Raft of options still to pore over for high-speed railway

A conference was convened on October 26 to discuss solutions to develop a high-speed railway on the North-South axis was attended by leaders from 0ministries, agencies, and sectors involve, as well as independent railway and mass transit experts.

The Appraisal Council for the venture signed a contract with the consulting consortium, which involves Consultancy and Construction Co., Ltd., Evo Vietnam Company, Ove Arup & Partners Hong Kong, and Hung Phu Trad JSC, to guarantee the evaluation of the pre-feasibility study of the railway project, as proposed by the Ministry of Transport (MoT).

Minister of Planning and Investment and chairman of the Appraisal Council Nguyen Chi Dung said, “With a scale of more than $60 billion and far-reaching effects on the development of the North-South economic corridor, plans must be carefully studied and must be highly responsible before being sent to agencies.”

Dung presented several topics at the conference, including speed range selection, exploitation technique, alignment and standard frames, foundations for calculating investment, and capital raising.

“These concerns will decide not only the investment plan for a high-speed railway along the North-South axis, but also the direction of growth for Vietnam’s railway and mechanical engineering industries over the next half-century,” Dung said.

|

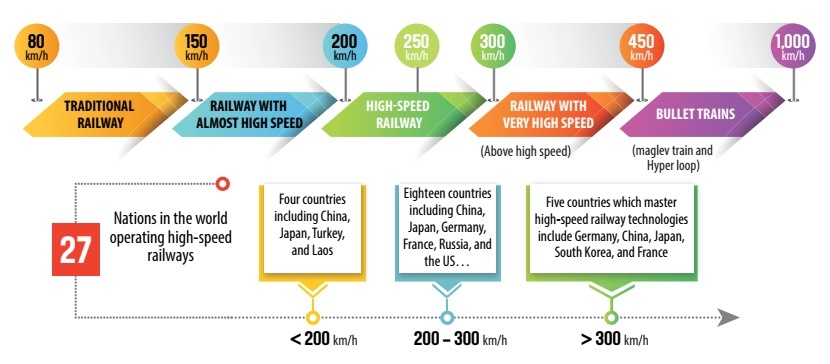

However, the consortium determined that the advisors who prepared the study had selected an unsuitable design and speed level, as most developed nations with high-speed railways operating at speeds above 300 km/h are technologically advanced (see box). Such nations have full freight railway networks and GDP several times greater than Vietnam’s.

According to a consortium representative, with the projected design and operational speed level, passenger trains alone will not generate sufficient money to ensure the project’s financial viability.

Moreover, the estimated figures for the project are unrealistic in terms of investment amount and rate used to determine the total investment, financial efficiency, and socioeconomic efficiency. Specifically, the pre-feasibility study for the project estimates a total expenditure of around $58.7 billion. However, verification findings by a separate unit work out the costs have been calculated in terms of the volume and investment, which state the total acceptable investment is $64.56 billion, or a 10 per cent increase.

Another drawback noted by the consortium is that the capital mobilisation proposed by the project planning consultant is not feasible if 80 per cent of the capital, or about $12 billion, is mobilised through state budget capital, official development assistance (ODA) loans, and concessional loans, while 20 per cent ($4 billion) is mobilised through private enterprises. Currently, no public-private partnership project in the world spends more than $10 billion in the railway industry.

According to the study, the project implementation time is also too long, exceeding 25 years, which poses risks of increasing costs, missed development opportunities, and failure to realise the 13th National Party Congress’ objective of transforming Vietnam into a high-income developed nation by 2045.

In the appraisal report, the consortium suggested a design speed of 250 km/h and an operational speed of 225 km/h for passenger and freight train operations. A representative at the conference said, “This speed level permits the operation of a mix of passenger and freight trains, creating chances for domestic firms to access and master high-speed rail technology.”

To economise on operating costs, the current trend of high-speed rail projects in Europe has decreased to 200-250 km/h, and feature mixed operations. This speed range fits with the plan for the high-speed railway construction scenario on the North-South axis that the MoT submitted to the Ministry of Planning and Investment in mid-October.

With this possibility, estimates are that the total investment of the project to be $61.67 billion, of which nearly $1.7 billion is anticipated to be mobilised from real estate auctions in 50 urban areas with a scale of 200-500 hectares per site, according to the transit-oriented development (TOD) model, representing 63.15 per cent of the total invested capital.

