Banking-as-a-Service picks up steam to aid growth strategies

At the Embedded Finance Summit 2022 on September 23, experts forecast that in the near future, banking, fintech, and non-fintech businesses will all participate in embedded finance, reshaping the way users interact with financial services. Startups in other industries, including e-commerce or proptech, might also move into fintech, finding opportunities to combine data, processes, and resources to better cater to increasing financial needs.

|

| Banking-as-a-Service picks up steam to aid growth strategies |

According to Pham Quang Minh, general director of Mambu Vietnam, a cloud-native banking platform that operates in a Software-as-a-Service model, three factors drive this new model. “First is the decline in profit and fee revenue for traditional financial products, second is increased demand for digital experiences in financial products, and third is the strategic advantage of organic growth,” said Minh.

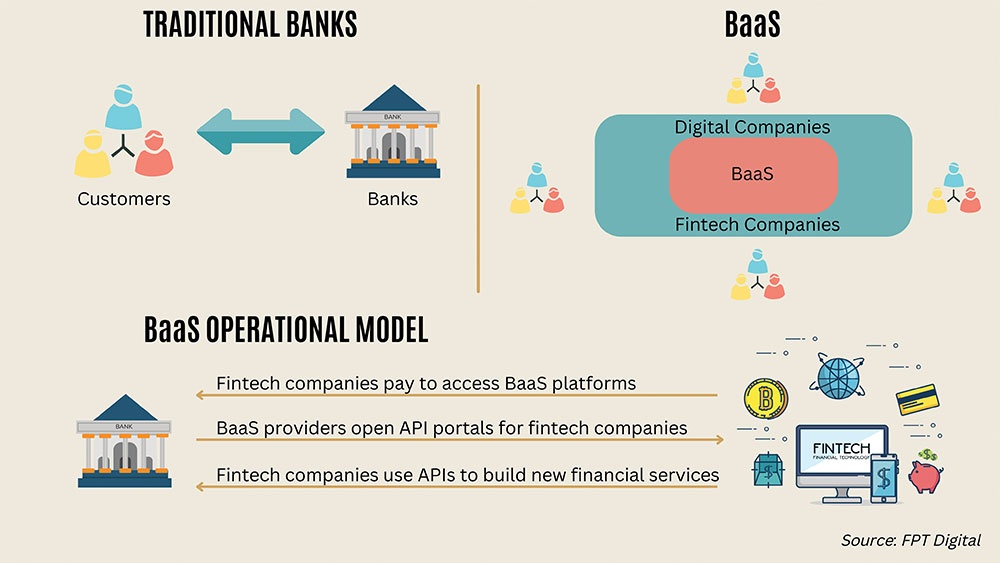

He added that to provide Banking-as-a-Service (BaaS) services and create embedded finance capabilities, it is necessary for banks to revamp their technology infrastructure to support Application Programming Interface (API) connectivity with third parties.

“Banks must define a digital transformation strategy, select a business model, and build an open ecosystem for financial services. In addition, banks must decide which third-party products to bring into their platforms and sales channels, and which bank products to integrate into these platforms,” Minh said.

“Banks in Vietnam often build a digital banking platform integrated with third-party products and services into a super app. However, they need to have a balanced digital transformation strategy between two business models: digital banking and open banking/BaaS. Infrastructure is a core requirement in the business of embedded financial products,” he added.

Nguyen Viet Chau, head of Innovation Lab at MB Bank, said that connectivity among different parties in the market was a winning strategy in applying embedded finance to banks. “When banks deploy super apps, the growth in the number of users can go from 2-3 million to 10 million. However, if banks aim to serve 40-50 million users, they need to connect with many market partners through intermediaries in embedded financial platforms,” Chau said.

“Embedded finance helps us standardise some of our services to make it easier to connect with third parties. For example, just by connecting with Grab, we can immediately reach a large number of users with a more reasonable customer acquisition cost,” he added.

The September 23 summit also saw a number of cooperation and partnerships between businesses in different areas, including embedded finance platform Credify, OCB’s consumer finance company Com-B, Bao Bao Minh Insurance, digital product seller Gia Kho Group, health app iQi Health, and financial advisor Paretix.

Nevertheless, embedded finance and BaaS are still in their infancy in Vietnam. According to Henry Lam, head of Corporate Digital Banking at Techcombank, the common practice in most countries is to digitally transform and create data, and build transformation models based on that data. “Vietnam can first develop data-based digital lending, which must initially be a centralised ecosystem with a permit to provide financial data,” Lam said. “Organisations with an established ecosystem such as Vingroup and MB have a certain advantage, but other businesses will soon follow.”

Savis Technology Group assessed that while open banking is inevitable for banks to stay in line with market trends, the transformation process requires careful planning. “Compared to fintech companies, banks need to be more careful as they cannot afford mistakes when entering these API ecosystems,” Savis noted.

| VIR talk show to discuss digital talent and transformation in banking On September 26, VIR will host a talk show with Jens Lottner, CEO of Techcombank, who will discuss with VIR's Linh Le the current state of the digital transformation in the banking industry and possible solutions for the shortage of digital talents. |

| Banking, real estate not ideal options for short-term investors By the end of this year, oil and gas, transportation, insurance, retail, and hydropower sectors will see positive signals, while the banking and real estate sectors are not ideal options for short-term investment, said experts from DNSE Securities Company. |

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- New rules ease foreign access to Vietnam equities (February 05, 2026 | 17:29)

- 0.1 per cent tax proposed on each transfer of digital assets (February 05, 2026 | 17:27)

- Ministry of Finance tightens policy delivery at start of year (February 05, 2026 | 17:26)

- Vietnam steps up market reforms as FTSE Russell reviews upgrade progress (February 05, 2026 | 17:20)

- 2025 profits mixed amid strong energy and farming results (February 05, 2026 | 17:18)

- Cashless payments hit 28 times GDP in 2025 (February 04, 2026 | 18:09)

- SSIAM and DBJ launch Japan Vietnam Capital Fund (February 04, 2026 | 15:57)

- Banks target stronger profits, credit growth in 2026 (February 04, 2026 | 15:43)

- Vietnam on path to investment-grade rating (February 03, 2026 | 13:07)

- Consumer finance sector posts sharp profit growth (February 03, 2026 | 13:05)

Tag:

Tag:

Mobile Version

Mobile Version