On June 21, the company paid more than $1.3 million for the remaining dividend payment of 2022 at 35 per cent in cash. The first dividend payment in cash was made in July 2022 at 10 per cent.

The company also aims to offer shareholders a 45 per cent dividend payment for 2022 in stock, and a 55 per cent bonus share to double its chartered capital from $39.5 million to $79 million.

Another big name on UPCoM, Binh Son Refining and Petrochemical JSC, also wants to move to HSX.

However, its listing dossier faces an issue related to a company that held BSR’s capital contributions many years ago.

The State Securities Commission has guided BSR to turn to the Ministry of Finance (MoF) for help disentangling the situation.

All being well, the company hopes to shift on to HSX in Q3 this year.

2023 AGM season saw many firms mull over plans to move from UPCoM to HNX and HSX, with more additions in the pipeline from those that are yet to be listed.

Moving to official bourses would facilitate stock transactions, and create added value when businesses join a playing field that mandates higher requirements for governance and securities law obedience.

Interested companies include Bao Chau Pharma, Siba High-Tech Mechanical Group, Dong Duong Construction and Trading JSC, VCP Power and Construction JSC, Vietnam Construction Securities JSC, and Quy Nhon Port JSC, to name but a few.

Tran Thi Thuy Ngoc, deputy CEO at Deloitte Vietnam, feels that since other capital raising channels such as bonds and credit remain costly at present, raising capital via the stock market is a solution for firms with solid projects and transparent operations.

Ngoc expects increasing numbers of firms to engage public offerings over the coming months.

In a conversation with VIR, an MoF executive said that they would support firms with plans to raise capital through stock and bond issuances, with the prime target of increasing the quality of supply in the market.

| Raft of deals boost Sembcorp standing Singaporean energy and urban development group Sembcorp Industries has signed four agreements with Vietnamese partners to support the country’s energy transition as well as its sustainable development. |

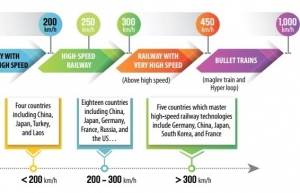

| Raft of options still to pore over for high-speed railway Choices on innovative solutions, railway speed, and capital mobilisation for the North-South high-speed railway project must better accommodate Vietnam’s circumstances. |

| New Thai-Vietnam relations take form with raft of deals Thai investments are expected to continue growing across Vietnam thanks to the country’s improved business climate, with both nations establishing new measures to drive ties last week. |

| Raft of deals to brighten up foreign funding picture Positive signs in economic growth alongside trust from foreign investors are the driving forces helping Vietnam hit between $36-38 billion in foreign investment capital commitment in 2023, up 30 per cent on-year. |

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Tag:

Tag:

Related Contents

Latest News

More News

- Private capital funds as cornerstone of IFC plans (February 20, 2026 | 14:38)

- Priorities for building credibility and momentum within Vietnamese IFCs (February 20, 2026 | 14:29)

- How Hong Kong can bridge critical financial centre gaps (February 20, 2026 | 14:22)

- All global experiences useful for Vietnam’s international financial hub (February 20, 2026 | 14:16)

- Raised ties reaffirm strategic trust (February 20, 2026 | 14:06)

- Sustained growth can translate into income gains (February 19, 2026 | 18:55)

- The vision to maintain a stable monetary policy (February 19, 2026 | 08:50)

- Banking sector faces data governance hurdles in AI transition (February 19, 2026 | 08:00)

- AI leading to shift in banking roles (February 18, 2026 | 19:54)

- Digital banking enters season of transformation (February 16, 2026 | 09:00)

Mobile Version

Mobile Version