Spotify to stir up Vietnamese and Thai music streaming markets

|

| Spotify targets launching in Vietnam and Thailand before going public |

Shifting focus in Spotify’s Asia strategy

According to TechCrunch, Spotify is looking to step up its game in Asia by launching its music streaming service in Vietnam and Thailand and “seriously considering” expansion in India, perhaps even within the year.

While Spotify declined to comment on its plans in Vietnam and Thailand to TechCrunch, it has started hiring for music editor positions in both countries. The move is considered a precursor to launching services, as the company followed a similar strategy in Indonesia in 2015. Then, it started hiring for the exact same post in October and launched its service within six short months.

The positions will likely be headquartered at Spotify’s Asia-Pacific headquarters in Singapore and based on the events in Indonesia, the music streaming service might be launched within 2017 already—though there is little to justify the six-month timeframe.

Spotify is one of the largest music streaming services in the world, with more than 100 million registered and 50 million paying subscribers. The company’s service is available in 60 countries worldwide, though significant markets in Asia remain unexplored.

The company was reported to have financial difficulties as it decided to streamline its business model before going public without actually staging an IPO. At the time, they chose to push the move off to 2018, but Snap’s and other successful IPOs signified ideal market conditions to forge ahead. This likely lead to Spotify shifting focus from India to “easier” markets, like Vietnam, Thailand, and Japan.

In India, Spotify would meet significant competition from iger Global-backed Saavn and Times Internet’s Gaana, as well as Apple’s iTunes (available since 2015) and Google Play Music that arrived just this year. Despite the Indian market’s sheer size and the significant monetary benefits of seizing just a small slice of the market, Spotify’s management likely found following the path of least resistance their best bet to boost performance before going public.

Digital music in the world

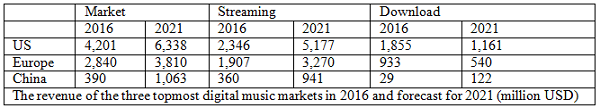

Internet statistics portal Statista Inc. offers insightful data on the global and Vietnamese digital music industry’s performance that can be utilised to understand Spotify’s choice of entering Vietnam and Thailand as well as the challenges ahead in its unexplored Asian market pockets.

According to Statista’s database, the global digital music industry’s three largest markets are the US, Europe and China. While the US and Europe signify largely developed economies with high per capita incomes, an undoubtedly vital factor in people’s choice of accessing online musical content, China is a budding market with lower incomes and rampant semi-legal streaming and downloading alternatives—features widely shared by Vietnam, Thailand, and even India, that could serve as a basis of comparison.

|

Indeed, many network operators offer free 3G data for music streaming, liberating gigabytes of memory on mobile phones in exchange for subscribing for monthly data plans and subscribing to music streaming services, like that of Spotify, for a fixed charge or simply downloading a free application that features third-party advertisements.

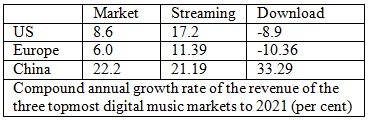

Recent years show a marked change in digital consumption habits both in the US and Europe, and to some degree, in China as consumers are departing from downloading their favourite tunes to streaming them online.

This broke the 13-year growth series of music download sales that began in 2003 with Apple’s iTunes, as now that there is bandwidth, internet speed, and mobile internet accessibility, streaming is a better choice.

The global digital music market was about $9.2 billion in 2016, and accounted for 11 per cent of the global digital media market. Combined, the US, Europe, and China cover 81 per cent of the global digital music market, with a cumulated amount of $7.4 billion. Of this, the US is the peerless champion in digital music consumption, standing at $4.2 billion in 2016. The size of the European market was $2.3 billion in 2016, and China is $0.4 billion, far below its peers.

|

In the case of wealthy US and European consumers, the one-off payments and subscriptions seem to be worth the extra storage, as more and more of them choose to stream music instead of downloading it. According to Statista, from now till 2021, revenue from streaming will increase at a 17.2 and 11.39 per cent rate in the US and Europe, respectively, while revenues from downloaded tracks will fall by 8.9 and 10.36 per cent, annually.

It is interesting to note how music streaming accounts for 67 per cent of the digital music market in Europe, far outstripping the US’ 56 per cent.

In China, on the other hand, both streaming and downloading are going through the roof, growing by 21.19 and 33.29 per cent on annum, respectively. Nevertheless, based on the sheer differences in market size, China is far from catching up with the US and EU within a foreseeable time, as its revenue is poised to hit the $1 billion mark by 2021, while the US and EU are pretty much over that threshold by their individual sectors already.

China is also different from the US and Europe markets in that the “willingness to pay for digital music is very low,” as most music is streamable for free on semi-legal alternatives. On the other hand, 92 per cent of the market is generated by “mostly ad-based streaming,” at least partially thanks to the fact that Chinese consumers arrived to the market equipped with better devices than the US and European pioneers some 13 years ago, with ready access to smoother technological solutions.

Also a feature shared by Spotify’s newest coming markets, a constant thorn in the side of music streaming and downloading service providers on the Chinese market is the abundance of free streaming services operating in constant violation of property rights.

A one-time payment or monthly subscription for unlimited music streaming might sound nice for US and European customers who can easily afford these prices than Chinese customers. While doubtlessly, service providers are making an effort to tailor service fees to regional purses, prices in China remain above the affordable for the wide Chinese population, leading to ample demand for illegal streaming and downloading, and downward pressure on the charges of legally operating providers.

