Legal framework sought for Vietnam’s biopharma sector

Le Van Son, chairman of the Vietnam Pharmaceutical Corporation (Vinapharm), is expecting a supporting legal framework with concrete enforcement tools to enable the development of the pharmaceutical industry.

“In Vietnam, although we have issued several policies about the pharmaceutical industry development in different periods, there is still a lack of enforcement among ministries and agencies, as well as among industries and businesses, thus yet ensuring the success that was expected,” Son said.

|

| Chemical technology activities are hotting up in Vietnam’s pharmaceutical sphere |

The Ministry of Health holds 65 per cent of the controlling shares in Vinapharm. It now consists of 23 member companies, 18 of which are engaged in pharma production and five of which operate in distribution.

Similarly, Imexpharm Pharmaceutical JSC, Vietnam’s fourth-biggest pharmaceutical firm, is interested in joining with international groups in the global chain of clinical trials and distribution of new biopharma products and others.

Le Van Nha Phuong, deputy general director of Imexpharm, said, “Domestic pharma firms like Imexpharm hope to cooperate with multinational corporations that are members of the European Chamber of Commerce in Vietnam’s Pharma Group in the development path.”

Vinapharm and Imexpharm are among domestic and international pharma firms that participated in a roundtable titled “Globalising Vietnam’s Biopharma Sector” on August 17 to discuss the path ahead for the future development of the biopharma sector, thus enabling local pharma firms to grow.

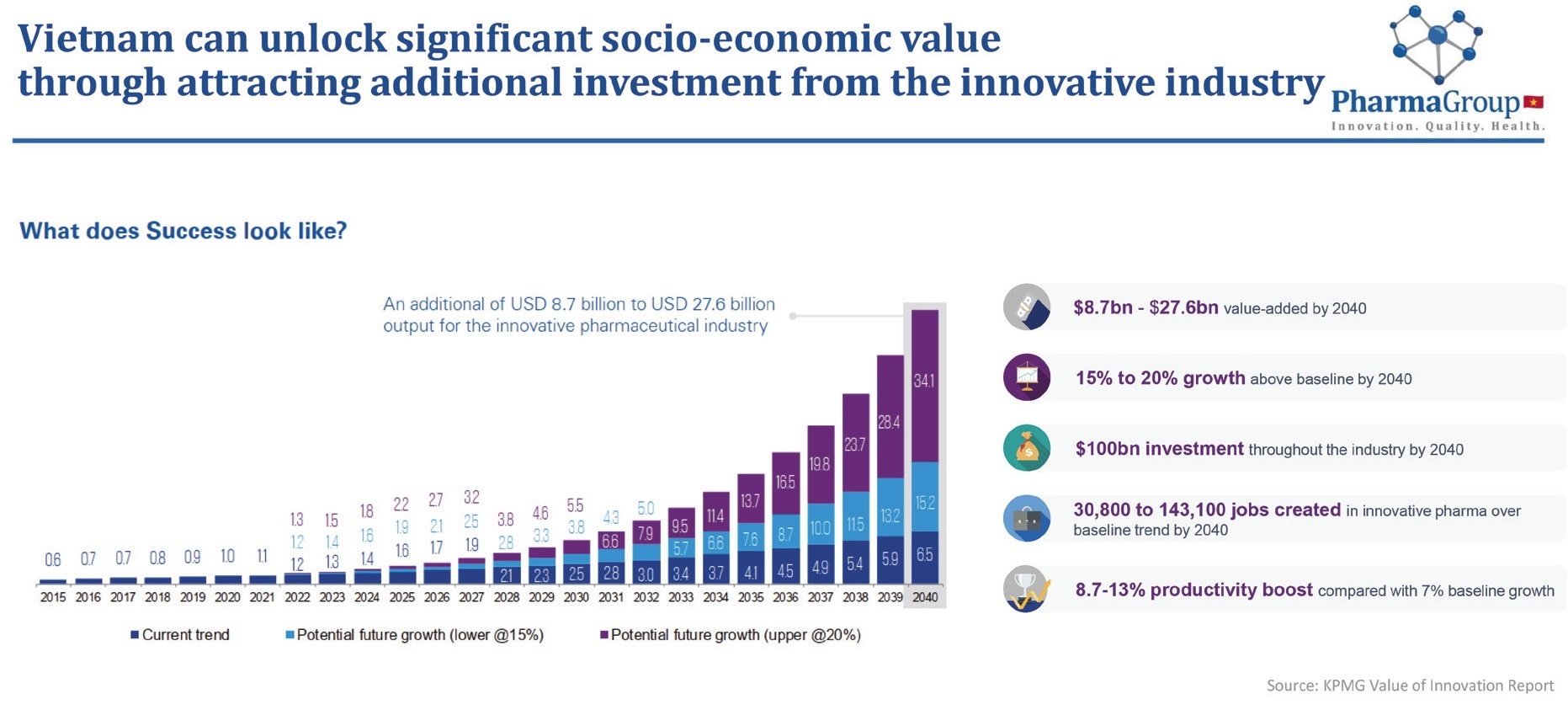

According to participants at the roundtable, Vietnam has already shown in other areas that it can succeed in global competition. These are the foundations for success, even in such a competitive and fast-growing sector as biopharma. They, however, said that Vietnam needs more than just these fundamental elements to succeed globally – it needs the right strategy.

