Posco capital expansion at odds with inferior results

|

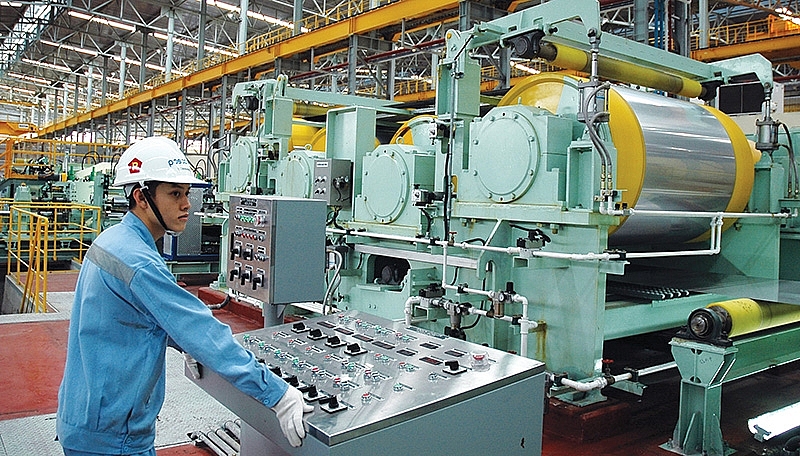

| Posco’s subsidiaries have been encountering financial difficulties, Photo: Le Toan |

Posco is planning to pour ₩21.2 billion ($17.22 million) in Posco SS Vina JSC until 2022, raising its current investment capital in the Vietnamese joint venture to $682.2 million.

With the new investment, Posco will frontload ₩11.1 billion ($9.1 million) this year, while it is also ramping up its automotive steel plate plant in Indonesia and the Czech Republic with a total of more than ₩54.4 billion ($44.2 million) for this year.

The move aims to improve the subsidiary’s production efficiency and reduce its expenses. South Korea’s largest steelmaker is keeping on track, but the task is proving increasingly difficult, at least in the Vietnamese market where Posco SS Vina has failed to turn a profit.

Based in the southern province of Ba Ria-Vung Tau, Posco SS Vina was established in 2010 to produce the world’s highest-quality h-section, sheet pile, and deformed bars by grafting using the steel technology of Posco, with up-to-date melting and rolling facilities.

As of the end of last December, Posco SS Vina JSC (formerly, Posco SS VINA Co., Ltd.) recognised impairment losses amounting to ₩204.546 billion ($166.1 million) since recoverable amount based on value-in-use is less than its carrying amount, stated Posco’s consolidated financial statement for 2019 released late April.

“Posco SS Vina has been in a difficult situation due to intensified market competition in Vietnam. Rebar is traditionally a red-ocean market and competition in the h-beam market is also fierce as supplies from Southeast Asia are flowing in. The management is well aware that it is difficult to be sustainable under these conditions and are considering various options to stabilise business,” read Posco’s report.

The Posco SS Vina mill began operation in 2015 with an output target of about one million tonnes per year, but has never been able to turn a profit. Failing to get profit in its subsidiary, Posco sold 49 per cent in the subsidiary to Japan’s Yamato Kogyo Group late last year.

Selling the shares at Posco SS Vina is said to be aimed at focusing more on structural steel products. However, the whole steel market has witnessed a heavy slump due to the global health crisis and competition with Chinese steel products.

Even prior to the COVID-19 outbreak, ratings agency Moody’s had already cut outlook for the steel industries in the United States (since October 2019), Europe (May 2019), and Asia (August 2019) based on weak fundamentals. Thus, the fate of Posco SS Vina continues to hang in the balance.

Posco’s report noted, “Auto steel is more affected than other products due to the pandemic and halted automaker operations. Thus, we expect the sales ratio of auto steel to decrease, especially in the second quarter. To better cope with the demand condition, we have to adjust our sales mix flexibly. Weakening export sales will be directed to the domestic market.”

Home appliances will see almost no change from the pandemic fallout and Posco is still in talks with shipbuilders. The distribution and pipe-making markets are highly affected by global prices, so Posco will respond to a possible drop of prices with flexibility. The company had to cut its 2020 revenue target to ₩57.5 trillion ($46.7 billion) from ₩63.8 trillion ($51.8 billion).

Posco is seeking to improve its presence across Southeast Asia. In Vietnam, Posco has many subsidiaries including Posco E&C Vietnam, Posco International Vietnam Co., Ltd., Posco ICT Vietnam, Posco Vietnam Holdings, and Posco Vietnam Processsing Center Co., Ltd., among others.

Despite the implementation of many large projects in Vietnam, some of the group’s subsidiaries have been encountering a series of unexpected crises and many years of consecutive losses.

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Tag:

Tag:

Related Contents

Latest News

More News

- South Korean company to build synthetic graphite anode material plant in Thai Nguyen (March 05, 2026 | 16:41)

- YADEA launches $100-million smart manufacturing plant in Bac Ninh (March 03, 2026 | 11:55)

- Law on Investment takes effect (March 02, 2026 | 16:21)

- VinFast invests nearly $500 million in its EV plant in Ha Tinh (March 02, 2026 | 16:19)

- Ho Chi Minh City attracts nearly $980 million in FDI in early 2026 (March 02, 2026 | 10:57)

- Japan’s Fujiya strengthens production base in Vietnam (February 28, 2026 | 09:00)

- Haiphong gains new growth impetus from strategic planning and integrated infrastructure (February 27, 2026 | 16:40)

- Kurz Vietnam expands Gia Lai factory (February 27, 2026 | 16:37)

- SK Innovation-led consortium wins $2.3 billion LNG project in Nghe An (February 25, 2026 | 07:56)

- THACO opens $70 million manufacturing complex in Danang (February 25, 2026 | 07:54)

Mobile Version

Mobile Version