Listed companies lean into ESG conventions

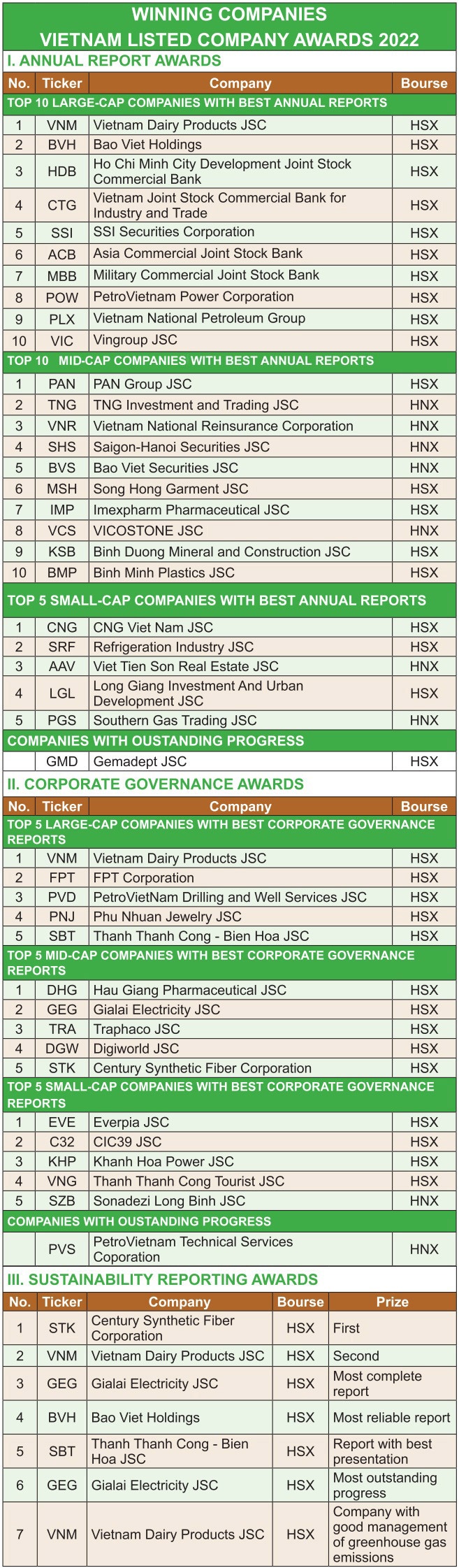

The Ho Chi Minh City Stock Exchange (HSX), the Hanoi Stock Exchange, and Vietnam Investment Review last week presented the annual Vietnam Listed Company Awards (VLCA) under the exclusive endorsement of fund management firm Dragon Capital.

|

| Companies were honoured for report quality over a range of criteria |

This year demonstrated businesses’ ability to overcome unprecedented challenges, the event participants heard. Thus, the annual reports of award-winning companies this year in all three capitalisation groups indicated major changes compared to the previous year. Most companies even achieved maximum scores, showing that they have increasingly invested in the quality of reports.

According to the VCLA organisers, businesses made strides in developing annual reports this year in both content and form. Annual reports in this year’s final round were all highly evaluated with eye-catching presentations, while also delivering unique slogans and clearly conveyed messages, reflecting the characteristics of the businesses. Most businesses displayed their financial data and business results in a clear and concise manner, and also invested in writing annual reports in English to comply with best practices.

Aside from the annual reports with full evaluation information, some reports still lack sufficient information about subsidiaries and associated companies, their financial performance, and the ownership ratio in these companies. Some annual reports have yet to conduct in-depth financial analysis and provide shareholders with sufficient and rich information. Meanwhile, sustainability reports were graded by experts from the ACCA. The evaluation criteria focus on how businesses report on their environmental, social, and governance (ESG) performance.

This year the VLCA, which has been a major annual event on the Vietnamese stock market for 15 years, changed the evaluation criteria with a view to improve the quality of reporting and keep up with the market trends like climate change issues and greenhouse gas emissions. For the first time, the organisers this year added an award for companies with good management of such emissions. The award aims to encourage listed companies to pay more attention to environmental issues and the impacts of climate change.

