Disaster response aid accelerated via insurance

From September, Vietnam was one of the countries receiving allocations from the International Federation of Red Cross and Red Crescent Societies’ Disaster Response Emergency Fund (IFRC-DREF), covered by a groundbreaking indemnity insurance policy – a new method to unlock capital for humanitarian activities.

|

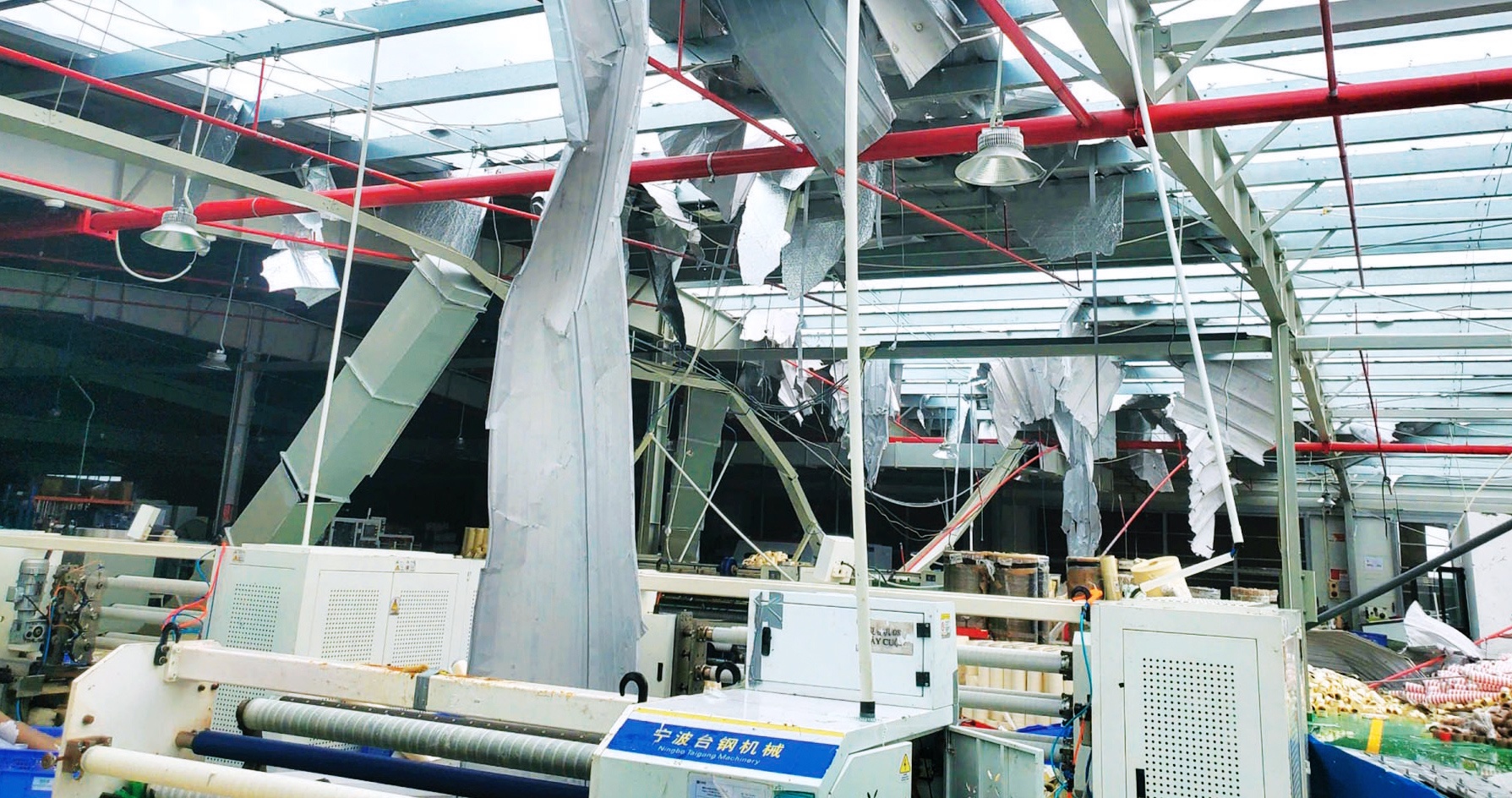

| Typhoon Yagi in September called for significant disaster-related funding from more sources, Photo: Thanh Son |

Typhoon Yagi that month brought torrential downpours in Vietnam, threatening access to safe drinking water and sanitation for three million people in the northern region of the country, displacing 130,200 people and damaging around 260sq.km of crops.

The IFRC has allocated around $662,000 from the DREF fund to support disaster response groups following Yagi. Support activities were deployed by the Vietnam Red Cross Society, who are providing relief to affected families by helping to rebuild homes, providing emergency household kits and clean water, and organising blood donations.

