Full steam ahead for LNG capacities to omit other fossil fuels?

Khanh Hoa province, on the south-central coast, has recently been leading the way in attaining attraction from both domestic and foreign financiers when it comes to the gas and electricity sector.

Among the suitors is one from the United States, proposing the Millennium gas power project with a forecast capacity of 14,400MW and 17 million tonnes of storage for liquefied natural gas (LNG) per year. Joining in are Embark United Co., Ltd. and US Quantum Corporation to establish a 6,000MW gas power venture and a port warehouse to receive and process six million tonnes of LNG per year.

Japanese investors did also not ignore the opportunity to develop gas power projects in Khanh Hoa, as Sumitomo Corporation proposed to invest in a 3,000MW gas power scheme and a storage system for three million tonnes of LNG per year, while J-Power Co., Ltd. wants to invest in a gas turbine power project with a capacity of 3,000MW.

Despite a slightly slower approach, the province is also seeing the presence of more domestic investors, led by Electricity of Vietnam which proposed a 6,000MW gas power project, while Petrolimex wants to build a warehouse for around three million tonnes of LNG per year.

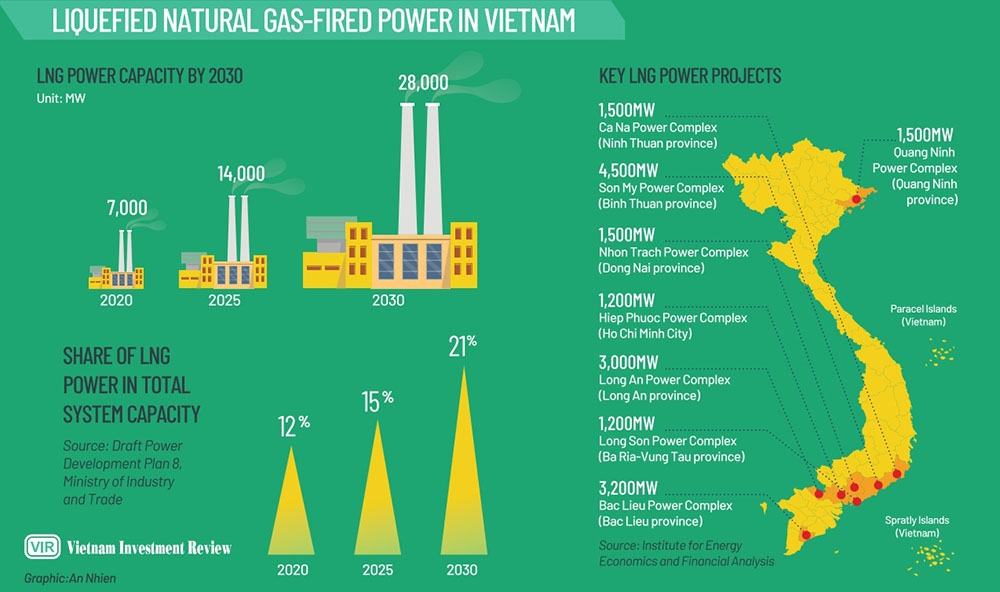

Those involved in the gas power sector all understand that developing such a project in Vietnam is a difficult task, as the country is still in the process of building its Power Development Plan 8 (PDP8). Nevertheless, the total installed capacity of power sources by 2030 is supposed to reach 137.2GW, of which gas accounts for 21 per cent.

Tran Ky Phuc, director of the Institute of Energy under the Ministry of Industry and Trade (MoIT) – the unit in charge of building the PDP8 – said that electricity demand in this plan is calculated lower than in the revised PDP7, reducing the forecast amount by 3-4 billion kWh in 2020 and 9-10 billion kWh in 2030.

|

Realistic needs

The development of gas power sources in Vietnam is the result of the exhaustion of fossil fuels, the limitations of hydropower, and the fact that nuclear power is currently halted and new and renewable energy sources only meet a very small part of the actual demand.

The Institute of Energy forecasts that Vietnam’s energy import rate will increase sharply by 2035 by nearly 2.5 times compared to 2015, from 54 to about 90 million tonnes of oil equivalent by 2025.

The increasing investment in the gas and electricity sector is a prerequisite for LNG imports. Data from the MoIT shows that Vietnam has become a net energy importer since 2015, with a net import rate of about 5 per cent of the total energy supply.

Meanwhile, the country started to import LNG in 2018, which is expected to reach about 3.6 million tonnes of LNG per year by 2025, as the domestic gas consumption is forecast to reach 13-27 billion cubic metres, but production might just deliver around 13-19 billion cu.m.