Digital music industry in Vietnam

Spotify is bound to find similar issues in Vietnam, Thailand, and India as the generally outlined issue in China. As Vietnamese telecommunications firms are busy rolling out 4G and enhancing 3G services and the majority of internet users are connected through mobile devices, the market seems ready for renowned music streamers to enter.

To step further into the grounds of speculation, Vietnamese consumers are likely to pose higher demand for streaming than for downloading their favourite tracks, as their devices are mostly capable of handling 3G (and, with time, 4G), provided that network operators will accommodate this demand.

While per capita incomes are on the uptake and the country’s economic prospects are rosy, Vietnamese consumers may not be ready to spend big on streaming music, given easy content piracy and freely accessible illegal streaming platforms. Similar to the $1.5 average revenue per internet user in China, Vietnamese users spend about $1.3 per person.

As it stands, copyright infringement and the violations of intellectual property rights make Vietnam a difficult market. Just last October, nhacSO.net, one of the three biggest music streaming websites in the country, stopped operations as consumers are “moving towards other models, which are unlike the one that nhacSO.net provides,” as a manager of FPT Telecom said in an interview with ICTnews, also reported by VIR.

|

| Spotify will have to take on Vietnam's largest music streamers to succeed |

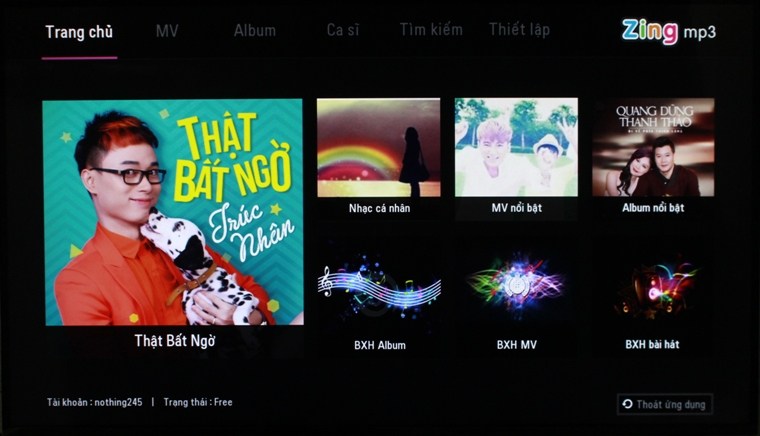

During its eleven years of operation, nhacSO.net grew up to be the leading music streaming site, to be then taken over by Zing mp3 (operated by VNG Corporation) and Nhaccuatui (NCT Corporation) in 2010. To this day, Zing mp3 and Nhaccuatui are doing well, ranking as the 7th and 23rd on the list of top 25 most visited websites in Vietnam compiled by reachingvietnam.com.

However, officially operating subscription-based or ad-supported unlimited access music streaming services have only a limited user penetration (not counting internet radio and video streaming). In 2017, the figure was only 3.5 per cent, and is forecasted to grow to 4.2 per cent by 2021. The market size, similarly, is relatively small: in 2017 Statista expects a total market revenue of $3 million. The market is forecasted to see a compound annual growth rate of 8.7 per cent until 2021, when revenue will be $4.1 million.

What Spotify’s success rides on in Vietnam (and indeed in Thailand and India, as well) is creating a package strong enough to force open Vietnamese users’ purses, which might prove insanely difficult. The company will not only need to come up with a library of tracks fitting local tastes (one that will contain an unparalleled variety of not only Vietnamese songs, but Korean and Japanese content) and land a deal with mobile operators to offer free data for music streaming—essentially starting a turf-war with Hong Kong’s PCCW Media that launched the music streaming brand MOOV that offers (arguably) the largest K-pop collection in Vietnam and is freely accessible for Vietnamobile 3G subscribers for only $3 a month.

And far be it from me to say MOOV is king of the market—it is relatively obscure, looming in the background behind Zing mp3, Nhaccuatui, Nhac Vui, Keeng, and Nhac DJ. At the least MOOV may provide a sensible starting point from which Spotify can improve for success.

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Latest News

More News

- Vietjet launches mega year-end ticket promotion (December 10, 2025 | 11:33)

- Vietjet launches daily Manila flights to celebrate year-end festive peak season (December 05, 2025 | 13:47)

- Phu Tho emerges as northern Vietnam’s new tourism hub (December 01, 2025 | 17:00)

- Vietjet completes Airbus A320/A321 updates ahead of deadline (December 01, 2025 | 09:49)

- Vietjet resumes Con Dao flights from early December (November 28, 2025 | 15:24)

- Free tickets, Lunar New Year promotions on offer at Vietjet Mega Livestream (November 26, 2025 | 15:32)

- UNIQLO unveils upgraded heat-retention wear at Hanoi event (October 26, 2025 | 10:00)

- Vietnam named among world’s top four culinary destinations (October 24, 2025 | 17:09)

- Vietnam and Denmark strengthen dialogue on sustainable fashion (October 20, 2025 | 09:11)

- Fusion rolls out special initiatives to celebrate Vietnamese Women’s Day (October 17, 2025 | 20:00)

Mobile Version

Mobile Version