Canned coffee hopes for comeback

|

| Georgia Coffee Max, photo source: mtv.vn |

Only a few months after launching a coffee drink infused with the iconic taste of Coca-Cola in Vietnam, the company has entered the canned coffee market with Georgia Coffee Max.

The move is in line with the company’s strategy as coffee has become a key thrust for Coca-Cola to rejuvenate growth in the Asia-Pacific. The rising consumption of coffee has created a demand, including the ready-to-drink (RTD) variety, and this opportunity is captured by Georgia Coffee Max’s fresh or canned products. A representative of Coca-Cola said, “Though there are other brands in the market, the pie is large enough for new players to enter.”

Le Trung Tin, director of the Georgia Coffee Max line, stressed the secret to success is capturing the Vietnamese taste in canned coffee. He said, “Coca-Cola’s use of 100 per cent Vietnamese-sourced coffee helps to structure the stages of cultivation and production in accordance with international standards, support stable output, as well as confirm the quality and position of Vietnamese coffee beans. This demonstrates Coca-Cola’s development commitment, supporting capacity building in the local value chain in order to enter the global supply chain.”

Meanwhile, Nestlé has showed ambition in the sector too, affirming that through one of the leading coffee processors in Vietnam, the canned Nescafé from Nestlé Vietnam will be the firm step in exploring a new market segment for young and dynamic Vietnamese, and bring a new vitality for Vietnamese coffee beans.

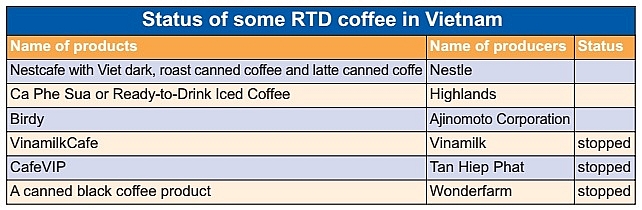

RTD coffee in Vietnam has also witnessed new products from other well-known brands such as Suntory PepsiCo, Highlands Coffee, and Ajinomoto. Other early birds include local dairy giant Vinamilk, which started putting up RTD coffee production facilities, followed by Tan Hiep Phat and Highlands Coffee.

|

However, though those brands initially ran aggressive marketing campaigns, the sector gradually fizzled out, with some disappearing. For instance, in 2013 local coffee giant Trung Nguyen launched a range of fresh coffee products in bottles and cartons, in sizes ranging from 500 millilitres to a litre. Within two years these too disappeared from grocery stores and supermarket shelves.

RTD coffee is far down customers’ shopping lists and is often not bought for weeks at a time, failing to alter consumer purchasing habits as most still prefer fresh roasted coffee.

Though it has not released any specific figures for RTD coffee so far, according to London-based Euromonitor International, it was still showing no signs of a breakthrough in Vietnam last year, and remained a niche category with slow growth in both the off-trade and on-trade channels. In fact, total sales of RTD coffee were amongst the lowest in non-alcoholic drinks, despite their long presence.

The research revealed that, despite the fairly weak performance in 2017, RTD coffee is expected to see better growth rates in Vietnam over the forecast period. The main target groups for RTD coffee are young office workers and young urban consumers, who are more willing to try out new concepts. It also predicted that the current leading players in the market expect to be threatened by the entry of other major brands in the forecast period, making the future of modern, canned coffee in Vietnam unpredictable and interesting.

“PepsiCo was one of the most notable new players in 2017, and it is expected to continue carrying out more marketing campaigns in the next few years to raise awareness of its My Café brand,” noted Euromonitor.

The My Café is a combination of Vietnamese milk coffee and Japanese matcha.

In the same way, Birdy, which has been distributed in Vietnam, is the creation of Ajinomoto. Produced by Calpis Corporation in Thailand, Birdy is trying to become more familiar with domestic customers, aiming to exploit other market segments and attempting to expand market share, according to the Japanese company’s recent announcement.

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- VinaCapital launches Vietnam's first two strategic-beta ETFs (February 26, 2026 | 09:00)

- PM sets five key tasks to accelerate sci-tech development (February 26, 2026 | 08:00)

- PM outlines new tasks for healthcare sector (February 25, 2026 | 16:00)

- Citi report finds global trade transformed by tariffs and AI (February 25, 2026 | 10:49)

- Vietnam sets ambitious dairy growth targets (February 24, 2026 | 18:00)

- Vietnam, New Zealand seek level-up in ties (February 19, 2026 | 18:06)

- Untapped potential in relations with Indonesia (February 19, 2026 | 17:56)

- German strengths match Vietnamese aspirations (February 19, 2026 | 17:40)

- Vietnam’s pivotal year for advancing sustainability (February 19, 2026 | 08:44)

- Strengthening the core role of industry and trade (February 19, 2026 | 08:35)

Tag:

Tag:

Mobile Version

Mobile Version