Taekwang looks for strategic stake in PV Power

|

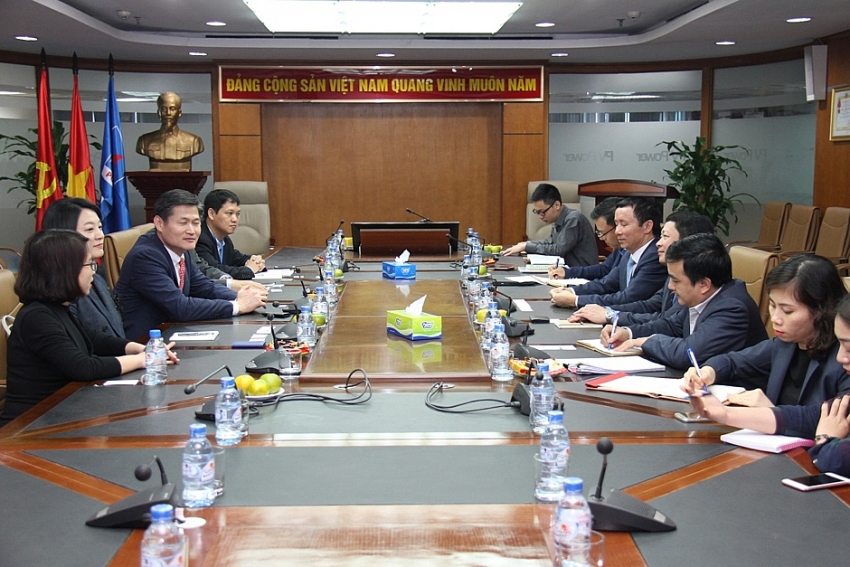

| Taekwang initiated talks to discuss strategic investment in PV Power |

Some days ago, representatives of Taekwang Power joined a working session with the leaders of PV Power to discuss options of buying nearly 29 per cent stake to become the strategic investor of PV Power.

The South Korean party has plans to spend VND12 trillion ($527.2 million) on the deal.

So far, PV Power met with 195 foreign investors, 35 of whom expressed intentions to make a bid. However, ultimately, only four firms submitted applications.

Two of these investors come from South Korea, one from Thailand, and one from Germany. The German firm registered to buy shares for a maximum of $100 million, while the three remaining investors registered to buy the entire 28.88 per cent stake offered to the strategic investor. However, the names of these firms have yet to be disclosed.

| PV Power was established in 2007 and is fully-owned by PetroVietnam. As the second-largest electricity producer in Vietnam, the company operates one coal-fired thermal power plant, three gas-fired power plants, and three hydropower plants. |

Taekwang Power is well-known as the co-investor of the $2.3-billion Nam Dinh 1 thermal power project.

Notably, in July 2017, the consortium including Saudi Arabian ACWA Power and Taekwang Power officially received an investment certificate for the project.

Nam Dinh 1 is the seventh foreign-invested power project licensed in Vietnam since the country opened its doors to foreign direct investment three decades ago.

The 1,200MW plant is an independent greenfield power project to be developed on a build-operate-transfer (BOT) basis. It is part of the 2,400MW Nam Dinh thermal power complex.

The project is scheduled to commence construction in early 2018. The first unit will enter commercial operations within 51 months, while the power facility will take 57 months.

The investment consortium will operate for 25 years. The project will be financed by Export-Import Bank of Korea and Korean Trade Insurance Corporation.

South Korean Posco E&C has been selected as a preferred bidder for the engineering, procurement, and construction (EPC) contract of the project.

The plant’s annual production will be 7,800GWh, which will be a considerable contribution to power generation in northern Vietnam and will facilitate the development strategy presented in the nation's power development strategy.

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- NAB Innovation Centre underscores Vietnam’s appeal for tech investment (January 30, 2026 | 11:16)

- Vietnam moves towards market-based fuel management with E10 rollout (January 30, 2026 | 11:10)

- Vietnam startup funding enters a period of capital reset (January 30, 2026 | 11:06)

- Vietnam strengthens public debt management with World Bank and IMF (January 30, 2026 | 11:00)

- PM inspects APEC 2027 project progress in An Giang province (January 29, 2026 | 09:00)

- Vietnam among the world’s top 15 trading nations (January 28, 2026 | 17:12)

- Vietnam accelerates preparations for arbitration centre linked to new financial hub (January 28, 2026 | 17:09)

- Vietnam's IPO market on recovery trajectory (January 28, 2026 | 17:04)

- Digital economy takes centre stage in Vietnam’s new growth model (January 28, 2026 | 11:43)

- EU Council president to visit Vietnam amid partnership upgrade (January 28, 2026 | 11:00)

Tag:

Tag:

Mobile Version

Mobile Version