Consumer finance regains growth momentum

In EVNFinance JSC's second quarter (Q2) financial statement, the company posted $6.1 million in pre-tax profit, soaring 57 per cent on-year, pushing the company’s cumulative pre-tax profit in the first six months (H1) to $12.94 million, marking a 56 per cent jump on-year.

|

This year, the company aims to rake in around $24.38 million in profit, up 43 per cent compared to 2023.

Lotte Finance Vietnam, a Vietnam branch of Lotte Card, pulled in 500 million won equivalent ($374,000) last month, ending six consecutive years incurring losses since 2018 when the firm acquired Techcom Finance, a local consumer finance firm.

Hanoi-based consumer finance firm HD Saison also showed a marked rebound in H1.

According to deputy CEO Dam The Thai, the company made $25.04 million, double that from one year ago and nearly equal to the company’s full-year profit for 2023 of $27.5 million.

Thai attributed the company’s upbeat results to improved net interest income (NIM) which fetched 30 per cent, up 1 percentage point compared to the end of 2023, while capital costs fell 0.3 percentage points to 7.8 per cent.

This year, HD Saison aims to count $41.6 million in profit, and the company’s leaders are confident of fulfilling the target.

At Mcredit- the consumer finance arm of military bank MB, chairman Luu Trung Thai revealed that the company’s bad debt ratio is currently about 8 per cent.

“MB envisages continued expansion of Mcredit’s loan portfolio at a reasonable level of 10-15 per cent, simultaneously focusing on risk control and building growth momentum for next year,” said Thai.

FE Credit, the financial arm under tech-driven lender VPBank, also saw a positive H1.

According to VPBank, thanks to resumed demand in Q2, FE Credit’s consumer finance segment saw 3.5 per cent credit expansion compared to Q4 of 2023.

Disbursed capital in Q2 also picked up 9 per cent compared to Q1 and saw a cumulative 53 per cent rise in H1 compared to one year ago.

A comprehensive reshuffle has gradually put FE Credit into a new growth cycle.

Figures from the central bank show that by the end of June, consumer loan outstanding balances amounted to $133.3 billion, up 10 per cent on-year.

Since 2010, the average growth of consumer loan outstanding balances has been higher than the economy's outstanding credit balances.

Finance and banking experts expect that a continued economic rebound in H2 would provide the catalyst to propel growth of consumer finance firms as purchasing power resumes momentum amid improved family incomes.

Nguyen Quoc Hung, deputy chairman and general secretary of the Vietnam Banks Association, however, noted that bad debt among consumer finance firms remains a worrisome issue.

“Different groups have emerged and are showing each other how to hide their of debts, making debt collection quite a challenging task,” said Hung.

| Momentum created for retail market Retail businesses are still optimistic about their prospects, with the sector predicted to reach a growth rate of nearly 130 per cent in 2024. |

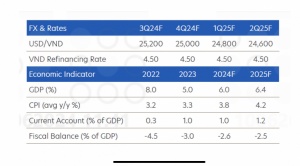

| Economic recovery momentum continues into second quarter UOB (United Overseas Bank) expects GDP growth to pick up to 6 per cent in the second quarter of 2024, extending the 5.66 per cent gain seen in the first quarter, and has maintained its growth forecast for Vietnam at 6 per cent for 2024. |

| Momentum created for aviation industry The increasing demand for aircraft components in the context of leading global aircraft manufacturers consistently facing order backlogs opens up opportunities for Vietnamese businesses to participate more deeply in the supply chain. |

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- Private capital funds as cornerstone of IFC plans (February 20, 2026 | 14:38)

- Priorities for building credibility and momentum within Vietnamese IFCs (February 20, 2026 | 14:29)

- How Hong Kong can bridge critical financial centre gaps (February 20, 2026 | 14:22)

- All global experiences useful for Vietnam’s international financial hub (February 20, 2026 | 14:16)

- Raised ties reaffirm strategic trust (February 20, 2026 | 14:06)

- Sustained growth can translate into income gains (February 19, 2026 | 18:55)

- The vision to maintain a stable monetary policy (February 19, 2026 | 08:50)

- Banking sector faces data governance hurdles in AI transition (February 19, 2026 | 08:00)

- AI leading to shift in banking roles (February 18, 2026 | 19:54)

- Digital banking enters season of transformation (February 16, 2026 | 09:00)

Tag:

Tag:

Mobile Version

Mobile Version