After completion of the investment preparatory work, scheduled for 2025, the project will be developed from then until 2031, with phase 1 consisting of site clearing for the whole project and 50 urban stations to construct the 361-km part of the Thu Thiem-Nha Trang route. This timeframe is required to analyse, assess, and refine the technology, to manage phase 2 of the project from 2031 to 2038.

Prof. Tong Tran Tung, former head of the MoIT’s Department of Science and Technology, believes the solution presented by the independent verification consultants is realistic and appropriate for Vietnam’s situation. This aligns with the Government Party Committee, which recently issued instructions for the construction of such a railway for both passenger and freight transport, with a design speed of around 200-250 km/h.

“However, that speed range should not be set in stone; rather, a study and comparison should continue to determine the optimal speed range,” Tung said. “I welcome the consultation and verification of the idea to mobilise funds from the TOD model to decrease the strain on ODA loans, providing relative freedom in selecting technology for the railway.”

According to Dr. Nguyen Ngoc Long, former director of the MoT’s Transport Construction Investment Management Authority, who contributed to all the pre-feasibility studies, such reports are responsible for clarifying the critical opinions of the verification unit, particularly the speed range of selection and the capital mobilisation plan.

Long advised that the units involved should collaborate to scientifically and impartially explain the concerns in the pre-feasibility study.

“There are so many variations to the MoT’s plan that this may be regarded as a whole separate project, and it must be carefully studied in addition to the Laos-implemented alternative of operating trains at speeds below 150 km/h,” Long said. “The mobilisation of capital from the TOD model is a promising alternative, but it is now merely hypothetical and may encounter numerous challenges in practice.”

| Most recent North-South high-speed rail funding scenarios Scenario 1: The current North-South railway line is built to operate the entire route according to double track standards for passenger transport and goods, with a capacity of 170 carriages per day in both directions. This scenario has an investment cost of approximately $42 billion, utilising a portion of the existing infrastructure. However, because the current railway line has very low technical standards, it would be challenging to upgrade and expand rail systems, and the level of utilisation is low. It does not create a motivating factor to advertise urbanisation, generate more major development space, add assets from the property fund, or contribute to shifting the growth model and structure of relevant regions. Scenario 2: Construction of a railway to carry people and cargo, with a maximum allowable speed of 180-225 km per hour, at an estimated cost of $64.8 billion. After constructing the complete North-South high-speed railway, it would examine and propose the role of the current railway depending on the country’s socioeconomic development circumstances. The MoT anticipates the following investing deviation strategy: from 2025 to 2032, invest in the development and management of Ho Chi Minh City-Nha Trang segment, connecting to Long Thanh International Airport. After the first phase, it will summarise and refine construction technology, manage exploitation to gain experience, and lower the duration of the next phase’s execution. It will then invest in the construction and operation of Hanoi-Vinh between 2030 and 2035. In the 2035–2045 period, investment in construction would begin to bring the Vinh-Nha Trang section into service. Source: Ministry of Transport |

| Vietnam Railways sees recovery in first half of 2022 Vietnam’s railway industry saw growth in revenue and cargo transport in the first half of 2022, heralding a recovery ahead. |

| Growing foreign interest in Vietnam Railways More international businesses are seeking opportunities in Vietnam’s railway industry, bringing high hopes for its new improvements ahead. |

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- Site clearance work launched for Dung Quat refinery upgrade (February 04, 2026 | 18:06)

- Masan High-Tech Materials reports profit: a view from Nui Phao mine (February 04, 2026 | 16:13)

- Hermes joins Long Thanh cargo terminal development (February 04, 2026 | 15:59)

- SCG enhances production and distribution in Vietnam (February 04, 2026 | 08:00)

- UNIVACCO strengthens Asia expansion with Vietnam facility (February 03, 2026 | 08:00)

- Cai Mep Ha Port project wins approval with $1.95bn investment (February 02, 2026 | 16:17)

- Repositioning Vietnam in Asia’s manufacturing race (February 02, 2026 | 16:00)

- Manufacturing growth remains solid in early 2026 (February 02, 2026 | 15:28)

- Navigating venture capital trends across the continent (February 02, 2026 | 14:00)

- Motivations to achieve high growth (February 02, 2026 | 11:00)

Tag:

Tag:

Mobile Version

Mobile Version