Shoots of recovery seen in industrial production

|

| Shoots of recovery seen in industrial production, Source:VNA |

At the closing ceremony of the 13th Party Central Committee’s eighth plenum on October 8, Party General Secretary Nguyen Phu Trong said for 2023, Vietnam’s GDP growth would likely “reach a rate of more than 5 per cent, and though this will be lower than the set target of about 6.5 per cent, it is still a relatively high level as compared to many nations in the region and wider world.”

“Over the past nine months, our country’s economy has continued to be a bright spot in the global economy’s grey picture. Our macroeconomic situation remains stable, with inflation, public debt, government debt, foreign debt, and state budget overspending brought under effective control,” he said. “The economy’s major balances have been ensured.”

“A greater priority is to boost growth and improve growth quality, generate employment, and increase incomes for workers, based on macroeconomic stability, major balances in the economy, and ensuring social security,” he added.

Global analysts FocusEconomics last week also released a projection that the Vietnamese economy may “miss the government’s 6.5 per cent growth target this year due to subdued private spending and exports.

“However, stronger public spending and looser monetary policy means Vietnam should remain among ASEAN’s top performers,” it said.

FocusEconomics panellists see Vietnam GDP expanding 5 per cent in 2023, and 6.3 per cent in 2024, while the respective rates were 4.2 and 4.7 per cent for ASEAN as a whole, in which all regional nations are predicted to see average growth rates of below 5 per cent for this year and about 4.5 per cent for next year.

The European Chamber of Commerce Vietnam’s (EuroCham) quarterly Business Confidence Index (BCI) released last week regained its upward trajectory in Q3, offering a glimmer of hope for the Vietnamese business environment after a turbulent year.

The BCI, which surveys over 1,300 European member companies, across many sectors, nudged up to 45.1 in the third quarter, from 43.5 in the previous quarter. While still well below the 50-point threshold for four straight quarters, this small rise is a positive.

Business sentiment appears to be in flux. Between Q2 and Q3, there was a three percentage point drop in business pessimism, while positive and neutral perspectives increased by six and four percentage points respectively.

Vietnam’s global investment appeal remains strong. A notable 63 per cent of surveyed businesses positioned Vietnam within their top 10 foreign investment destinations. Even more striking, 31 per cent ranked Vietnam among their top three, while an impressive 16 per cent hailed it as their foremost investment destination. Reflecting this confidence, over half of those surveyed plan to increase their foreign direct investment in Vietnam by the end of the year.

According to a government resolution released last week, Vietnam’s business and production activities are witnessing “positive changes, especially in the industrial sector.”

The added value of the entire industrial sector rose from minus 0.75 per cent in Q1 to 0.95 per cent in Q2, and to 4.57 per cent in Q3 – in which the manufacturing and processing sector also bounced back from minus 0.49 per cent in Q1 to 0.6 per cent in Q2, and 5.61 per cent in Q3.

“It is clear that domestic industrial production is on the uptrend, with localities that are the country’s industrial hubs on the rise,” said Prime Minister Pham Minh Chinh.

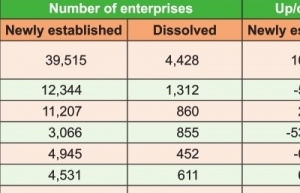

Figures from the Ministry of Planning and Investment showed that in September, nearly 18,500 enterprises were newly established, up 11.5 per cent on-year – bringing the total nine-month number of the enterprises of the type to 165,200, up 1.2 per cent on-year.

“The economy is witnessing positive recovery thanks to many already-enacted policies, ushering in new opportunities for business and production activities and attraction of investment,” the resolution said.

The government has underlined an urgent need to continue applying proper solutions to “drastically remove difficulties and obstructions for production and business activities, especially increasing the ability in absorbing capital of the economy.”

According to EuroCham, many hurdles persist, affecting businesses and investors. A substantial 59 per cent of the BCI survey cited administrative difficulties as their main challenge when operating in Vietnam.

Challenges such as uncertainties in rules and regulations, barriers in permit acquisition, and strict visa and work permit requirements for foreign workers also stood out as prominent issues.

To improve the nation’s foreign investment attraction, 58 per cent of respondents said streamlining bureaucracy was key, 48 per cent advocated for enhancing the regulatory environment, one-third called for upgrading transport infrastructure, and 22 per cent emphasised easing work permit requirements for foreign experts.

| Signs are up for industrial production and services Vietnam’s production and services are beginning to gain momentum, with expectations for a more positive recovery by the year’s end. |

| Industrial production on back foot Vietnam’s industrial production remains challenged despite signals of recovery in August, while a decline in business confidence means it may be a stretch to hit government-set goals. |

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- Pegasus Tech Ventures steps up Vietnam focus (February 05, 2026 | 17:25)

- The generics industry: unlocking new growth drivers (February 04, 2026 | 17:39)

- Vietnam ready to increase purchases of US goods (February 04, 2026 | 15:55)

- Steel industry faces challenges in 2026 (February 03, 2026 | 17:20)

- State corporations poised to drive 2026 growth (February 03, 2026 | 13:58)

- Why high-tech talent will define Vietnam’s growth (February 02, 2026 | 10:47)

- FMCG resilience amid varying storms (February 02, 2026 | 10:00)

- Customs reforms strengthen business confidence, support trade growth (February 01, 2026 | 08:20)

- Vietnam and US to launch sixth trade negotiation round (January 30, 2026 | 15:19)

- Digital publishing emerges as key growth driver in Vietnam (January 30, 2026 | 10:59)

Tag:

Tag:

Mobile Version

Mobile Version