Economy set for further rebound in Q4

|

Data released for the October-November period reaffirm that activities have stabilised and in some cases improved markedly compared to the first half of the year. Retail sales of goods and services rose by over 10 per cent on-year in November from 7 per cent in October, the fastest pace since May.

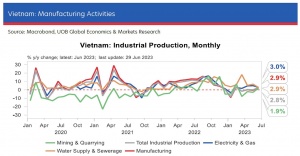

Industrial production rose 5.8 per cent on-year in November, driven by the 6.3 per cent growth in manufacturing output, bringing total industrial production year-to-date (YTD) growth to 1 per cent. Both industrial production and manufacturing sectors’ YTD readings have returned to positive since September, after hovering around negative growth in the earlier part of the year. Manufacturing output has been accelerating uninterrupted since its negative reading in May, suggesting that the sector’s momentum is likely to persist into 2024.

Interest rate cuts from the State Bank of Vietnam (SBV) have helped to reduce business costs, while the government has launched various policies to support business. Vietnam has reportedly decided to cut VAT by 2 percentage points from 10 per cent to 8 per cent, effective from January 1 to June 30 next year, with certain industries excluded from the reduction. Nonetheless, these measures should help ease the cost burden for businesses and will further encourage greater output.

The real estate market in Vietnam has shown some signs of stabilisation and even recovery, with reports of several investors resuming sales activities and launching new projects while the Vietnam Association of Real Estate Brokers (VARS) has reported a flurry of large-scale projects, spanning various categories from north to south, initiating sales campaigns.

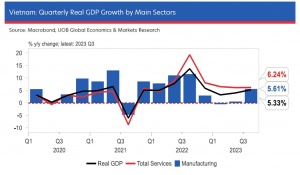

Despite stronger growth in Q3, the drag from the first six months of the year is the main reason why overall growth for the full year is likely to be constrained. The UOB expects momentum from Q3 to carry over to the final quarter of the year, especially with more supportive domestic policies, and should help Vietnam hit its full-year growth forecast of 5 per cent, with the assumption of further acceleration of GDP growth in Q4 to 7 per cent on-year.

