Home Credit partners with Be Group to promote Home PayLater

The partnership allows users to comfortably experience services like beFood (food delivery), flight tickets, train tickets, bus tickets, and insurance directly through the BE Super App without worrying about finances.

Although BNPL is a relatively new concept, it has quickly gained traction in Vietnam, with the BNPL market reaching $2.34 billion at the end of 2023, according to a report by Research&Markets. The market is expected to continue steadily growing with a compound annual growth rate of 27.6 per cent until 2029, reaching an impressive $11.27 billion of market size over the forecast period. The recent partnership between Home Credit and Be Group further boosts this trend, offering over 10 million BE users an additional convenient payment option with attractive credit.

|

| Home Credit has partnered with Be Group to launch the flexible "Buy Now, Pay Later" feature, Home PayLater, on the BE Super App. Photo: Home Credit |

Specifically, by activating Home PayLater from Home Credit on the BE Super App, users can access credit up to $988. The verification process is streamlined thanks to integrated digital technology. The Home PayLater payment method offers numerous advantages and financial support, including 45-day interest-free periods and no upfront payments for various services.

|

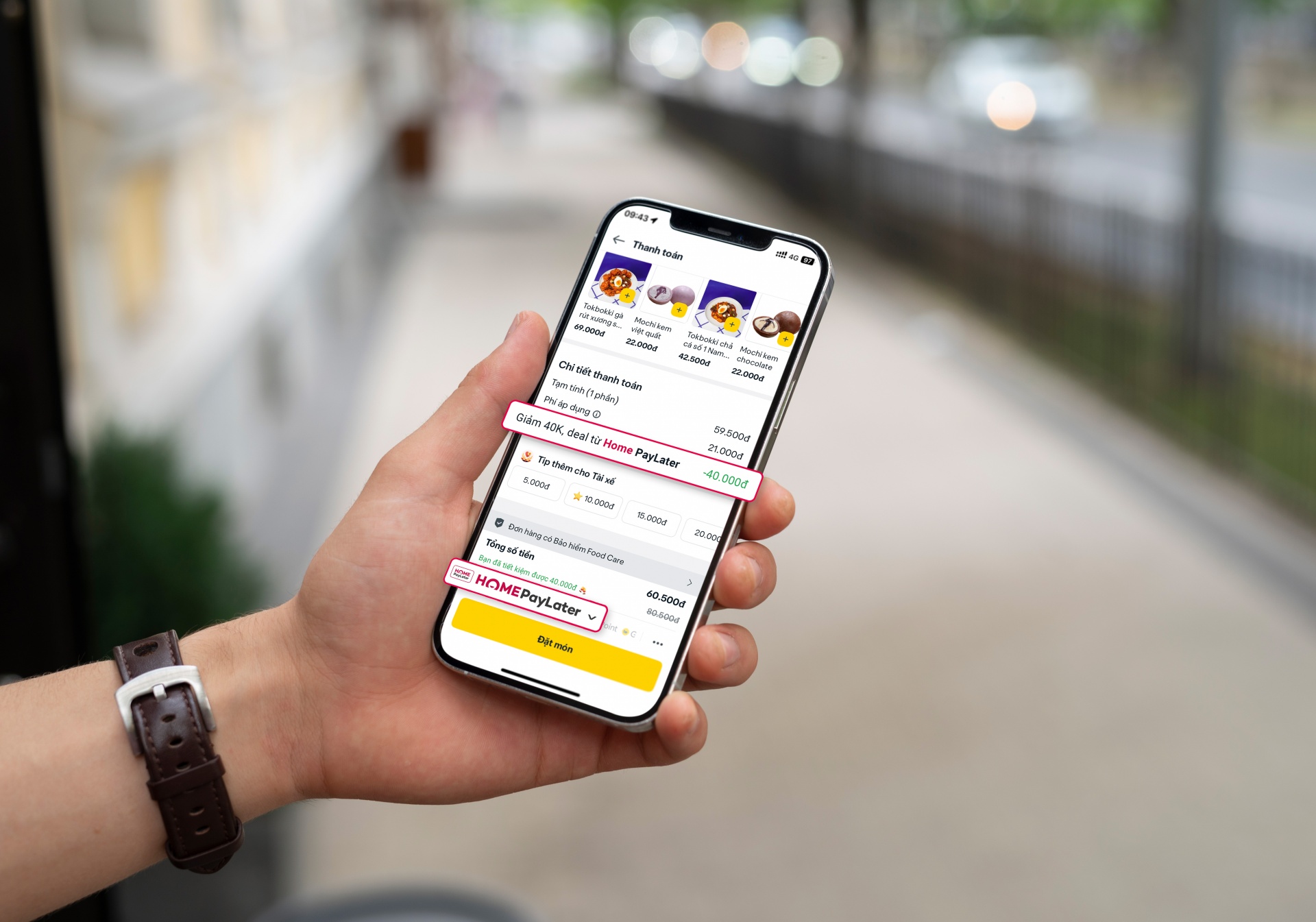

| Users can also enjoy discounts of 50 per cent when paying via Home PayLater for food orders on beFood. Photo: Home Credit |