In 2017, Decision No.553/QD-TTg approved the master plan for bio-industry development up to 2030. With regard to medicine and pharmacy, the decision covers vaccines, biological drugs, antibody products for the treatment of human diseases, and more.

The objectives of the plan include speeding up the construction and development of biotechnology in different industries and fields, giving priority to agricultural, medical and pharmaceutical products, industry and trade by 2025, and increasing the number of bio-industry companies by 20 per cent so that the bio-industry contributes to at least 5 per cent of GDP.

In Vietnam, most pharmaceutical manufacturers are now using chemical technology. Therefore, the competition among the companies in this field is significant, including fierce competition on price.

Meanwhile, research into the production and collection of active ingredients from the extraction of animals, plants, or microorganisms, known as biopharmaceuticals, has not really taken off yet in Vietnam.

Biopharmaceutical technology is a relatively new and growing field where biotechnology methods and techniques are applied to drug development. Today, most important therapeutic drugs in the market are of biological origin, such as antibodies, hormones, and vaccines.

Currently, there are only 14 domestic companies/enterprises producing biopharmaceutical products, two of which are Vinapharm member companies Imexpharm and Mekophar Chemical Pharmaceutical JSC.

Darrell Oh, a representative of the Pharma Group at the European Chamber of Commerce in Vietnam said that other countries have put in place policies to develop more research and an innovation-driven pharma industry.

For instance, in Singapore, an aggressive push into life sciences enables the country to rank fourth globally. In another case, Indonesia has a 15-year roadmap that focuses on tech transfer and research and development (R&D) to support and launch locally manufactured products. It has also relaxed foreign direct investment laws to encourage more funding from overseas.

“Current policies enable the development of pharma industry to reach the tech transfer phase, but also limits it to that phase,” Oh said. “Government strategy and policy incentives are crucial. Vietnam is in a similar position to where comparable markets were when they began industry development. Vietnam can learn from the development of its peers to inform its industry policies.”

According to experts at the roundtable, global biopharma is not structured like other leading sectors. It is truly an ecosystem rather than simply a group of very large global companies. The value chain attracts many players, going from basic research, clinical R&D, regulatory expertise, input production, manufacturing and distribution.

The industry has seen an increase in the participation of small companies. Last year, over 70 per cent of new biopharma products approved by the US Food and Drug Administration originated from small companies.

That is an enormous change from a decade or two ago and means that, for Vietnam, there are ample opportunities to identify specific areas of excellence in the global marketplace and through partnerships to create new market opportunities for its companies worldwide.

|

| Vo Thi Tuan Anh Chairman, Green Pharma Vietnam is considered one of the top six destinations worldwide for international pharma groups. They highly assess the growth potential of the local pharmaceutical industry. However, local pharma firms have not yet tapped into its advantages. At present, we still lack the development orientation for the biopharma industry. We need the world’s leading international pharma experts to help us work out this development orientation and then we submit it to the government seeking the mechanism for the industry. We and other pharma companies will together invite leading international experts to work on the development orientation for Vietnam’s biopharma industry, thus having a long-term development vision for the next 5-10 years. The recent coronavirus pandemic proves that an interruption in the pharmaceutical supply chain can happen unexpectedly at any time. Therefore, when more drugs can be produced in Vietnam, we will no longer worry about such an interruption, while increasing access to best-quality drugs at affordable prices. |

| Joseph Damond-Principal, DamondGlobal LLC The biopharma sector will be one of the leading economic growth engines of the 21st century. This is both because the technology is advancing at an amazing speed, and because countries around the world, like Vietnam, are demanding more and better healthcare. There is a technological revolution going on that is going to lead to cures and treatments for diseases that have been out of reach. These advances will both improve healthcare potential around the world, and create exciting new opportunities for those countries that are involved. If the late 20th century produced the tech revolution, this century will be more about biotech, particularly in advanced tech areas like gene and cell therapies and gene editing. These areas may seem exotic now, but in a few years they will be common. The good news is that aside from the United States, it is not really clear yet what countries will be leading in this sector, especially in Asia. It is not too late for Vietnam to get into this game or to catch up with others. In another decade, that may not be true – by that time, there may be more dominant regional and global players and hubs than there are now. For Vietnam, the time to engage in the global biopharma revolution is now. |

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- Masan Consumer names new deputy CEO to drive foods and beverages growth (February 23, 2026 | 20:52)

- Myriad risks ahead, but ones Vietnam can confront (February 20, 2026 | 15:02)

- Vietnam making the leap into AI and semiconductors (February 20, 2026 | 09:37)

- Funding must be activated for semiconductor success (February 20, 2026 | 09:20)

- Resilience as new benchmark for smarter infrastructure (February 19, 2026 | 20:35)

- A golden time to shine within ASEAN (February 19, 2026 | 20:22)

- Vietnam’s pivotal year for advancing sustainability (February 19, 2026 | 08:44)

- Strengthening the core role of industry and trade (February 19, 2026 | 08:35)

- Future orientations for healthcare improvements (February 19, 2026 | 08:29)

- Infrastructure orientations suitable for a new chapter (February 19, 2026 | 08:15)

Tag:

Tag:

Mobile Version

Mobile Version