|

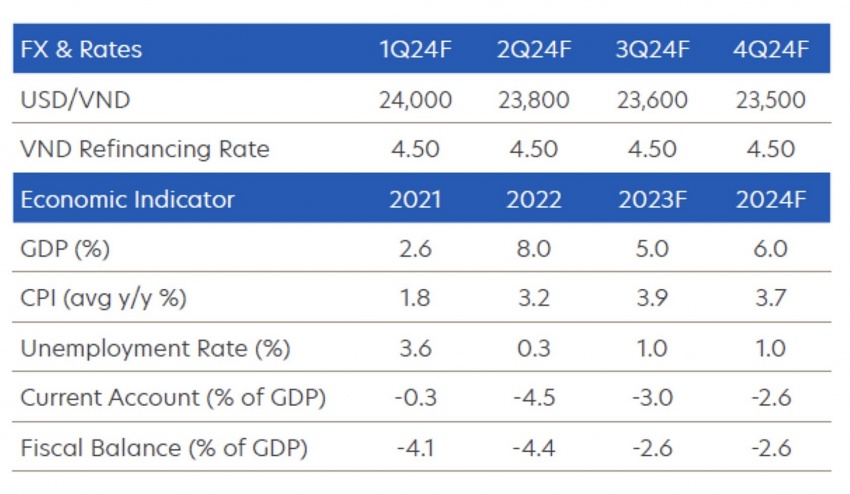

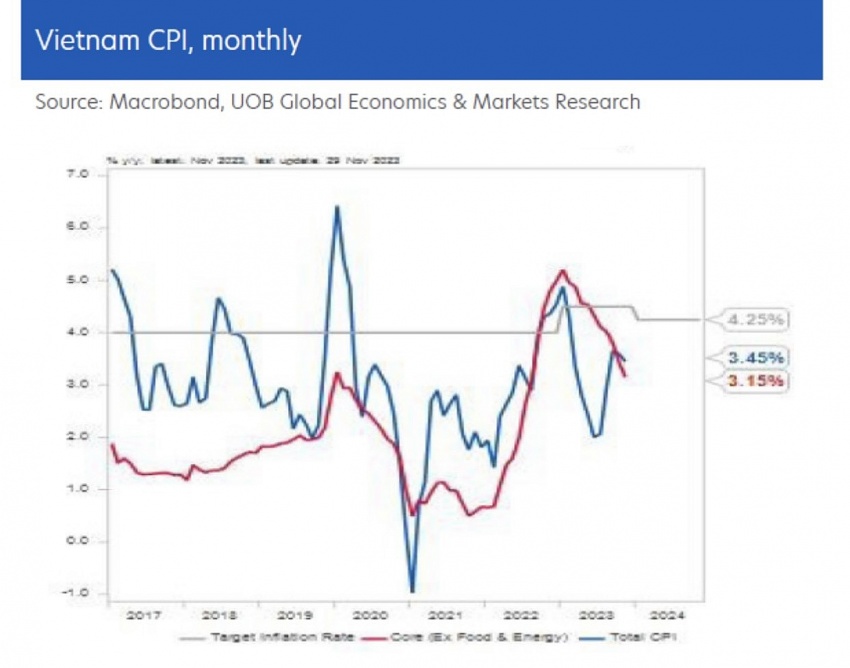

The SBV responded swiftly to the economic slowdown earlier this year with a rapid succession of interest rate cuts. The last policy rate reduction took place in June, when it lowered its refinancing rate by a cumulative 150 basis points, to 4.5 per cent. However, with the pace of economic activities quickening, and inflation rates already easing below the target level, the possibility of further rate cuts has diminished.

Indeed, the government has turned its focus to non-interest rate measures to support the economy. Prime Minister Pham Minh Chinh has reportedly asked the SBV to ensure sufficient credit is available for the remainder of the year, as the credit growth target of 14-15 per cent could yet be missed by several percentage points. As such, the UOB believes that the SBV will maintain its refinancing rate at the current level of 4.5 per cent.

| Soft momentum likely for Q3: UOB United Overseas Bank (UOB) maintains the full-year growth forecasts of 5.2 per cent for 2023 and 6 per cent for 2024, pencilling a projected 5.6 per cent on-year growth in Q3 this year and 7.6 per cent for Q4. |

| UOB adjusts 2023 growth forecast for Vietnam UOB (United Overseas Bank) has adjusted its full-year growth forecast for Vietnam to 5 per cent from 5.2 per cent previously, with the assumption of further acceleration of real GDP growth in Q4 at 7 per cent on-year. |

| UOB releases flagship study on consumer sentiment On November 1, United Overseas Bank (UOB Vietnam) held a ceremony to bring exposure to its flagship study on consumer sentiment across ASEAN. |

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Tag:

Tag:

Related Contents

Latest News

More News

- A golden time to shine within ASEAN (February 19, 2026 | 20:22)

- Vietnam’s pivotal year for advancing sustainability (February 19, 2026 | 08:44)

- Strengthening the core role of industry and trade (February 19, 2026 | 08:35)

- Future orientations for healthcare improvements (February 19, 2026 | 08:29)

- Infrastructure orientations suitable for a new chapter (February 19, 2026 | 08:15)

- Innovation breakthroughs that can elevate the nation (February 19, 2026 | 08:08)

- ABB Robotics hosts SOMA Value Provider Conference in Vietnam (February 19, 2026 | 08:00)

- Entire financial sector steps firmly into a new spring (February 17, 2026 | 13:40)

- Digital security fundamental for better and faster decision-making (February 13, 2026 | 10:50)

- Aircraft makers urge out-the-box thinking (February 13, 2026 | 10:39)

Mobile Version

Mobile Version