Appealing infrastructure can assist China+1 investment diversity efforts

On January 4, a Chinese business delegation led by Pei Yongzhi, chairman of Hengluda Bridge and Road Engineering based in Shanghai, visited the southern province of Binh Duong to explore investment opportunities in the locality.

Yongzhi expressed his great appreciation for Binh Duong’s development and investment climate in recent times. He noted that the Chinese business delegation has worked with a number of Binh Duong industrial park investors. This will act as a bridge to connect enterprises from both sides in the foreseeable future, Yongzhi added.

|

Vietnam has become a key manufacturing hub for Apple suppliers from China. Based on the analysis of 1,000 financial filings from Foxconn to Luxshare Precision, investment banking firm TD Cowen pointed out that Apple’s suppliers have spent around $16 billion on diversifying production assets away from China to India, Mexico, the US, and Vietnam since 2018.

“Supply chain field work suggests Vietnam has evolved into a major production hub for computers recently, and small volumes of MacBooks, iPads, and the Apple Watch are already being manufactured there,” said TD Cowen. “Capacity in Vietnam can support about 40 per cent of annual US Mac/iPad demand. While this is good progress, additional capacity is still required to meet US consumption needs.”

According to the report released by CNBC last week, Vietnam will be one of the best-positioned markets in Asia-Pacific for the first half of 2024, along with India and Japan. It noted that Vietnam has benefited from the China+1 strategy, with companies diversifying investments to help reduce their reliance on China.

Vietnam expects to see 6-6.5 per cent GDP growth in 2024 on the back of robust imports and exports, as well as stronger manufacturing activity. The optimism in the market has also led to a more than 14 per cent surge in foreign direct investment last year compared with 2022.

“China accounts for half of the new foreign inflows into Vietnam in 2023, reflecting the attractiveness of the Southeast Asian nation as a rising manufacturing hub,” said Yun Liu, an ASEAN economist at HSBC.

“A lot of Chinese firms have moved into their factories and tried to expand their factory capacity inside Vietnam. China is also Vietnam’s largest trading partner, with 30 per cent of Vietnamese imports coming from China, a large part of that is raw materials and intermediate goods,” Liu said.

Seck Yee Chung, partner of Baker McKenzie Vietnam, told VIR, “Vietnam can become a more appealing destination through strategic investments in industrial infrastructure. Foreign investors, including Chinese companies, typically seek the following requirements. First is to develop industrial parks (IPs) and economic zones (EZs) which provide foreign investors with a range of benefits, such as ready-made infrastructure, tax and other incentives. Vietnam should continue to develop new IPs and EZs in strategic locations to keep connecting to the global supply chain.”

Secondly, Vietnam needs to upgrade its existing infrastructure. The Bidding Law 2023 provides significant changes to project bidding, including the application of international bidding, criteria to assess bids and select winning investors, detailed regulations on the list of key provisions of project contracts, and conditions for project transfers, according to Chung.

“Also, Vietnam needs high-quality warehouses and factories equipped with modern machinery and technology. With the arrival of many new investors, the region is expected to be home to an exceptionally vibrant, ready-built industrial sector. Well-developed transportation and logistics networks will help facilitate the movement of more goods,” Chung added.

“By fulfilling these requirements and continuing to develop its industrial infrastructure, Vietnam can position itself as an attractive China+1 destination, providing a business-friendly environment for Chinese investors seeking to expand their operations in Southeast Asia. This can lead to mutually beneficial partnerships and further economic growth,” Chung noted.

In other factory investment movements, last week Dong Nai People’s Committee approved two projects from Hong Kong. Freudenberg & Vilene International Vietnam is pouring $10 million into a cotton production factory, while Ryder Industries Vietnam is injecting $15 million into an electronics manufacturing factory in the province.

| Seminar set to promote Chinese investment in Vietnam's electronics Vietnam Investment Consulting (VNIC) is cooperating with YueQiBao to organise a seminar exchanging and surveying the investment environment in Vietnam for Chinese electronics businesses on March 27 in Hanoi. |

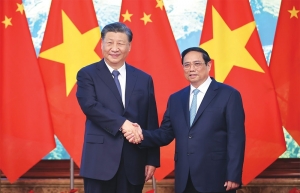

| PM calls for more Chinese investments Prime Minister Pham Minh Chinh called on Chinese investors to expand investment in Vietnam, while addressing the Vietnam - China Trade and Investment Cooperation Forum in Beijing on June 28 within the framework of his official visit to China. |

| Chinese conglomerates express strong interest in expanding investments in Vietnam Top Chinese groups, including Texhong Group, Goertek Group, and Energy China Group, have shown significant enthusiasm for expanding their investments across various sectors in Vietnam, signalling the country's growing appeal as a lucrative business destination. |

| Mutual wins a priority in Chinese ties The state visit to Vietnam by a top Chinese leader has ushered in numerous opportunities for both countries to further rivet their political, trade, and investment ties, among other areas. |

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- Vietnam, New Zealand seek level-up in ties (February 19, 2026 | 18:06)

- Untapped potential in relations with Indonesia (February 19, 2026 | 17:56)

- German strengths match Vietnamese aspirations (February 19, 2026 | 17:40)

- Kim Long Motor and AOJ Suzhou enter strategic partnership (February 16, 2026 | 13:27)

- Haiphong welcomes long-term Euro investment (February 16, 2026 | 11:31)

- VIFC in Ho Chi Minh City officially launches (February 12, 2026 | 09:00)

- Norfund invests $4 million in Vietnam plastics recycling (February 11, 2026 | 11:51)

- Marico buys 75 per cent of Vietnam skincare startup Skinetiq (February 10, 2026 | 14:44)

- SCIC general director meets with Oman Investment Authority (February 10, 2026 | 14:14)

- G42 and Vietnamese consortium to build national AI infrastructure (February 09, 2026 | 17:32)

Tag:

Tag:

Mobile Version

Mobile Version