Action required to halt cement supply-demand slip

Nguyen Quang Cung, chairman of the Vietnam Cement Association (VCA), believes licensing of new projects should be halted because there is no master plan for the industry. “We must be careful to maintain a balance between regional supply and demand. As a result of the severe overstock in the north, it is crucial to encourage cement producers in the south to spend more on increasing clinker production capacity. This will minimise the environmental effects of shipping clinker between the north and south,” said Cung.

|

He added that, in this situation, it is crucial to put into practice a consistent policy to increase the competitiveness of the cement industry by broadening the scope of capable enterprises and working towards the sector’s sustainable development. “In order to prevent supply-demand mismatches and international trade disputes, the authorities of provincial industrial parks should consult central authorities as well as relevant associations before approving new ventures,” Cung explained. “While implementing a new project, numerous elements must be considered, including supply and demand, energy consumption, and logistics.”

According to the VCA, the past 10 years of significant investment in the cement industry have produced a dangerous imbalance, with design capacity nearly doubling local demand and a sudden increase in cement exports as a result.

|

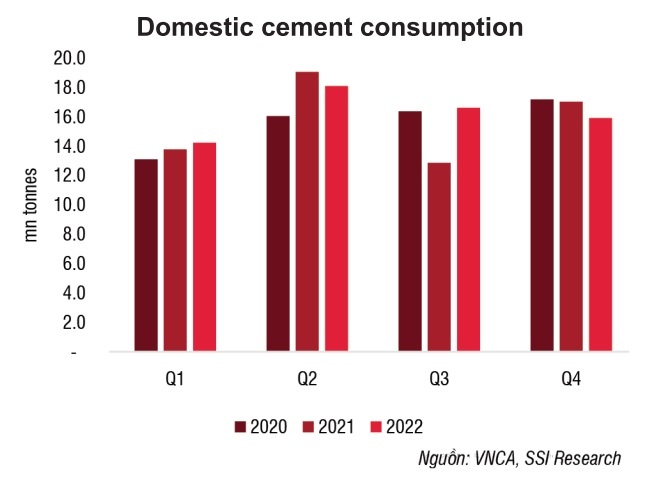

In 2023, Vietnam’s cement sector will see three new facilities come online, which will contribute to the nation’s total supply capacity of 120.7 million tonnes. Meanwhile, domestic demand for cement for 2023 is projected at only 63-65.5 million tonnes.

The market in 2023 has shown signs of cooling down. State-run Vietnam Cement Industry Corporation (Vicem) holds 35 per cent of the market share, and general director Le Nam Khanh acknowledged that cement consumption is low. “Meanwhile, production costs are continuously increasing, causing the profit of cement producers to suffer.”

Leaders of Vicem Bim Son Packaging set a target of only $11.35 million in revenues for 2023 and a pre-tax profit of $63,280. In the first quarter alone, the company estimated revenues of $2.6 billion and losses of $7,860. This is the first time Bim Son has made a loss in any period.

SSI Securities noted that the country’s cement industry is in a period of oversupply, but there is still a shortage of large cement factories.

“Domestic competitive pressure may increase when capacity rises. The domestic capacity rose by 3-10 per cent in the past 12 months, and we estimate that the performance utilisation of the industry fell from 95 per cent in 2021 to 89 per cent last year. We expect the price of cement in 2023 will either remain steady or dip slightly by 1-3 per cent compared to 2022,” noted SSI.

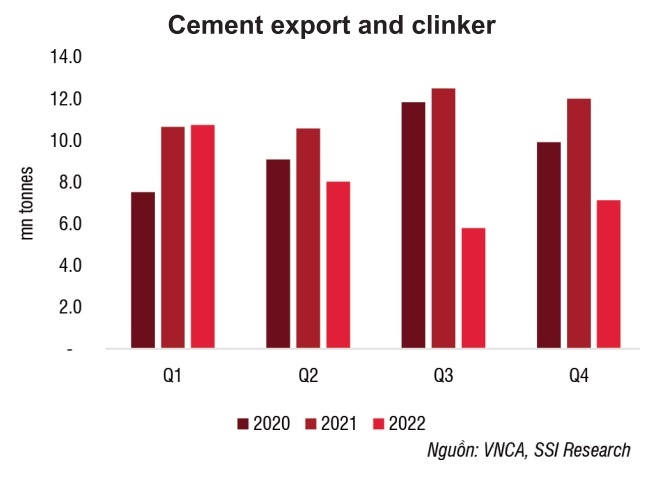

SSI added that clinker and cement demand weakened in both domestic and export markets in the past year. In the domestic market, the growth momentum has remained weak with lessened demand in both the north and south of the country due to low public investment disbursement for infrastructure projects, limited financing sources, and real estate developers’ reluctance to launch new ventures.

Meanwhile, Vietnam’s cement exports in recent months have dropped sharply due to the weakening of the residential real estate sector in China, which accounts for 30-35 per cent of the country’s total cement consumption. The total export volume last year only reached 31.7 million tonnes, down 29 per cent over the previous year.

| Cement groups tangle with GHG inventories Some major cement manufacturers are neglecting greenhouse gas inventories, while others have questions over how to approach effective tools for the work. |

| Cement businesses anticipate headwinds in 2023 Huge inventories, a stagnant real estate market, and capital source constraints are some of the factors heralding an unfavourable outlook for cement businesses in 2023. |

| Vietnam’s cement producers strive to deal with excess Vietnam’s cement industry is anticipating an oversupply issue as a result of China’s reopening and lower coal prices. |

| Cement exports under duress from neighbours The removal of a levy on imported cement in the Philippines could encourage Vietnamese exporters to engage in new ventures alongside Thailand. |

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- FDI disbursement in first two months highest in five years (March 07, 2026 | 09:00)

- EU standing ready to boost trade, investing (March 06, 2026 | 15:21)

- Fresh pathways laid out for industrial ties with Germany (March 06, 2026 | 15:18)

- South Korean company to build synthetic graphite anode material plant in Thai Nguyen (March 05, 2026 | 16:41)

- YADEA launches $100-million smart manufacturing plant in Bac Ninh (March 03, 2026 | 11:55)

- Law on Investment takes effect (March 02, 2026 | 16:21)

- VinFast invests nearly $500 million in its EV plant in Ha Tinh (March 02, 2026 | 16:19)

- Ho Chi Minh City attracts nearly $980 million in FDI in early 2026 (March 02, 2026 | 10:57)

- Japan’s Fujiya strengthens production base in Vietnam (February 28, 2026 | 09:00)

- Haiphong gains new growth impetus from strategic planning and integrated infrastructure (February 27, 2026 | 16:40)

Tag:

Tag:

Mobile Version

Mobile Version