Coping with the outbreak in the Vietnamese way – a role model?

|

| Prof. Andreas Stoffers former banker in Germany and Vietnam, Professor at SDI Munich University, now country director Vietnam for Friedrich Naumann Foundation for Freedom |

The world is currently teetering on the brink of the global health crisis. This pandemic was the trigger of the downturn, but certainly not the cause, which lies much deeper. After the longest economic boom of modern times after 2008, many seemed to have forgotten that economic crises have always been and still are quite normal. As in the past, there will be winners and losers. It will depend on how countries will deal with the crisis and what economic policy measures will be taken. Vietnam is presenting an interesting package of measures. Can it serve as a model?

Vietnam’s government has reacted to the pandemic early and fiercely. Schools were closed, events were cancelled, the population was reminded to be careful, and now, borders were closed and entry to the country has been restricted. Nevertheless, nowhere in Vietnam was any sign of a similar panic to what can be seen now in the increasingly hectic European Union. After the danger had initially seemed to be ignored in the West, headlessness is now apparent. Moreover, thanks to the starving European Central Bank’s (ECB) policy of recent years, essential monetary policy instruments are now missing in the EU. This is different in Vietnam, as we shall see.

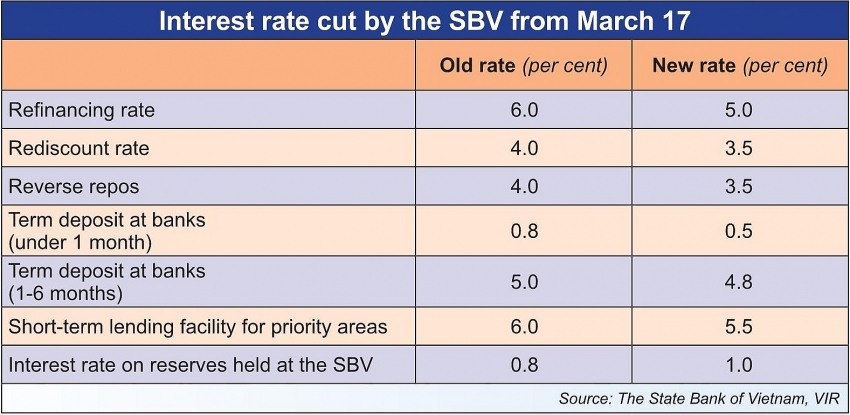

The monetary and fiscal policy of Vietnam seems promising and includes the following parts: (i) A credit package of VND250 trillion ($10.87 billion); (ii) a fiscal package of VND30 trillion ($1.3 billion); (iii) the lowering of the refinance rate from 6 to 5 per cent and of the discount rate from 4 to 3.5 per cent; as well as (iv) several measures of the Ministry of Finance regarding tax and fee reductions.

The credit package is not a huge threat to inflation. Rather, it can be used to defer loans, to remove or reduce interest rates, and to reduce transaction fees.

This is not new money supply being pumped into the economy, but a lubricant to support companies in a spin. It reduces operating costs for banks and, although the banks’ earnings will fall, liquidity will remain in the banking system. The fiscal package also entails only minor inflationary risks. However, it helps companies to reduce taxes or to receive tax moratorium. Here, too, liquidity is maintained.

With both appropriate packages, however, it is important to ensure that the stakeholders involved know how the packages work and that there is clarity about the recipients as not everyone needs support, others like small- and medium-sized enterprises (SMEs) may require more, and that the money is used carefully, so it does not exacerbate inflationary tendencies and takes fiscal policy resources out of the hands of the government. No one knows how long this pandemic will last. Fiscal policy reactions may then become even more important which will require resources.

|

The interest rate cuts by the central bank also send an important signal. They enable companies to obtain loans more cheaply. Unlike the ECB or the Fed, whose interest rates have been lowered to zero since 2016 (for the ECB) or since March 16 (for the Fed), the State Bank of Vietnam (SBV) has not yet shot its bolt.

For example, how can the ECB still support the market through its interest rate stance? Even now, the ECB’s disastrous zero interest rate policy is already causing massive difficulties for European banks.

A majority of banking profits, meaning around 70 to 80 per cent, come from margins. With a zero-interest rate policy, the margins will be almost completely eliminated. The savings and the transformation margins become negative and the credit margin is reduced to a minimum. Loans at low or zero interest rates allow companies that are actually no longer viable to continue to exist as zombies and a large bubble is created.

In Vietnam, the situation is much better. The SBV still has plenty of leeway on interest rates. However, it should be a warning finger for Vietnam against a zero interest rate policy.

Of course, the Vietnamese policy also entails risks. For example, the national debt will increase. Since 2016, the national debt has nearly touched the ceiling of 65 per cent, which offers limited space to borrow more. In addition, it could happen that companies rely too much on government support rather than finding ways out of the crisis by themselves, which would ultimately make them strong. Vietnam should resist the temptations of long-standing Keynesian policies. This always leads to an upward spiral of state interventionism. There have been economic crises and there always will be. It would be alchemy to believe that Keynesian instruments can eliminate or dampen them. Measures may be necessary in this case, but they should be taken with a sense of proportion and be limited in time.

The following is recommended for Vietnam. First, the provision of emergency aid is beyond question. Here, the above-mentioned packages of measures are the right way forward, if they are not designed to last too long. Second, a massive state investment policy in the Keynesian sense is not advisable. Instead, energy should be put into promoting both domestic and foreign direct investment in the private sector.

Third, in concrete terms, strengthening e-commerce or diversifying customer groups could be two viable solutions. Fourth, state-owned enterprises should not be the beneficiaries of any subsidies whatsoever. SMEs need the money much more urgently. Fifth, state price controls are counterproductive and distort competition. They should be avoided in order to prevent side-effects such as black markets and the waste of resources (minimum prices) or queues and low investment (maximum prices). Sixth, social measures such as unemployment benefits are definitely appropriate to support citizens in need. Lastly, in view of the warning example of the EU, a zero-interest rate policy should never be introduced to Vietnam.

I am convinced that Vietnam will emerge stronger from this crisis with a prudent monetary and fiscal policy. The role of the Vietnamese economy in the world will grow. In view of the foreseeable fall in asset prices, particularly in the EU, good investment opportunities will arise for Vietnam within the framework of the ratified EU-Vietnam Free Trade Agreement. In any case, free trade will help all participating nations to get back on their feet more quickly. So far, it seems that the current Vietnamese crisis policy can indeed serve as a role model for others.

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- Spring Fair 2026 boosts domestic demand (March 02, 2026 | 16:30)

- Law on Investment takes effect (March 02, 2026 | 16:21)

- Ho Chi Minh City attracts nearly $980 million in FDI in early 2026 (March 02, 2026 | 10:57)

- Businesses bouncing back after turbulent year (February 27, 2026 | 16:42)

- VinaCapital launches Vietnam's first two strategic-beta ETFs (February 26, 2026 | 09:00)

- PM sets five key tasks to accelerate sci-tech development (February 26, 2026 | 08:00)

- PM outlines new tasks for healthcare sector (February 25, 2026 | 16:00)

- Citi report finds global trade transformed by tariffs and AI (February 25, 2026 | 10:49)

- Vietnam sets ambitious dairy growth targets (February 24, 2026 | 18:00)

- Vietnam, New Zealand seek level-up in ties (February 19, 2026 | 18:06)

Tag:

Tag:

Mobile Version

Mobile Version