Seaports face challenging forecasts

|

| Seaports face challenging forecasts |

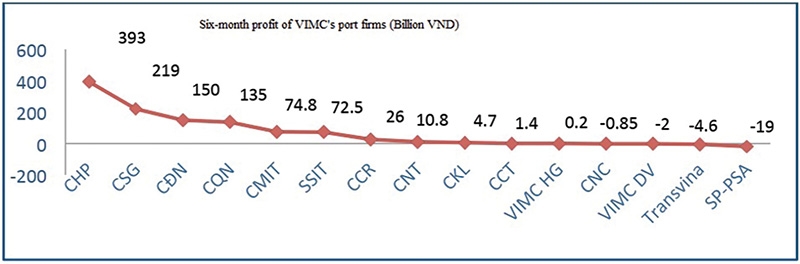

Shipping giant Vietnam Maritime Corporation (VIMC) last week held its first-half review meeting, with positive developments and potential challenges in the seaport segment being the key points discussed.

CEO Nguyen Canh Tinh told VIR, “Most seaports reported encouraging results, with some having higher business results compared to the same period last year – and some even surpassed the yearly targets.”

According to VIMC’s statistics, Cai Mep International Terminal (CMIT), and SP-SSA International Terminal (SSIT) have been making profits since late 2020. Between January and June, CMIT reported a six-month profit of $3.25 million, while SSIT made $5.39 million and witnessed a 96.75 per cent on-year rise in revenues.

Moreover, the former’s container throughput rose 14.11 per cent, while the latter saw an on-year increase of 300 per cent in container throughput, surpassing the yearly target by nearly 14 per cent.

Located in the Cai Mep-Thi Vai port area of the southern province of Ba Ria-Vung Tau, CMIT has Denmark’s APM Terminals as a foreign stakeholder, while SSIT is a joint venture between VIMC and SSA Marine. Meanwhile, SP-PSA – a joint venture between VIMC and Singapore-based PSA, also lying in the Cai Mep-Thi Vai area – handled nearly 2.5 million tonnes of goods during the six-month span, up nearly 33 per cent on-year, and meeting 62.66 per cent of the yearly target.

While SP-PSA failed to attract container throughput, its revenue ascended 25.3 per cent from the same period last year to $5.21 million and fulfilling 61.62 per cent of the yearly target.

In the north, Cai Lan International Container Terminals was estimated to handle 504 twenty-foot equivalent units of container throughput, up 1.36 per cent on-year. Its revenue rose 6.05 per cent to on-year to $6.65 million.

Located in the northeastern province of Quang Ninh, the facility is a joint venture seaport between VIMC and US-based Carrix, the parent company of SSA Marine.

The VIMC leader attributed the positive results to economic rapid recovery in countries, especially China, the EU, and the US, leading to growing demands for consumption of goods and materials.

Moreover, the dry cargo ship market in the first half saw improvements. The Baltic Dry Index hit 3,267 in mid-June, up nearly 3,000 on-year and reaching the highest level since 2016.

What is more, the global container vessel market continues to be bustling, while import-export turnover rose over 30 per cent on-year.

With business improvements of joint-venture seaports, VIMC reported the total volume of goods and commodities via its ports at 67.95 million tonnes during the first half, up 24.5 per cent on-year, and meeting 60 per cent of the yearly target.

Between January and June, Vietnam’s total volume of goods through seaports in Vietnam in the first six months of 2021 was estimated at 363 million tonnes, up 7 per cent on-year. Container throughput strongly rose with over nine million tonnes, up 24 per cent, with seaports in the northern port city of Haiphong, Ho Chi Minh City, and Ba Ria-Vung Tau being among the biggest contributors.

Despite the improvements, joint-venture seaports and others are facing barriers to growth. VIMC admitted that the growth rate of seaports remains lower than regional peers. Saigon Port’s container market share is just 1.8 per cent of the region; meanwhile, Haiphong port is yet to develop new services.

Among such seaports, SP-PSA is yet to attract container vessels in spite of strong growth of 39 per cent in Ba Ria-Vung Tau, and many others in the Cai Mep-Thi Vai port area operate at full capacity, thus possibly making it hard to attract more goods.

Worse still, IT application at port operations remains slow, failing to meet new trends and lagging behind their rivals like Saigon Newport and Gemadept.

Industry insiders forecast that the shipping market in the second half of 2021 will continue to develop positively as the World Bank, the International Monetary Fund, and the Organisation for Economic Co-operation and Development have raised their economic growth forecasts globally.

In addition, trade by means of the seas in 2021 is also forecast to undergo more positive growth than in the previous year, with containers projected to rise 6 per cent, dry commodities 4 per cent, and oil products at 7 per cent.

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- A golden time to shine within ASEAN (February 19, 2026 | 20:22)

- Vietnam’s pivotal year for advancing sustainability (February 19, 2026 | 08:44)

- Strengthening the core role of industry and trade (February 19, 2026 | 08:35)

- Future orientations for healthcare improvements (February 19, 2026 | 08:29)

- Infrastructure orientations suitable for a new chapter (February 19, 2026 | 08:15)

- Innovation breakthroughs that can elevate the nation (February 19, 2026 | 08:08)

- ABB Robotics hosts SOMA Value Provider Conference in Vietnam (February 19, 2026 | 08:00)

- Entire financial sector steps firmly into a new spring (February 17, 2026 | 13:40)

- Digital security fundamental for better and faster decision-making (February 13, 2026 | 10:50)

- Aircraft makers urge out-the-box thinking (February 13, 2026 | 10:39)

Tag:

Tag:

Mobile Version

Mobile Version