Manufacturing confidence jumps to one-year-high

|

According to a survey released by S&P Global Vietnam on March 1, Vietnam's manufacturing sector continued to grow marginally in February, with both output and new orders up for the second month running.

The S&P Global Vietnam Manufacturing Purchasing Managers' Index (PMI) posted 50.4 points in February, up fractionally from 50.3 points in January and above the 50 point no change mark for the second consecutive month.

The rate of improvement in the health of the sector signalled by the index remained only marginal.

New orders increased modestly for the second month running, with some survey respondents of the survey linking higher total new business to improved new orders from abroad. The rate of growth in new export orders slowed, however, and was only marginal.

Consistent with the picture for new orders, output growth was recorded for the second consecutive month in February. The latest rise was modest and broadly in line with that seen in January. Production increased in the consumer and investment goods sectors, but the intermediate goods category saw a reduction.

Higher new orders encouraged manufacturers to expand their staffing levels for the first time in four months, and to the greatest extent in a year. That said, a number of survey respondents indicated that new hires had only been on a temporary basis.

With employment up and new order growth remaining relatively muted, firms were able to deplete backlogs of work for the first time in three months.

In part, firms used stocks of finished goods to help meet order requirements, thereby resulting in a further depletion of post-production inventories. In fact, the latest fall was the fastest in four months, and joint-sharpest since January 2023.

Manufacturers also opted to use up stocks of purchased inputs in February as opposed to buying new items. Purchasing activity decreased marginally for the fourth month running, while the latest fall in stocks of inputs was the most pronounced since June 2021.

Where firms did purchase inputs, they were faced with lengthening suppliers' delivery times again in February amid reports of shipping delays. The rate of deterioration in vendor performance was only marginal, however.

Production expansion plans and work on new products contributed to a jump in business confidence midway through the first quarter, with positive sentiment regarding output also reflecting expected new order growth. Confidence reached a one-year-high, as close to 55 per cent of respondents expressed optimism.

Andrew Harker, economics director at S&P Global Market Intelligence, said, “Vietnamese manufacturers were able to build on the return to growth seen in January with a further expansion in February. Particularly positive elements of the latest PMI survey were renewed job creation and the strongest business confidence for a year."

"The overall expansion remained relatively muted, however, and this led to further caution regarding purchasing and inventory holdings. Likewise, although output prices increased following a fall in January, the rate of inflation was only marginal as some firms remained reluctant to hike prices in a competitive environment. Manufacturers will need to see stronger and sustained growth of new business before they can be confident enough to invest in inputs and start to raise their selling prices more in line with their own cost burdens," Harker added.

| Manufacturing production rises for first time in five months Manufacturers in Vietnam recorded a return to growth at the start of 2024 as tentative signs of improving demand fed through to renewed increases in new orders and output. |

| ASEAN manufacturing sector sees slight improvement There are some new and slight improvement across the ASEAN manufacturing sector in January, according to S&P Global Ratings, with the headline ASEAN manufacturing PMI rising from 49.7 in December to 50.3. Manufacturers continued to be optimistic about the 12-month output outlook. Growth was recorded across four of the seven ASEAN members. |

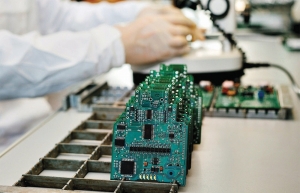

| Chip training the hot new trend for 2024 The thirst for human resources in the semiconductor manufacturing industry has prompted many training institutions to open related majors before the 2024 enrolment season. |

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Tag:

Tag:

Related Contents

Latest News

More News

- Vietnam, New Zealand seek level-up in ties (February 19, 2026 | 18:06)

- Untapped potential in relations with Indonesia (February 19, 2026 | 17:56)

- German strengths match Vietnamese aspirations (February 19, 2026 | 17:40)

- Kim Long Motor and AOJ Suzhou enter strategic partnership (February 16, 2026 | 13:27)

- Haiphong welcomes long-term Euro investment (February 16, 2026 | 11:31)

- VIFC in Ho Chi Minh City officially launches (February 12, 2026 | 09:00)

- Norfund invests $4 million in Vietnam plastics recycling (February 11, 2026 | 11:51)

- Marico buys 75 per cent of Vietnam skincare startup Skinetiq (February 10, 2026 | 14:44)

- SCIC general director meets with Oman Investment Authority (February 10, 2026 | 14:14)

- G42 and Vietnamese consortium to build national AI infrastructure (February 09, 2026 | 17:32)

Mobile Version

Mobile Version