Import of LNG will continue to increase strongly between 2026 and 2035 to about 6-10 million tonnes per year due to the increased market demand of around 23-31 billion cu.m.

While the gas demand in Vietnam has increased sharply in recent years, Le Minh Nguyen, regional director of German MAN Energy Solutions SE said, “Onshore gas output is on a downward trend. By the end of 2020, the gas output of PetroVietnam reached approximately 9.16 billion cu.m, while the figures for 2019 and 2018 were about 9.6 billion cu.m and 9.7 billion cu.m respectively.

According to Minh, Vietnam’s gas field reserves are now estimated at 700 billion cu.m, which can be exploited in around 40-50 years. More gas supply will also be added in 2023 when the two projects at the Blue Whale field and O Mon’s Block B are updated.

Imports for gas projects, such as Nhon Trach 3 and 4, are only meant to happen in the short term. However, the initial investment capital was one of the main bottlenecks, affecting both the exploration of new gas sources and their exploitation. Initial investments in gas projects are very large and, for example, amounted to $6-7 billion for O Mon’s Block B field and around $10 billion for the Blue Whale field.

Strict conditions

Vietnam’s forced import of LNG for electricity generation has become an opportunity for US energy companies to participate more deeply in the country’s gas sector. ExxonMobil is cooperating with PetroVietnam and its subsidiary, PetroVietnam Exploration Production Co. Ltd., to implement the Blue Whale field, the largest gas field in Vietnam, located about 100km from the central coast to the east and holding approximately 150.79 billion cu.m of gas.

The gas supply of the Blue Whale field is secured in sync with the construction progress of the two mixed gas turbine power plants Dung Quat I and Dung Quat III in the south-central province of Quang Ngai.

However, in the long run, Vietnam needs partners to realise the diversified power source target, and the United States could support it. Yet, the first dialogue session on energy – one of five US dialogues conducted worldwide between Vietnam and the US held in 2018 – did not reach an agreement, despite efforts behind the scenes during the previous three years.

This dialogue session stopped at the trend of future cooperation, with some suggestions for development in the oil and gas sector yet leaving the renewable energy sector almost unchanged while coal-fired thermal power was not discussed at all.

According to the US, Vietnam should develop gas power plants using LNG rather than continuing to operate coal-fired power plants. This recommendation is not new but has now also been noticed at the national level.

The US proposal may be suitable for Vietnam’s target of diversified power sources, but there is no immediate progress because of the lack of a legal framework for electricity and gas. Even in the revised PDP7, the content for gas power remains fuzzy. It may take Vietnam up to three years to add this proposal to the new PDP8 and prepare the infrastructure for gas imports.

Since the first gas was exploited at the Tien Hai C field in 1981, the country has exploited nearly 150 billion cu.m of gas, according to Dr. Nguyen Hong Minh, deputy director of the Vietnam Petroleum Institute.

Minh said that oil and gas exploration has identified a depletion rate of only 16 per cent, but investment in oil and gas has continuously declined in recent years. The demand for capital increases and may sum up to $13-14 billion for the 2019-2025 period, but each year only a few hundred million US dollars can be mobilised.

Tran Sy Thanh, PetroVietnam’s former chairman said, “The oil and gas industry has difficulties to attract investment with the current mechanisms such as the strict contract conditions in the revised Law on Petroleum.”

Besides that, some taxes are also creating additional pressure on businesses participating in this field. For example, the gas industry is subject to a water resource tax of VND100 million ($4,300) for each square kilometre of the used sea surface, while each exploration lot needs about 5,000 sq.km, equivalent to an expense of $10-15 million. Thanh said that no investor can bear such a heavy tax.

Inappropriate regulations are currently a huge barrier to investment in the sector. Hoang Anh Tuan, deputy director of the MoIT’s Domestic Market Department, confirmed that the contents in the Law on Petroleum and the follow-up Decree No.96/2015/ND-CP regulating oil and gas exploration Vietnam’s territories “are inconsistent with reality.”

Tuan cited that there are many regulations on adjusting the upstream sector – which includes searching for potential underground or underwater crude oil and natural gas fields – but not on the midstream and downstream sectors – the former of which involves the transportation, storage, and wholesale marketing of crude or refined petroleum products while the latter includes the refining of petroleum crude oil and processing and purifying of raw natural gas. Mid-and downstream activities are mainly regulated through the laws on enterprises, public investment, construction, environmental protection, and other relevant legal documents.

