Super Typhoon Yagi drives steel stock prices up

At the close of trade on September 16, the VN-Index had dropped12.45 points, landing at around 1,239. The telecommunications sector experienced the largest decline, with a drop of 2.45 per cent, followed by the real estate and IT sectors.

However, many stocks defied the overall trend, most notably in the steel sector, where investors expected that the damage caused by Typhoon Yagi would boost demand for roofing sheets and construction steel. Hoa Phat Group (HPG) and Hoa Sen Group (HSG) were the standout stocks, both leading the market in terms of liquidity.

Steel stocks also saw strong price increases. By the close of the trade, shares in Hoa Phat Group had risen 1.61 per cent, Hoa Sen Group by 2.04 per cent, Nam Kim Group by 2.43 per cent, Vietnam Germany Steel Pipe by 2.31 per cent, and Tien Len Steel Group by 0.36 per cent.

"After each storm and flood, there is generally increased construction demand, which benefits the steel sector. However, this is not a long-term story. Looking back at the steel sector’s performance following major storms, the upward trend in steel stocks hasn’t lasted, except in 2016," said Nguyen The Minh, head of research and development for retail clients at Yuanta Securities Vietnam.

"In reality, the steel sector is facing difficulties due to sluggish export growth and weak domestic demand as the real estate market hasn’t recovered as expected. Therefore, steel stocks may soon return to reflecting the underlying fundamentals of the industry," he added.

|

In fact, the sharp increase in steel stocks at this time is partly coincidental with investor optimism, as many stocks have already undergone significant corrections. For instance, HPG saw a maximum decline of over 6 per cent in the second half of August and a total drop of around 17 per cent from its June peak.

Taking a more cautious view, experts at KB Securities Vietnam noted that the steel sector remains one of the weakest stock groups in the market.

"The current price trends of steel stocks are influenced by the overall market conditions and global steel price trends. In the near-term, the price increases driven by the demand for reconstruction and repair of civil infrastructure affected by Typhoon Yagi will be short-lived. Investors interested in steel stocks should adopt a long-term view. In contrast, short-term investments in this sector are not encouraged due to the current weak price support factors," KB Securities Vietnam said.

| Banks scaling up support in aftermath of Typhoon Yagi Banks across the country have proactively introduced flexible support schemes to assist individuals and businesses severely impacted by Typhoon Yagi. |

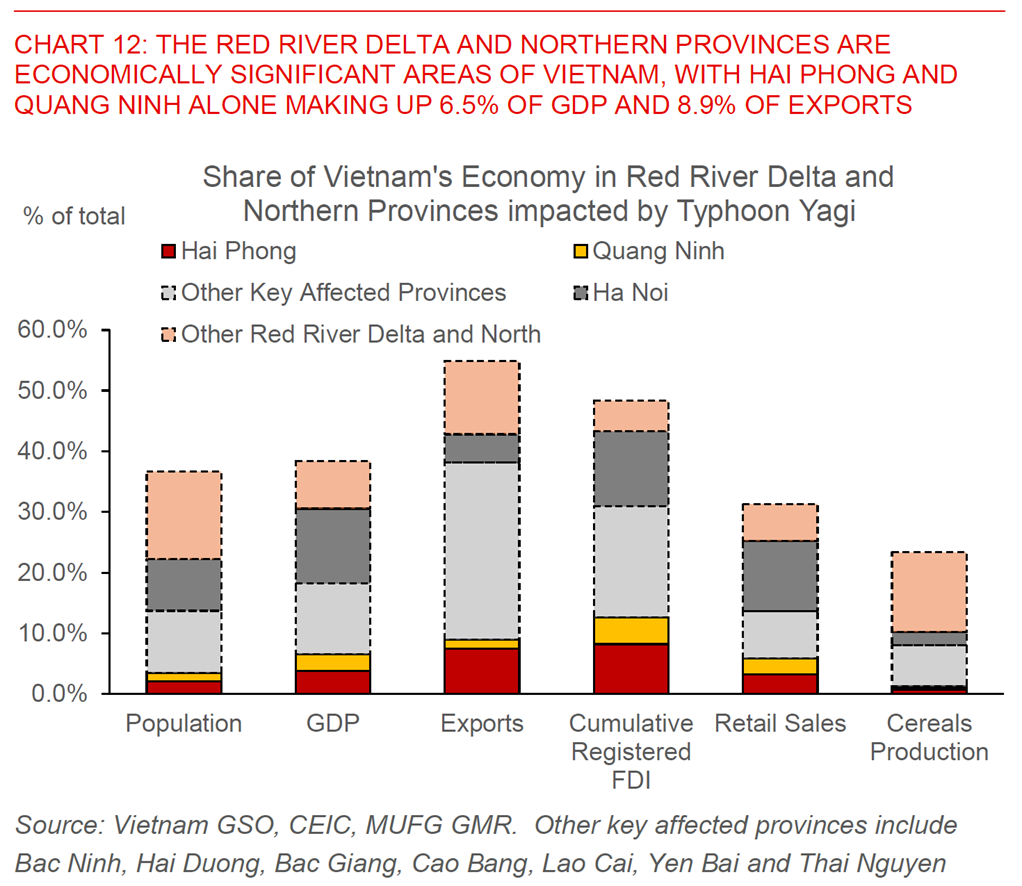

| Typhoon Yagi estimated to cause $1.6 billion in damage for Vietnam An estimated $1.6 billion in damages has been incurred due to Typhoon Yagi, with a projected 0.15 per cent reduction in Vietnam’s GDP for 2024. |

| Vietnam's GDP may slow up to 0.5 per cent due to Typhoon Yagi The impact of Typhoon Yagi may reduce Vietnam's 2024 GDP growth by between 0.2 per cent to 0.5 per cent, according to a report released by Mitsubishi UFJ Financial Group (MUFG) on September 16. |

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- Banking sector targets double-digit growth (February 23, 2026 | 09:00)

- Private capital funds as cornerstone of IFC plans (February 20, 2026 | 14:38)

- Priorities for building credibility and momentum within Vietnamese IFCs (February 20, 2026 | 14:29)

- How Hong Kong can bridge critical financial centre gaps (February 20, 2026 | 14:22)

- All global experiences useful for Vietnam’s international financial hub (February 20, 2026 | 14:16)

- Raised ties reaffirm strategic trust (February 20, 2026 | 14:06)

- Sustained growth can translate into income gains (February 19, 2026 | 18:55)

- The vision to maintain a stable monetary policy (February 19, 2026 | 08:50)

- Banking sector faces data governance hurdles in AI transition (February 19, 2026 | 08:00)

- AI leading to shift in banking roles (February 18, 2026 | 19:54)

Tag:

Tag:

Mobile Version

Mobile Version