Steel schemes set despite US duties

|

The US Department of Commerce last week imposed duties of up to 456 per cent on certain steel products imported from Vietnam using South Korean- or Taiwanese-origin substrate. The steel products involved in the decision refer to corrosion-resistant steel products (CORE) and cold-rolled steel (CRS).

The move was no surprise for local steel-makers, with the United States previously applying anti-dumping duties of 531 per cent on Vietnamese-shipped CORE, and in 2017 duties of nearly 200 per cent were placed on galvanised items processed from Chinese steel. Vietnamese manufacturers had already, as a result, diversified material sources and witnessed government efforts to tighten the process in order to avoid illegal shipments.

While industry insiders shrugged at the move, saying it likely will not place much of an effect on Vietnamese steel-makers, it may even produce a windfall for Hung Nghiep Formosa Ha Tinh Steel Co., Ltd, operator of a $10.5 billion steel and port complex in the central province of Ha Tinh.

Formosa is the only producer of hot-rolled steel materials for CORE and CRS. According to a VIR source, Vietnam produced 4.5 million tonnes of this steel in 2019, mostly contributed by Formosa.

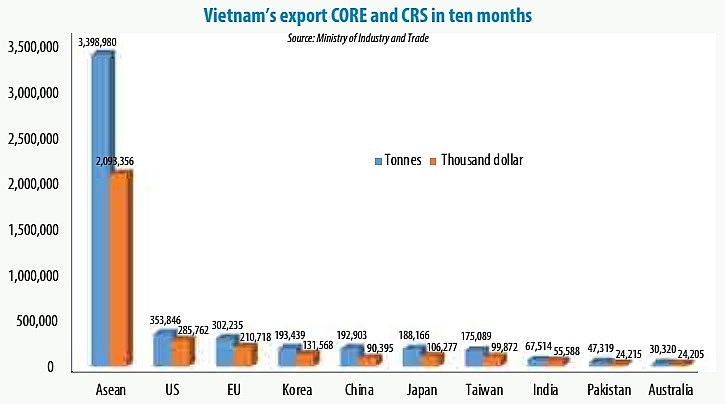

In a document from the Vietnam Steel Association, the suggestion was made that steel-makers should use material sources from Formosa, as well as from the Japanese or Brazilian market, in order to reduce the risks when exporting to the US. The US currently accounts for 6.5 per cent of Vietnam’s total steel exports, while the Southeast Asian market makes up for 65 per cent. Thus those using materials from Formosa and markets outside South Korea and Taiwan will not be subject to the US’ tariff.

The positive demand could be a driver for Formosa to start its third blast furnace construction soon, having previously considered construction delay due to concerns of a Chinese steel capacity glut. The group fired up its second blast furnace last year to bring Formosa’s total production capacity to 6.71 million tonnes of liquid cast iron annually, with sales estimated at $3.5 billion.

Formosa was licensed in 2008 with the registered capital of $2.7 billion. The company has since sought to have its investment certificate amended 14 times, gradually increasing the chartered capital. The company asked to raise its capital to $7.8 billion in 2012, and $10.5 billion following the latest adjustment in 2015.

Meanwhile, Hoa Phat Steel also last week furthered plans to start operations of the second phase of its Dung Quat steel plant in the first half of 2020, which will lift domestic availability of hot-rolled coil and put pressure on prices.

Total flat steel exports of Vietnam in 2019 up to October have contracted by nearly 20 per cent, compared with 9.8 per cent growth in the same period of 2018.

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- State corporations poised to drive 2026 growth (February 03, 2026 | 13:58)

- Why high-tech talent will define Vietnam’s growth (February 02, 2026 | 10:47)

- FMCG resilience amid varying storms (February 02, 2026 | 10:00)

- Customs reforms strengthen business confidence, support trade growth (February 01, 2026 | 08:20)

- Vietnam and US to launch sixth trade negotiation round (January 30, 2026 | 15:19)

- Digital publishing emerges as key growth driver in Vietnam (January 30, 2026 | 10:59)

- EVN signs key contract for Tri An hydropower expansion (January 30, 2026 | 10:57)

- Vietnam to lead trade growth in ASEAN (January 29, 2026 | 15:08)

- Carlsberg Vietnam delivers Lunar New Year support in central region (January 28, 2026 | 17:19)

- TikTok penalised $35,000 in Vietnam for consumer protection violations (January 28, 2026 | 17:15)

Tag:

Tag:

Mobile Version

Mobile Version