Further FDI incentives forecast to spur on high-value inflows

Bright spots for foreign direct investment (FDI) mobilisation in the first half of the year mainly come from new and additionally-registered investment, according to the latest announcement from the Ministry of Planning and Investment’s Foreign Investment Agency (FIA). Of these, 804 projects – down 43.3 per cent on-year – received new investment certificates, with the total registered capital of nearly $9.55 billion, a rise of 13.2 per cent on-year.

|

| Further FDI incentives forecast to spur on high-value inflows |

Explaining the decrease of project numbers and the rise of newly-registered capital, FIA director general Do Nhat Hoang said that the number of small-scale initiatives have dropped in particular. The number of new projects under $5 million in the first half declined by 48.2 per cent on-year, and by 56.1 per cent over 2019, while the number of new projects between $5-50 million was also reduced by 13.4 per cent on-year.

“However, the number of new projects with more $50 million has risen by 73.3 per cent on-year,” Hoang said.

The most outstanding of these projects remains the Long An I and II liquefied natural gas scheme developed by VinaCapital GS Energy Pte., Ltd., a joint venture between South Korean GS Energy and VinaCapital. They were granted investment certificates in March and are expected to be put into operation by the end of 2025 with capacity of 3,000MW.

Meanwhile the billion-dollar O Mon II thermal power plant developed by a joint venture between Vietnam Trading Engineering Construction JSC and Marubeni Corporation from Japan was granted an investment certificate in January.

Despite the prolonged pandemic, many overseas investors are attempting to retain commitment and belief in Vietnam’s investment climate through the expansion and increase of FDI over recent times. In the first half of 2021, 460 projects – down 12.5 per cent on-year – increased capital with a total of $4.12 billion, up 10.6 per cent on-year. The most contributions are the adjustment of Polytex Far Eastern Vietnam Co., Ltd. from Taiwan, which raised its capital by $610 million in May, and LG Display Haiphong of South Korea with the capital by $750 million in February.

Hoang of the FIA also highlighted that while the number of newly- and additionally-registered projects declined, “the average size of a new project has soared to $11.8 million per venture from about $6 million in the first half of last year, and adjusted project have risen to $8.9 million each from $7.1 million last year.”

However, capital contributions and share purchases were still on the downtrend during 2020 and in the first half of 2021. There were only 1,855 such instances – down 55 per cent on-year, and the total investment of $1.61 billion - down 54.3 per cent on-year in the first half of the year.

“The health crisis has significantly hit deals because investors need to research the market and business operations carefully before making any decision of capital contributions and share purchases,” Hoang explained. “The difficulties in travel since last year have been holding back numerous decisions and plans of investors.”

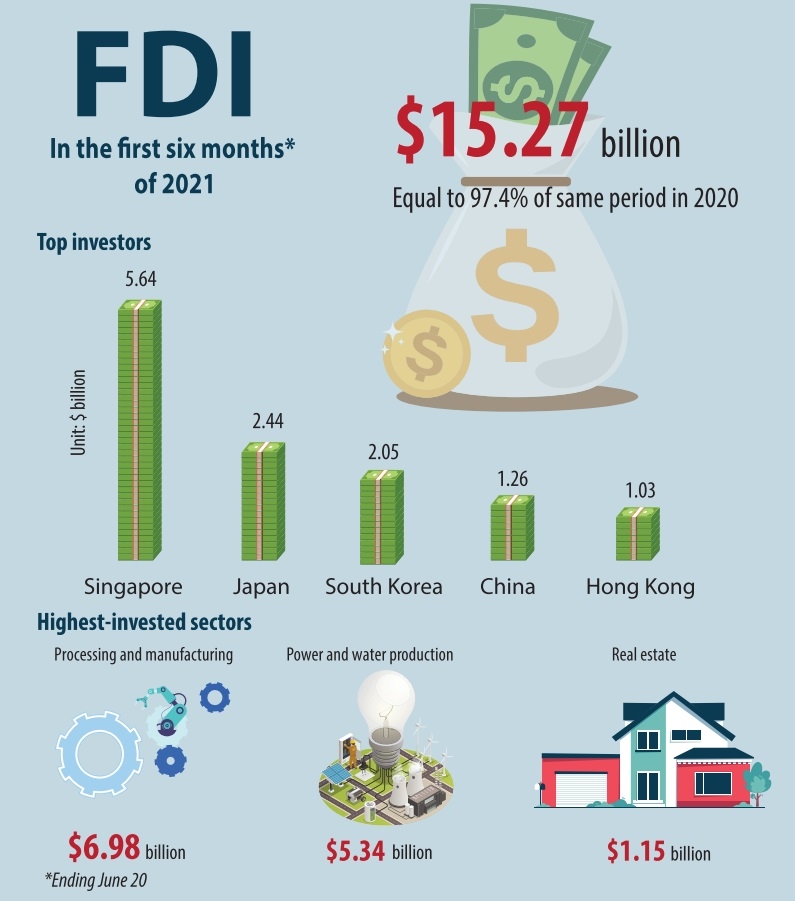

The total newly-registered and added capital, as well as capital contributions and share purchases in the first half of 2021, amounted to $15.27 billion, equalling 97.4 per cent on-year. Of this, new and additionally-registered FDI captures almost 90 per cent of total FDI, and soared by 12.4 per cent. The FIA stated that some reasons could explain the decrease of the number of new, adjusted, and capital-contribution and share-purchase projects. Global FDI activities are on a downtrend and the pandemic is still causing chaos, and most countries are still heavily restricting travel.

“Vietnam’s selective investment attraction policies have reduced the volume and increased the value. However, some investment and business procedures are still challenging investors, and it is difficult to find out new effective measures replacing the old investment promotion activities,” Hoang added.

He highlighted some advantages and disadvantages of FDI mobilisation, as well as an expected boom in such investment when new policies on incentives and management of industrial zones will be adopted in the near future.

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- Foreign leaders extend congratulations to Party General Secretary To Lam (January 25, 2026 | 10:01)

- 14th National Party Congress wraps up with success (January 25, 2026 | 09:49)

- Congratulations from VFF Central Committee's int’l partners to 14th National Party Congress (January 25, 2026 | 09:46)

- 14th Party Central Committee unanimously elects To Lam as General Secretary (January 23, 2026 | 16:22)

- Worldwide congratulations underscore confidence in Vietnam’s 14th Party Congress (January 23, 2026 | 09:02)

- Political parties, organisations, int’l friends send congratulations to 14th National Party Congress (January 22, 2026 | 09:33)

- Press release on second working day of 14th National Party Congress (January 22, 2026 | 09:19)

- 14th National Party Congress: Japanese media highlight Vietnam’s growth targets (January 21, 2026 | 09:46)

- 14th National Party Congress: Driving force for Vietnam to continue renewal, innovation, breakthroughs (January 21, 2026 | 09:42)

- Vietnam remains spiritual support for progressive forces: Colombian party leader (January 21, 2026 | 08:00)

Tag:

Tag:

Mobile Version

Mobile Version