Rising production confidence bodes well for next year

Industrial production continued its positive uptrend in October, with the estimated index for industrial production (IIP) increasing 5.5 per cent on-month and 4.1 per cent on-year, according to a government report released last week.

|

| Rising production confidence bodes well for next year, Illustrative photo (Photo: VNA) |

As compared to the same period last year, the processing and manufacturing sector – which creates more than 80 per cent of industrial growth – climbed 4.9 per cent; while the mining sector declined 5.7 per cent.

The electricity production and distribution sector rose by 5.6 per cent, meanwhile, and the sector of water supply and wastewater and waste treatment increased 5.2 per cent.

Vietnam Electricity (EVN) reported that all of its activities in September were also ensured, meeting increased demand for electricity across the economy.

The group’s total electricity output in September reached 23.5 billion kWh, up 6.7 per cent on-year. Cumulatively in the first nine months of 2023, the figure hit nearly 210 billion kWh, up 3.1 per cent on-year. So far this year, EVN has commenced construction of 50 works and put into operation around 60 power projects.

Cumulatively, the 10-month IIP is estimated to ascribe 0.5 per cent on-year, stated last week’s government report. “The economy is bouncing back,” stated Prime Minister Pham Minh Chinh at last week’s government meeting on the national socioeconomic performance for 2023 so far. “Our macroeconomic situation remains stable, with inflation, public debt, government debt, foreign debt, and state budget overspending brought under effective control. The economy’s major balances have been ensured.”

“A greater priority now is to boost growth and improve growth quality, generate employment, and increase incomes for labourers based on macroeconomic stability,” the PM stressed, adding that the key task is to revive and advance industrial production.

In an example, after suffering from a loss of about $3 million in the first three quarters of this year, Hanoi Textile and Garment Material Production JSC in Hanoi in early October inked five export contracts with Taiwanese firms.

“The total value of the contracts cannot be revealed now, but I’m sure it can ensure sufficient employment for our 500 workers from now until the year’s end,” a company representative said. “At present, we are also negotiating more contracts with several South Korean partners for the first six months of next year.”

The General Statistics Office (GSO) last week reported that in the first 10 months of this year, although total export turnover of textiles and garments was down 0.7 per cent on-year at $2.7 billion, cloth made from artificial fibres like those made at Hanoi Textile and Garment Material Production JSC increased 8.3 per cent on-year.

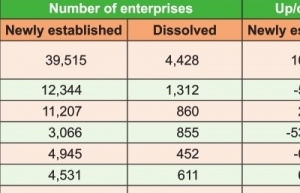

The GSO said business confidence continued to rise in October. Specifically, the month saw more than 15,400 newly established enterprises with registered capital of $5.3 billion and a number of new workers registered at nearly 131,600. These were up 21.7 per cent in the number of enterprises, 7.4 per cent of registered capital, and 64.3 per cent in the number of workers as compared to the previous month.

In its October macroeconomic updates about Vietnam, Standard Chartered Bank has lowered the country’s 2023 GDP growth to 5 per cent on-year from the previous 5.4 per cent, reflecting the weaker-than-expected data and a gloomier global outlook.

The revised forecast would require Q4 growth of 7 per cent on-year, which may still be challenging. Standard Chartered maintains a robust 2024 GDP growth forecast of 6.7 per cent.

According to the bank, Vietnam’s macro indicators show a tentative improvement; trade has yet to signal a clear manufacturing rebound. However, the domestic recovery continues and is likely to strengthen further, with a robust retail sales. The construction and accommodation sectors maintained strong growth in the year to date; manufacturing has started to expand.

“The medium term outlook remains promising given Vietnam’s economic openness and stability. To reinvigorate foreign direct investment (FDI) inflows, Vietnam needs to resume rapid GDP growth and develop its infrastructure,” said Tim Leelahapan, economist for Thailand and Vietnam at Standard Chartered.

According to the Ministry of Planning and Investment, cumulatively as of October 20, total newly registered and newly added FDI, and that from capital contributions and stake acquisitions, hit nearly $25.76 billion, up 14.7 per cent on-year.

Total 10-month FDI disbursement reached an estimated $18 billion, up 2.4 per cent on-year, which was the highest 10-month disbursement sum over the past five years.

| Signs are up for industrial production and services Vietnam’s production and services are beginning to gain momentum, with expectations for a more positive recovery by the year’s end. |

| Industrial production on back foot Vietnam’s industrial production remains challenged despite signals of recovery in August, while a decline in business confidence means it may be a stretch to hit government-set goals. |

| Shoots of recovery seen in industrial production Although Vietnam’s targeted economic growth may be unreachable, there are positive signs of recovery in industrial production and business confidence. |

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- Hermes joins Long Thanh cargo terminal development (February 04, 2026 | 15:59)

- SCG enhances production and distribution in Vietnam (February 04, 2026 | 08:00)

- UNIVACCO strengthens Asia expansion with Vietnam facility (February 03, 2026 | 08:00)

- Cai Mep Ha Port project wins approval with $1.95bn investment (February 02, 2026 | 16:17)

- Repositioning Vietnam in Asia’s manufacturing race (February 02, 2026 | 16:00)

- Manufacturing growth remains solid in early 2026 (February 02, 2026 | 15:28)

- Navigating venture capital trends across the continent (February 02, 2026 | 14:00)

- Motivations to achieve high growth (February 02, 2026 | 11:00)

- Capacity and regulations among British areas of expertise in IFCs (February 02, 2026 | 09:09)

- Transition underway in German investment across Vietnam (February 02, 2026 | 08:00)

Tag:

Tag:

Mobile Version

Mobile Version