Additionally, users of Home PayLater on BE enjoy other benefits such as free account setup, no conversion fees, no usage fees, and early settlement fees, providing a smoother and more seamless BNPL experience. During the launch promotion, users can also enjoy discounts of 50 per cent (up to $1.58) when paying via Home PayLater for food orders on beFood and 50 per cent off (up to $11.86) for flight, train, or bus tickets.

Home Credit has already partnered with major retailers like Mobile World Group, Tiki, Traveloka, and Lotte Cinema to incorporate Home PayLater. This partnership between two major players in digital finance and technology adds more excitement to the vibrant BNPL market while also simplifying and digitalising the spending experience for millions of BE users, reaching customers in Ho Chi Minh City, Hanoi, and over 50 other provinces and cities nationwide.

|

| With Home PayLater, users can comfortably enjoy services like beFood (food delivery), flight tickets, train tickets, bus tickets, and insurance with up to 45 days of interest-free credit. Photo: Home Credit |

Michal Skalicky, chief customer officer at Home Credit Vietnam, stated, “The introduction of Home PayLater on the BE Super App not only augments Home Credit's service offerings but also presents millions of BE users with a more adaptable and appealing payment alternative. We are confident that this represents a substantial stride towards fulfilling the escalating needs of customers and delivering them enhanced convenience and value.”

Home Credit is one of the first digital finance companies to launch BNPL in Vietnam, With the Home PayLater product simplifies instalment shopping for users. No income proof is required; just a portrait photo, a national ID, and a completed registration form allow customers to begin shopping with Home PayLater at over 700,000 retail points nationwide. After account setup, users can register for loans for shopping transactions via flexible BNPL terms of up to 12 months.

Hoang Cong Huan, head of business development at Be Group, shared, “We are thrilled to collaborate with Home Credit to bring BE users a more flexible and convenient payment solution. With Home PayLater, users can freely enjoy services on BE without financial worries. This is a new step to strengthen our position as a comprehensive super app that caters to all the needs of the Vietnamese people.”

BE is a Vietnamese super app offering a wide range of services, integrating five modes of transportation (motorbike, car, plane, bus, train), food delivery, and goods delivery. The app has achieved over 200 million downloads and operates with over 400,000 driver partners nationwide. Following the launch of Home PayLater, Be Group is continuing to innovate and develop its ecosystem of products to fully meet the daily needs of Vietnamese users.

| Home Credit prioritises sustainable development with tight risk control Given the volatile financial market situation, Home Credit Vietnam has prioritised sustainable development with tight risk control, focusing on secure operations with adequate buffers. |

| Home Credit Vietnam releases annual Sustainability Report 2023 Home Credit Vietnam has released its Sustainability Report 2023 demonstrating the integration of environmental, social and governance (ESG) factors in all operations at the digital finance company. |

| Home Credit recognised as one of the Best Companies to Work for in Asia Home Credit Vietnam was named one of the Best Companies to Work for in Asia at the HR Asia Awards 2024 ceremony on August 8. |

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- Masan Consumer names new deputy CEO to drive foods and beverages growth (February 23, 2026 | 20:52)

- Myriad risks ahead, but ones Vietnam can confront (February 20, 2026 | 15:02)

- Vietnam making the leap into AI and semiconductors (February 20, 2026 | 09:37)

- Funding must be activated for semiconductor success (February 20, 2026 | 09:20)

- Resilience as new benchmark for smarter infrastructure (February 19, 2026 | 20:35)

- A golden time to shine within ASEAN (February 19, 2026 | 20:22)

- Vietnam’s pivotal year for advancing sustainability (February 19, 2026 | 08:44)

- Strengthening the core role of industry and trade (February 19, 2026 | 08:35)

- Future orientations for healthcare improvements (February 19, 2026 | 08:29)

- Infrastructure orientations suitable for a new chapter (February 19, 2026 | 08:15)

Tag:

Tag:

Mobile Version

Mobile Version