An Phat Holdings mobilises $9 million from HSX auction

|

| An Phat Holdings sold 4.3 million shares on the HSX |

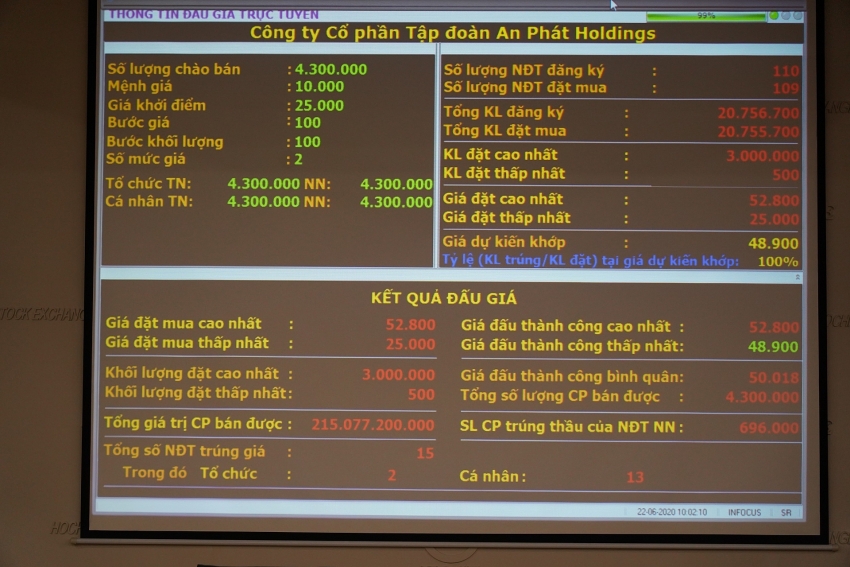

On June 22, An Phat Holdings organised an auction to sell 4.3 million shares on the Ho Chi Minh City Stock Exchange (HSX) with the initial price of VND25,000 ($1.08) apiece. The auction attracted 109 investors who registered to buy 20.8 million shares in total.

As a result, 15 investors won the auction with the average unit price of VND50,018 ($2.17), double the initial price. Whit this price, An Phat Holdings is valued at VND6.6 trillion ($286.96 million) and the group acquired VND215.08 billion ($9.35 million) from the sale.

The proceeds will be used to build the AnBio compostable biological materials manufacturing factory in Haiphong. The construction is expected to kick off in early 2021 and finish in 2020. The factory has a total investment capital of VND1.5 trillion ($65.22 million) with the capacity of 20,000 tonnes per year.

Thanks to An Phat Holdings' proactivity, in the next 3-5 years, the revenue ratio of compostable biological packages will increase from the existing 10 to 50 per cent of package products. In addition, it will contribute to increasing the group's profit margin (these products feature an average profit margin of 20 per cent while the general profit margin of packaging is 14 per cent)

The capital demand of the AnBio factory is over $70 million, thus, half of which the company planned to allocate from its equity and the rest mobilise through loans. The group expects to mobilise 80 per cent of the necessary capital for the project this year and the rest next year.

This year, An Phat Holdings plans to put about 20 million shares on sale, equalling 14 per cent of the outstanding shares, with 15.75 million offered to strategic investors and 4.3 million sold in public auction. At present, the company is negotiating with foreign investors about future co-operation strategies.

|

An Phat Holdings was established in March 2017, focusing on compostable biodegradable products and materials, packaging, technical and interior plastics, precision engineering, and mould samples, materials, and chemicals for the plastic industry and industrial real estate. Its charter capital reached VND1.42 trillion ($61.74 million) and in this January it became a public company.

In 2019, An Phat Holdings’ consolidated revenue and after-tax profit reached VND9.51 trillion ($413.48 million) and VND712 billion ($30.96 million), respectively, up 19 and 305 per cent on-year. Previously, the company's main income came from packaging manufacturing (90 per cent of both revenue and profit), but now with the expansion into other areas, especially supporting industry, it accounted for 12 per cent of the group's consolidated revenue structure and increased average annual growth of 9 per cent during 2015-2019.

Especially, after more than a year of official operation, the industrial real estate segment has achieved remarkable success by contributing 7 per cent of the group's revenue and 29 per cent of its gross profit in 2019, while the compostable biodegradable product segment is also steadily increasing its contribution to the group's revenue.

In 2020, An Phat Holdings targets revenue and net profit for the whole year to reach VND12 trillion ($521.74 million) and VND650 billion ($28.26 million). In the long term, its driving force is expected to be the compostable biodegradable product line through the investment in AnBio.

Pham Do Huy Cuong, standing deputy general director and CFO at An Phat Holdings, said, “The IPO and listing on the HSX will help the group enhance opportunities to mobilise capital and improve capacity to implement long-term goals. Together with the right strategic direction and the expansion of other potential production and business fields, especially the investment in the compostable biodegradable bio-material factory, we are confident that in the next five years, the group will grow rapidly, becoming the leading high-tech and environmentally friendly plastic group in Southeast Asia.”

After the successful auction of 4.3 million shares on June 22, An Phat Holdings plans to hold a roadshow in early July 2020 before officially selling more shares to strategic investors at the end of the month.

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- PM outlines new tasks for healthcare sector (February 25, 2026 | 16:00)

- Ho Chi Minh City launches plan for innovation and digital transformation (February 25, 2026 | 09:00)

- Vietnam sets ambitious dairy growth targets (February 24, 2026 | 18:00)

- Masan Consumer names new deputy CEO to drive foods and beverages growth (February 23, 2026 | 20:52)

- Myriad risks ahead, but ones Vietnam can confront (February 20, 2026 | 15:02)

- Vietnam making the leap into AI and semiconductors (February 20, 2026 | 09:37)

- Funding must be activated for semiconductor success (February 20, 2026 | 09:20)

- Resilience as new benchmark for smarter infrastructure (February 19, 2026 | 20:35)

- A golden time to shine within ASEAN (February 19, 2026 | 20:22)

- Vietnam’s pivotal year for advancing sustainability (February 19, 2026 | 08:44)

Tag:

Tag:

Mobile Version

Mobile Version