Stumbling seaport companies seeking international flavour

|

| VIMC holds stakes in 14 port businesses, which were the group’s most profitable arena last year |

Having trouble attracting cargo for years, the fate of Cai Lan International Container Terminal (CICT) seems to be inevitable after it reported a poor performance in 2019. CICT, located in the northeastern province of Quang Ninh, is a joint venture (JV) seaport between the Vietnamese state-owned shipping giant Vietnam Maritime Corporation (VIMC) and US-based Carrix, the parent company of SSA Marine.

According to a VIR source, VIMC is considering divesting state stakes in CICT and possibly other JV seaports that are facing difficulties. VIMC has four such ports with foreign partners including CICT, SP-PSA, SSIT, and Cai Mep International Terminal (CMIT).

“The business performance of CICT in 2019 faced difficulties with container throughput and goods in bulk decreasing due to stiffening competition from Lach Huyen International Seaport, located in the northern port city of Haiphong, which is not very far from CICT,” Nguyen Canh Tinh, acting CEO of VIMC, told VIR.

“In the long term, CICT will be less competitive in both container throughput and goods in bulk. We plan to consider divesting state stakes in this seaport in the future.”

Still in trouble

|

Statistics from VIMC show that CICT is estimated to see total container throughput reach 57,850 of the TEU cargo capacity rate in 2019, down 47 per cent on-year while handling 2.96 million tonnes of goods in bulk, equal to the 2018 volume.

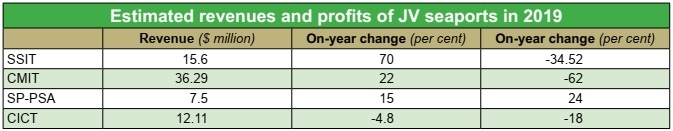

The Quang Ninh facility is estimated to make revenues of $12.11 million, a drop of 0.5 per cent on-year. In 2018, big improvements were witnessed at the seaport with the US in terms of volume and revenue when it reported a throughput of 62,760 TEU for that year’s first 10 months, easily surpassing its yearly target of 19,838 TEU. Meanwhile, in previous years, CICT had to handle goods in bulk to survive.

However, the joy has not lasted. CICT is forecast to face further difficulties in the coming months when more terminals are put into operation at Lach Huyen International Seaport.

In 2019, the performance of the other three JV ports improved, although not to the extent hoped for. Their profit remains negative during the year.

SP-PSA, a JV between VIMC and Singapore-based PSA, located in the Cai Mep-Thi Vai area of the southern province of Ba Ria-Vung Tau, is also in a hardship despite recent improvements.

Throughout 2019, SP-PSA reported no container throughput while its volume of goods in bulk rose 11 per cent on-year to over 3.43 million tonnes in comparison with the estimated figure at 1.54 million tonnes in 2016. The seaport is also estimated to fetch revenue of nearly $7.5 million during the 12-month span, up 15 per cent on-year. It loss amounted to $9.8 million, up 24 per cent on-year.

Consistently ranking lower than other seaports of the type, SSIT – a JV between Vinalines and SSA Marine – nevertheless witnessed better results in 2019 in revenue, but still incurred a loss of $10.28 million, and an on-year fall of 63 per cent in the volume of goods in bulk. However, the improvement has not been ample enough to help it cover huge losses incurred in the past.

Also located in the Cai Mep-Thi Vai area, SSIT’s container throughput rocketed 438 per cent in 2019 to 224,120 TEUs. Its goods in bulk ascended 63 per cent to 2.55 million tonnes.

Although being the most profitable JV seaport, CMIT, which has Denmark’s APM Terminals as foreign stakeholder, failed to make an expected profit in 2019, although its revenue rose 22 per cent to $36.3 million, and container throughput increased 7 per cent on-year.

Attractive but concerning

The seaport segment attracts the most foreign direct investment (FDI) in the transport sector thanks to its ability to control revenue sources, thus helping Vietnam’s seaports to become a link in the global supply chains of global shipping lines and seaport operators. VIMC, which has stakes in 14 port companies and operates over 13,000 metres of piers with a total capacity of 75 million tonnes a year, is seen as a springboard for international groups to venture further into the lucrative market amid growing trade.

Recently, a number of international financiers sought opportunities to invest in Vietnamese seaports. In mid-May 2019, Thailand’s Thoresen Group expressed interest in acquiring a 65-per-cent stake in Cai Cui-Can Tho Port in the Mekong Delta city of Can Tho.

Earlier, many other investors from Japan, the United States, and South Korea have also expressed strong interest in acquiring state stakes in ports in Haiphong, Ho Chi Minh City, and Danang.

While seaports are VIMC’s most profitable business line in 2019, with steady growth of over 6 per cent greatly contributing to business results, worries have also been raised over possible snags.

VIMC once planned to divest state stakes in CICT and others, at that time, international groups were also interested in the move. SP-PSA was reported to want to raise stakes in VIMC while SSA Marine offered to buy VIMC’s entire stake in CICT. Vietnam-Oman Investment JSC also proposed buying a stake in Haiphong Port. However, the divestment was delayed for unknown reasons.

Le Duc Khanh, director of market strategy department at PetroVietnam Securities, said that to reduce wide-scale but ineffective investments, and to more effectively use the capital in line with capacity and expertise, VIMC needs to divest some JV seaports. The state stake divestment is more difficult than in other businesses as VIMC will have to find suitable partners with strong experience in seaport management and financial capacity.

“However, not all seaports are appealing to investors. Evidently, JV seaports, and regional-standard seaports having strategic important location, advanced technology and capacity to accommodate big vessels are more attractive to investors,” he told VIR.

Khanh’s thoughts resonated with other industry insiders who said that this move is a golden opportunity for foreign investors to buy stakes in state-run port operators and JV ports at cheap prices, letting them gain the ability to make important decisions in their operations. One concern is the possibility of state stake divestment, and we will have to wait until specific figures are announced.

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- SK Innovation-led consortium wins $2.3 billion LNG project in Nghe An (February 25, 2026 | 07:56)

- THACO opens $70 million manufacturing complex in Danang (February 25, 2026 | 07:54)

- Phu Quoc International Airport expansion approved to meet rising demand (February 24, 2026 | 10:00)

- Bac Giang International Logistics Centre faces land clearance barrier (February 24, 2026 | 08:00)

- Bright prospects abound in European investment (February 19, 2026 | 20:27)

- Internal strengths attest to commitment to progress (February 19, 2026 | 20:13)

- Vietnam, New Zealand seek level-up in ties (February 19, 2026 | 18:06)

- Untapped potential in relations with Indonesia (February 19, 2026 | 17:56)

- German strengths match Vietnamese aspirations (February 19, 2026 | 17:40)

- Kim Long Motor and AOJ Suzhou enter strategic partnership (February 16, 2026 | 13:27)

Tag:

Tag:

Mobile Version

Mobile Version