Summit outcome hits Asian markets

|

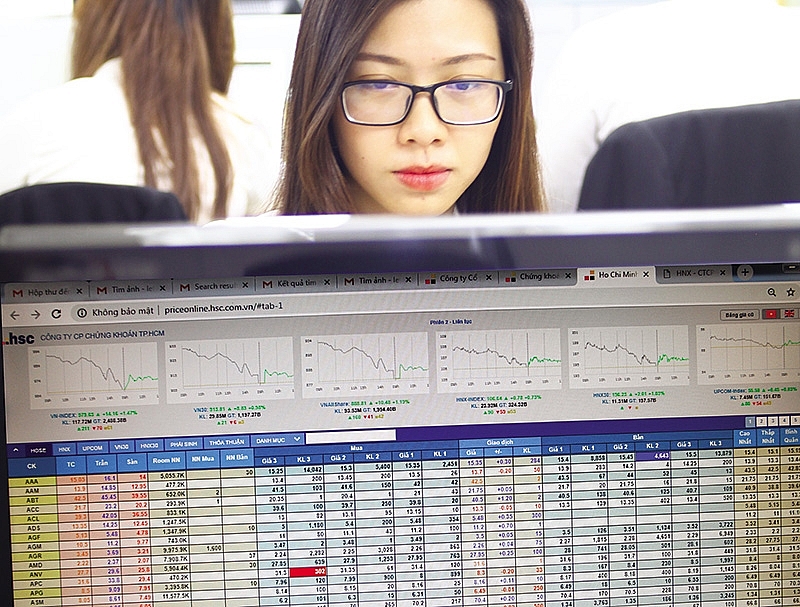

| Despite suffering a drop on Thursday, the VN-Index’s long-term prospects remain bright going forward |

Last Thursday, markets around the region reacted negatively to United States President Donald Trump’s decision to end his meeting with Democratic People’s Republic of Korea (DPRK) Chairman Kim Jong Un ahead of schedule. Vietnam’s VN-Index dropped 24 points, 2.5 per cent, to 965.47 points, marking the steepest drop experienced by the index in 2019. South Korea, whose President Moon Jae-in halted all of his activities on Thursday in order to monitor the event, also saw its KOSPI decline by 1.76 per cent.

Other major Asian markets also went through a tough day. Singapore’s STI fell 0.97 per cent, the Shanghai Composite Index dropped by 0.44 per cent, while Japan’s Nikkei Index and the Hong Kong Han Seng declined by 0.79 and 0.43 per cent, respectively. Other regional markets, including Indonesia, Malaysia, Thailand, and the Philippines, also recorded slight decreases.

In a daily report, Neil Wilson, chief market analyst at trading website Markets.com, said that the lack of progress made by the US with the DPRK and China has affected Asia’s stock markets negatively. The analyst referred to ongoing trade tensions between the US and China, who remain at odds over tariff issues.

Last week, Asian markets were also hit by rising tensions between India and Pakistan, which prompted the latter to close its airspace.

For Vietnam, Thursday’s drop ended a rally which had begun in mid-February, following the week-long Lunar New Year holiday. Analysts at Phu Hung Securities pointed out that rather than the negative outcome of the summit, “a variety of reasons” might have contributed to the decline. “Foreign investors net sold on the last trading day of February, and the iShares MSCI Frontier 100 exchange-traded fund also revamped its portfolio on the same day,” the analysts explained.

Official data shows that foreign investors sold shares worth VND332 billion ($14.4 million) on February 28, disrupting the buying spree that started last month.

Other analysts from MB Securities and VNDirect Securities also noted that after a short uptick in stock prices, investors may have chosen to lock in profits, which resulted in an oversupply, followed by an index drop. VNDirect emphasised that a weak VN-Index represented a good buying opportunity “in tough times” for investors, especially blue-chip stocks thanks to their long-term prospects.

“One bearish trading day stems from various factors, from the Trump – Kim summit and MSCI portfolio restructuring. As a result, this could be a temporary occurrence [to the VN-Index],” wrote Tran Hoang Son, head of research at MB Securities.

The analyst added that the demand and supply curve last Thursday was heavily skewed thanks to the MSCI restructuring, thus “no technical analysis should be necessary”.

Indeed, on Friday, the Vietnamese market welcomed in the new month on a positive note, with the VN-Index rising by 1.47 per cent to 979.63 points. Net selling by foreign investors also slowed down to VND92 billion ($4 million).

Petri Deryng, portfolio manager at PYN Elite Fund, said that the long-term picture for Vietnam is “pretty clear”. According to him, the stock market will experience hiccups from time to time, but will generally enjoy upward trajectory thanks to the rise in various stock groups.

“The growth outlook for the Vietnamese economy translates into excellent earnings growth outlooks in all the country’s home market sectors. Stock markets sometimes tend to reward such long-term earnings growth expectations with substantial stock price hikes, as the equities would otherwise become undervalued,” the investor commented.

Deryng added that the domestic equities market will continue to modernise, with “substantial changes” coming soon. He remained optimistic that the economy is on track to double its size over the next decade.

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- Banking sector targets double-digit growth (February 23, 2026 | 09:00)

- Private capital funds as cornerstone of IFC plans (February 20, 2026 | 14:38)

- Priorities for building credibility and momentum within Vietnamese IFCs (February 20, 2026 | 14:29)

- How Hong Kong can bridge critical financial centre gaps (February 20, 2026 | 14:22)

- All global experiences useful for Vietnam’s international financial hub (February 20, 2026 | 14:16)

- Raised ties reaffirm strategic trust (February 20, 2026 | 14:06)

- Sustained growth can translate into income gains (February 19, 2026 | 18:55)

- The vision to maintain a stable monetary policy (February 19, 2026 | 08:50)

- Banking sector faces data governance hurdles in AI transition (February 19, 2026 | 08:00)

- AI leading to shift in banking roles (February 18, 2026 | 19:54)

Tag:

Tag:

Mobile Version

Mobile Version