The awards also evaluated the impact of the COVID-19 pandemic on the strategy and implementation of ESG. Accordingly, businesses have taken measures to ensure health, safety, employment and welfare policies for their employees during the pandemic. In particular, many did not lower salaries or delay payments, while carrying out community connection programmes to support locals in the fight against the coronavirus.

With regard to corporate governance, businesses need to be encouraged to capitalise on their encouraging strengths. In particular, businesses held early AGMs in 2021, thereby completing the publication of annual reports and holding the general shareholder meetings on schedule.

Meanwhile, sustainability reporting continues to make progress in quality, with the breakthrough reports in the top group. Enterprises releasing their own sustainability reports increased from 12 in 2020 to 16 this year. Many businesses have demonstrated a strong commitment to adopting ESG standards.

According to Tran Anh Dao, deputy general director of the HSX, there were varying reasons for late announcement of some information in 2022, including late financial reports, annual reports, and corporate governance reports.

On the other hand, there were some common causes of corporate governance report infractions, such as some firms not guaranteeing the composition or quantity of independent board members, or breaching restrictions on transactions with shareholders and related parties.

This year, the HSX handled some violating cases, including 38 businesses being warned, 25 businesses being controlled, eight businesses forced into limited transactions, three businesses being suspended from transactions, and 10 being delisted altogether.

Reasons for these infractions included negative undistributed profit after tax, late submission of annual/reviewed financial statements, and violation of the obligation to disclose information, to name a few.

Hoang Duc Hung, chairman of International Internal Audit Vietnam, emphasised that internal auditing plays a crucial part in the corporate governance environment, thus cementing companies’ transparency and lasting success.

Nguyen Hoang Nam, partner and ESG Leader of Assurance Services at PwC Vietnam, added, “As one of the top international audit and consulting firms participating in the assessment council, we acknowledge that the quality of sustainability reports of Vietnamese listed companies has improved over the course of time.”

Despite the government’s efforts, there is still room for improvement to raise awareness of publicly listed companies in Vietnam in the areas of green energy development or ESG interest, Nam added. “Market participants are waiting for Vietnam’s policymakers to provide detailed guidance on the country’s green finance regulations or specific ESG reporting measures,” Nam said.

Dominic Scriven, executive chairman of Dragon Capital, also noted, “Despite the challenging capital market in this year’s context, including stock market and corporate bond market, we still believe in the long-term outlook of Vietnam’s equity landscape.”

Publicly listed companies should launch their annual reports and sustainability reports in English to promote official data to international investors. “The Vietnamese government is making concerted efforts to upgrade its market status and we believe this is a positive signal for the country’s economy,” Scriven said.

|

| Vietnam Listed Company Awards 2021 shapes stock market development Vietnam Listed Company Awards 2021 continues to promote the key factors driving the development of the Vietnamese stock market post-COVID-19, including corporate governance, transparency, and sustainable development. |

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- Vietnam sets ambitious dairy growth targets (February 24, 2026 | 18:00)

- Masan Consumer names new deputy CEO to drive foods and beverages growth (February 23, 2026 | 20:52)

- Myriad risks ahead, but ones Vietnam can confront (February 20, 2026 | 15:02)

- Vietnam making the leap into AI and semiconductors (February 20, 2026 | 09:37)

- Funding must be activated for semiconductor success (February 20, 2026 | 09:20)

- Resilience as new benchmark for smarter infrastructure (February 19, 2026 | 20:35)

- A golden time to shine within ASEAN (February 19, 2026 | 20:22)

- Vietnam’s pivotal year for advancing sustainability (February 19, 2026 | 08:44)

- Strengthening the core role of industry and trade (February 19, 2026 | 08:35)

- Future orientations for healthcare improvements (February 19, 2026 | 08:29)

Tag:

Tag:

Mobile Version

Mobile Version