Cement producers continue to count losses

At the end of June, 12 cement producers released their second quarter financial statements, with only two units posting profit growth.

Vicem Ha Tien Cement JSC – a large member of the state-owned cement conglomerate Vietnam Cement Industry Corporation (Vicem) – witnessed a 16 per cent drop in its consolidated revenue on-year, falling to $84.3 million, and around $2.5 million in consolidated post-tax profit, down nearly 57 per cent on-year.

|

Although such outcomes marked an improvement compared to the record losses seen in Q1 of this year, the company still shed $1.13 million in H1. This sharply contrasts with the more than $7 million profit that was counted one year ago.

Similarly, Bim Son Cement JSC saw $210,970 in losses in Q2 of this year – its fourth consecutive loss-making quarter.

Its second quarter consolidated financial statement also records a 21 per cent drop in the company’s revenue, which stood at $37.67 million.

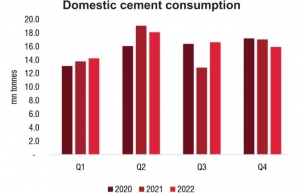

| Q4 is often a key season for cement consumption, yet with the current situation, many firms expect the falling demand to continue for the rest of this year. |

In H1, Bim Son Cement posted $73.4 million in revenue, down 25 per cent, and counted nearly $2.2 million losses. 12 months earlier, it generated nearly $5.5 million in profit.

Vicem But Son, another major unit under Vicem, experienced similar woes. In H1 of this year, the company raked in $56.65 million in net revenue, showing a 12 per cent drop, and incurred $1.35 million in losses. This comes off the back of the nearly $2 million it made a year ago.

The company has attributed its bleak business results to the fact that the first half of this year was a very tough time for the sector, with gloomy market prospects and rising production costs.

While not having to endure the losses of the aforementioned firms, Vicem Hoang Mai JSC saw its revenue in Q2 of this year tumble by nearly a half. It posted $98,500 in post-tax profit, compared to $464,100 in the same period last year.

In H1, the company posted $26,200 in profit, far lower than last year's figure of $489,450.

Ngo Duc Luu, Vicem Hoang Mai’s deputy general director, believes that the cement market is facing a serious oversupply, with the designed capacity of approximately 130 million tonnes far outstripping the mere 65 million tonnes of domestic demand.

The remainder is set for export, with 65 per cent of the volume earmarked for the Chinese market.

However, since 2022, China has reduced its imports from Vietnam, forcing firms to seek other markets such as countries in South America and Bangladesh. However, this export volume is comparatively insignificant, leading to rising inventories at cement plants.

This has caused a remarkable decline in prices, with the rising input costs further compounding the issue.

Q4 is often a key season for cement consumption, yet with the current situation, many firms expect the falling demand to continue for the rest of this year, causing further difficulties.

Most cement producers are pessimistic about their 2023 business results, seeing little hope of achieving their set targets.

| Training on GHG emissions for private cement companies 50 cement manufacturers joined a 2-day training course on greenhouse gas (GHG) emissions inventory and mitigation from December 14 to 15. |

| Action required to halt cement supply-demand slip Cement leaders are calling for a tightening of approvals for new projects in Vietnam due to the current supply-demand imbalance in the sector. |

| All options on the table as livestock firms take on losses Livestock businesses in Vietnam are struggling with record low profits after a drop in both prices and demand. |

| Record input costs thwart cement groups Demand and oversupply issues continue to thwart the cement industry, as inputs for production are failing to see a drop in costs. |

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- A golden time to shine within ASEAN (February 19, 2026 | 20:22)

- Vietnam’s pivotal year for advancing sustainability (February 19, 2026 | 08:44)

- Strengthening the core role of industry and trade (February 19, 2026 | 08:35)

- Future orientations for healthcare improvements (February 19, 2026 | 08:29)

- Infrastructure orientations suitable for a new chapter (February 19, 2026 | 08:15)

- Innovation breakthroughs that can elevate the nation (February 19, 2026 | 08:08)

- ABB Robotics hosts SOMA Value Provider Conference in Vietnam (February 19, 2026 | 08:00)

- Entire financial sector steps firmly into a new spring (February 17, 2026 | 13:40)

- Digital security fundamental for better and faster decision-making (February 13, 2026 | 10:50)

- Aircraft makers urge out-the-box thinking (February 13, 2026 | 10:39)

Tag:

Tag:

Mobile Version

Mobile Version