Delays certain but developers push ventures ahead

|

According to a survey from Savills Hotels, Vietnam has one of the largest pipelines in Southeast Asia with an astonishing 20 per cent compound annual growth rate of supply over the past three years.

There are 49 projects under construction with nearly 17,000 rooms expected to be available in 2020. Of those, 53 per cent reported struggles with delays but are still on track to be open by the end of the year.

The remaining 23 have been postponed until 2021, more than 60 per cent of which are delayed to the first and second quarter, and the rest unable to confirm. Of those reporting longer delays, 90 per cent are in coastal destinations.

|

For the rest of this year, some remarkable hotel brands are expected to be opened such as JW Marriott Danang, Regent Phu Quoc, and Zannier Bai San Ho, which confirms Vietnam’s potential as an emerging luxury destination.

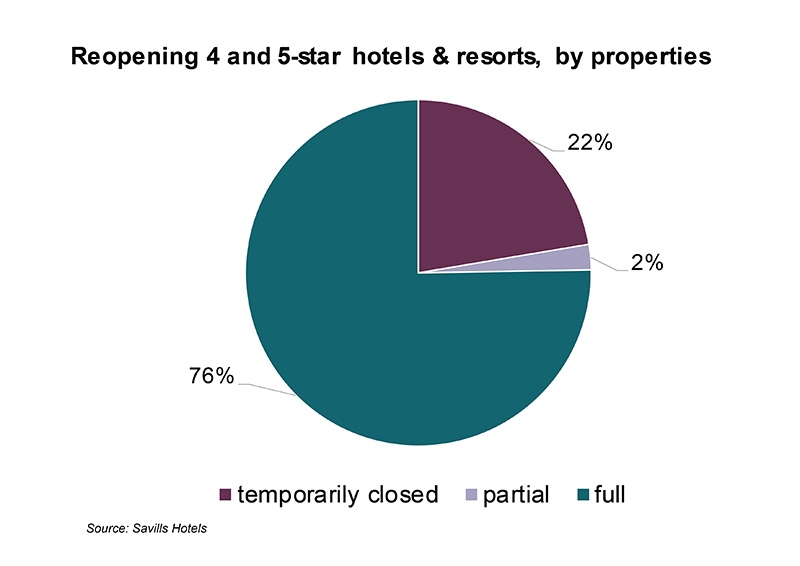

Most resorts resumed operations with attractive promotions in May, with almost half offering deals and lowering rates. Upscale or luxury segments targeted local demand with value deals, combined with free food and beverages and transportation.

Adjusting pricing and using clever and ideally integrated promotions is a smart way for resorts to increase competitiveness until recovery drives room rates back up, according to Savills Hotels.

A consequence of the steep demand drops in April saw room rates drop in properties that previously relied on international visitors. Average room rates were reported to have fallen by 29 per cent. Nevertheless, most upscale properties are reluctant to lower rates, anticipating recovery once international routes start to re-open and corporate business resumes.

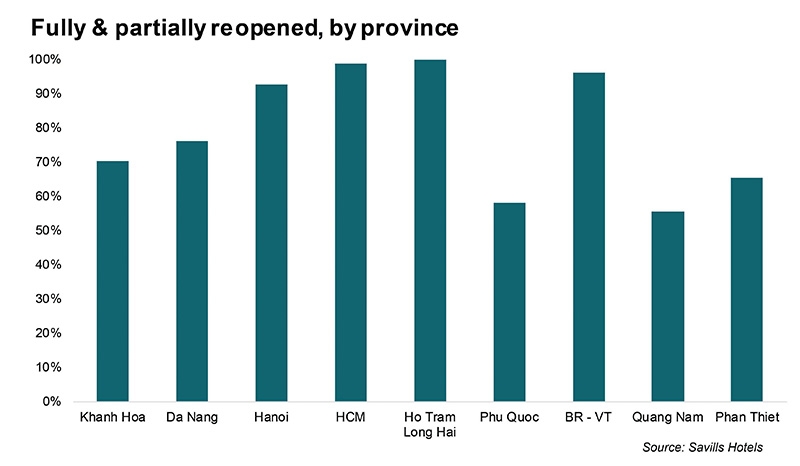

Coastal destinations like Danang, Phu Quoc, Quang Nam, and Phan Thiet have the most aggressive promotions. These have been heavily impacted by the precipitous drop in foreign tourists and are relying on promotions aimed at local guests to stay afloat.

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- An Phat 5 Industrial Park targets ESG-driven investors in Hai Phong (January 26, 2026 | 08:30)

- Decree opens incentives for green urban development (January 24, 2026 | 11:18)

- Public investment is reshaping real estate’s role in Vietnam (January 21, 2026 | 10:04)

- Ho Chi Minh City seeks investor to revive Binh Quoi–Thanh Da project (January 19, 2026 | 11:58)

- Sun Group launches construction of Rach Chiec sports complex (January 16, 2026 | 16:17)

- CEO Group breaks ground on first industrial park in Haiphong Free Trade Zone (January 15, 2026 | 15:47)

- BRIGHTPARK Entertainment Complex opens in Ninh Binh (January 12, 2026 | 14:27)

- Ho Chi Minh City's industrial parks top $5.3 billion investment in 2025 (January 06, 2026 | 08:38)

- Why Vietnam must build a global strategy for its construction industry (December 31, 2025 | 18:57)

- Housing operations must be effective (December 29, 2025 | 10:00)

Tag:

Tag:

Mobile Version

Mobile Version