Another problem is that, when Vietnam uses LNG to generate power, it may not always be fully accepted. Morten Bæk, Denmark’s former Permanent Secretary of State at the Ministry of Climate, Energy, and Utilities, noted that the dependence on imported gas sources “will remain present in the future,” when Vietnam develops gas power. Bæk does also not believe that gas power can be the sole answer to sustainability and should only be considered one of many diverse energy sources.

| Recently initiated LNG power projects As of December 2020, at least 30 thermal gas power projects with a total expected capacity of about 93GW have been proposed for research and construction. About half of these are complexes fully integrated with components from LNG import ports, storage tanks, recycling systems, pipelines, and power generation plants. The remaining projects are merely power plants running on LNG. For projects proposed by investors and provincial authorities, only 17.6GW has been officially approved in the revised PDP7. No project has started its construction yet. Subsidiaries of state-run PetroVietnam and Electricity of Vietnam (EVN) are now listed in a few projects that have reached a relatively significant stage of development. PetroVietnam’s PV Gas is currently constructing the LNG Thi Vai terminal, one of the only two import ports in Vietnam under construction, expected to come into operation in 2022. This port will provide gas for PV Power’s Nhon Trach 3 and 4 power plants with a total expected capacity of 1.5GW – both plants are the first two in the country designed to use LNG, expected to operate from 2023. PV Gas has established a joint venture with the US’ AES Group to develop an LNG warehouse at Son My Port worth $1.4 billion, scheduled to open in 2024. Among integrated projects, PV Power also leads the consortium of investors for the $1.9-billion LNG project in the northeastern province of Quang Ninh with a full range of imported infrastructure components, tanks, recycling systems, and power plants, and a planned capacity of 1.5GW, conducted with Japanese partners. GENCO3 of EVN is also developing a similar project, LNG Long Son, with a generated capacity of 1.2GW, which is proposed to come into operation in 2026. Meanwhile, Japan as a long-term partner of Vietnam’s electricity industry currently leads in the number of energy companies pursuing LNG projects, with names such as Tokyo Gas, Sojitz, Kyushu, JERA, and J-Power. Following is the US with familiar names like ExxonMobil and AES, and South Korea with Kogas and GS Energy. So far, these investors have chosen to cooperate with domestic private enterprises and state-owned enterprises. ExxonMobil last October signed an MoU with of Haiphong and the Japanese power company JERA to cooperate for the development of an LNG power plant in the northern port city. The project is divided into two phases with a total estimated capital sum of $5.1 billion and will include a port with floating storage and gas recycling facilities, gas pipelines, and a 4.5GW gas power plant. In addition, Tokyo Gas and Marubeni participated in a joint venture led by PV Power to develop the Quang Ninh LNG project, with an MoU signed in last October under the witness of Japanese Prime Minister Suga Yoshihide during his trip to Vietnam. Japan’s Sojitz and Kyushu are working with French EDF for the Son My 1 thermal power plant project with an expected capacity of 2.3GW. In July 2019, South Korea’s Kogas Group also signed on for construction of LNG Ke Ga, a project worth $2 billion with a capacity of 1.5GW in the south-central province of Binh Thuan. That November, Gulf Energy of Thailand signed an MoU with the south-central province of Ninh Thuan to research and develop the LNG Ca Na power generation complex with a capacity of 6GW. Source: Institute for Energy Economics and Financial Analysis |

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Themes: Sustainable Energy

- 16th national conference on nuclear science and technology opens in Danang

- Technology and Energy Forum 2023 to open in Quang Ninh

- Asia Clean Capital Vietnam receives backing from Swiss Investment Manager

- Amazon scales renewable energy to fight climate change

- Universal Alloy Corporation Vietnam partners with Asia Clean Capital Vietnam

Related Contents

Latest News

More News

- Japanese business outlook in Vietnam turns more optimistic (January 28, 2026 | 09:54)

- Foreign leaders extend congratulations to Party General Secretary To Lam (January 25, 2026 | 10:01)

- 14th National Party Congress wraps up with success (January 25, 2026 | 09:49)

- Congratulations from VFF Central Committee's int’l partners to 14th National Party Congress (January 25, 2026 | 09:46)

- 14th Party Central Committee unanimously elects To Lam as General Secretary (January 23, 2026 | 16:22)

- Worldwide congratulations underscore confidence in Vietnam’s 14th Party Congress (January 23, 2026 | 09:02)

- Political parties, organisations, int’l friends send congratulations to 14th National Party Congress (January 22, 2026 | 09:33)

- Press release on second working day of 14th National Party Congress (January 22, 2026 | 09:19)

- 14th National Party Congress: Japanese media highlight Vietnam’s growth targets (January 21, 2026 | 09:46)

- 14th National Party Congress: Driving force for Vietnam to continue renewal, innovation, breakthroughs (January 21, 2026 | 09:42)

Tag:

Tag:

Mobile Version

Mobile Version