The IFRC-DREF is a vital fund that provides immediate funding for National Red Cross and Red Crescent Societies when disasters strike, especially for smaller-scale emergencies that may not attract global attention.

The fund was at risk of running dry before the end of 2023, prompting the IFRC to work with insurance broking company Aon and reinsurers to secure an indemnity insurance policy for the fund, the first such arrangement for the humanitarian sector.

Since the start of 2023, and for an annual premium of $3.4 million, the IFRC-DREF pot has been insured on an indemnity basis.

A potential payout of up to $17 million available if, or when, demands on the IFRC-DREF fund because of natural hazard-associated disasters hit a certain threshold - a deductible set at $37.4 million in one calendar year. For the rest of the calendar year, further demands on the IFRC-DREF for natural hazard disasters are covered by the insurance payout, up to the maximum cap of $17 million.

In 2024 allocations to respond to Typhoon Yagi in Asia tipped IFRC-DREF spend over the insurance trigger threshold. Overall, there have been almost 100 separate allocations in the year, combined with those to respond to the impacts of eligible natural hazards, which have exceeded the annual threshold.

President of Aon Eric Andersen said: “the IFRC was there to provide shelter, blankets, food, and water as they have for more than 100 years worldwide. But this time, the aid was funded by insurance companies a half a world away, the result of an innovative risk management initiative pioneered by the IFRC, brokered by Aon, and funded by international donors.”

“And it won’t be the last. Due to climate and other risks, floods in Algeria, typhoons in Vietnam and wildfires in Bolivia have left 43 million people impacted by disaster in September alone. At Aon, we believe funding should not, and cannot, stop emergency aid,” Andersen continued.

He added that the IFRC-DREF insurance policy expanded the impact and scale of emergency aid by the IFRC and was proof that the private sector can do more to support humanitarian organisations and the world’s most vulnerable populations.

According to the IFRC’s under-secretary general for Global Relations and Humanitarian Diplomacy, Nena Stoiljkovic, the triggering of the insurance policy is a significant moment.

“For the first time ever a single, worldwide, commercial indemnity insurance policy will pay the emergency humanitarian costs of disasters. The scale of the needs caused by 2024’s disasters is sobering. But the fact the insurance is helping with the burden is good news and proof that there are innovative finance solutions that we hope to grow in coming years,” Stoiljkovic said.

| Sao Do Group joins efforts to overcome consequences of Typhoon Yagi Sao Do Group is scaling up its efforts to help businesses overcome the consequences of Typhoon Yagi in the northern port city of Haiphong, one of the localities hardest hit by the tragic storm. |

| ADB approves $2 million to support Yagi response The Asian Development Bank (ADB) approved a $2 million grant on September 27 to assist the government of Vietnam in providing emergency and humanitarian services to residents affected by the super Typhoon Yagi in the northern region of the country. |

| Manufacturing production suffers after Typhoon Yagi Typhoon Yagi had a significant impact on Vietnam's manufacturing sector in September, with heavy rain and flooding causing temporary business closures and delays across production lines and supply chains. |

| Rebuilding lives a priority in aftermath of Typhoon Yagi In the wake of Typhoon Yagi, addressing the tragic consequences and rebuilding efforts has become paramount, with crucial bank support and strategic advice from industry experts guiding the process. |

| Tokio Marine Insurance Vietnam helps Lao Cai to recover from Typhoon Yagi Tokio Marine Insurance Vietnam (TMIV) launched the “Clean Water for Children and School Restoration” scheme to help Lao Cai province recover from Typhoon Yagi in December. |

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- Shinhan Life Vietnam builds growth on people strategy (October 07, 2025 | 09:45)

- Insurance sector initiates rapid response after Typhoon Bualoi devastation (October 03, 2025 | 18:25)

- Non-life insurers face mounting pressure after typhoon hits motor sector (October 02, 2025 | 18:59)

- Prudential Vietnam delivers responsible investment package (September 25, 2025 | 10:37)

- Insurers struggle to keep pace with EV rapid adoption (August 29, 2025 | 17:12)

- Non-life insurance market in sees bright spots in H1 despite rising challenges (August 28, 2025 | 16:21)

- Life insurance rebounds with renewed growth and trust (August 06, 2025 | 18:04)

- Global Care launches Vietnam’s first insurance KOL platform (July 25, 2025 | 09:42)

- Liberty Insurance leaves mark at 2025 Insurance Asia Awards with dual wins (July 14, 2025 | 07:27)

- New CEO takes helm at Prudential Vietnam (July 07, 2025 | 17:51)

Tag:

Tag:

Mobile Version

Mobile Version