Promising signs ahead for Singapore-led FDI

|

A marketplace of 200 countries and territories, and over 100 million members are the impressive numbers belonging to Alibaba.com - the world’s largest business-to-business e-commerce platform - with which Singapore’s Innovative Hub Pte., Ltd. has signed a memorandum of understanding (MoU) to expand operations in Vietnam.

With the MoU, Innovative Hub, which focuses on e-commerce advisory services, can now penetrate the Vietnamese market, laying the path for the company to achieve its ambitious goal of being one of the most active and influential service providers in Southeast Asia. It plans to provide digital solutions for small- and medium-size enterprises (SMEs) in Vietnam, and wish to co-operate with manufacturers and wholesalers, associations and federations, retailers, exporters, and e-commerce and digital solution providers.

This is one of 26 companies partaking in a Singaporean business mission to Vietnam last month to seek business and investment opportunities. Other groups included Fundnel Pte., Ltd., Quest Ventures, KinderWorld, Koda Ltd., Kwan Brothers Pte., Ltd., NTUC Fairprice Co-Operative Ltd., PSA Corporation Ltd., Siasun Automation Pte., Ltd., Select Group Pte., Ltd., and Singapore Technologies Engineering Ltd.

“We continue to see potential for investment and collaboration in several sectors, including consumer and lifestyle, and innovation and startups, which is an emerging sector in the market,” Tan Soon Kim, assistant CEO of Enterprise Singapore (ESG)– the Singaporean government agency championing enterprise development – told VIR.

Emerging sectors

Vietnam’s consumer sector and e-commerce is attractive to Innovative Hub and other Singaporean newcomers in the market such as Koda, Kwan Brothers, Select Group, and NTUC Fairprice because of the local rising middle class and purchasing power. With the maturing of Vietnam’s consumer sector, Singapore’s food service and lifestyle brands can look to tap into this market by providing more options and customised experiences.

Select Group is expanding its operations beyond the shores of Singapore to Malaysia, Indonesia, and Vietnam. It is planning to establish casual dining, Chinese fine dining, and themed food courts in Vietnam in particular.

Meanwhile, Kwan Brothers, an international luxury brand specialising in crafting crocodile leather handbags and accessories, is eyeing a soft launch in the country through luxury private trunk shows, embarking on e-commerce services, and expanding further into Ho Chi Minh City, where most of the international luxury brands gather.

NUTC Fairprice, Singapore’s largest retailer serving over 600,000 shoppers daily, aims to expand its footprint in Hanoi as well as other provinces. The company currently operates four hypermarkets and over 30 convenience stores in Ho Chi Minh City.

According to Kim of the ESG, there are new sectors which hold great potential for both countries to work together, in line with the emergence of the Fourth Industrial Revolution. With Vietnam making rapid progress as a startup hub, in which the number of startups has soared from around 400 in 2012 to over 3,000 by last year, Singapore sees opportunities for their technology companies and startups to tap into this vibrant ecosystem to find partners, co-innovate, and offer solutions. To encourage this, the ESG announced the expansion of the Global Innovation Alliance network to Ho Chi Minh City on July 18. The initiative by the Singaporean government provides an entry point for startups and SMEs from the city-state to connect with the local innovation and business community in Vietnam.

Evidently, Fundnel, Southeast Asia’s largest private investment platform, along with Quest Ventures and other Singaporean companies, is interested in startups driven by the Vietnamese government’s goal of renewing the growth model based on innovations.

According to Kim, the Vietnamese government is taking strong action to build a number of supporting policies to create favourable conditions for the development of innovations to unblock the financial resources for related activities.

As part of the July visit, the mission held meetings with leaders of Hanoi, Ho Chi Minh City, and Danang which aim to develop into smart cities with a series of projects calling for investment in order to work on the possibilities of joining their efforts.

In this view, Siasun Automation, which leverages core technologies like Artificial Intelligence, Big Data, robotics, the Internet of Things, and smart manufacturing, is planning to digitally transform Vietnam through technology adoption in various industries like manufacturing, logistics, automotives, education, and infrastructure.

Traditional interests

According to the National Business Survey 2018/2019 by the Singapore Business Federation, Vietnam is listed as the top market of interest by the Singapore business community. Renewable energy, the consumer sector, and infrastructure are now the big draws for Singaporean firms in the Vietnamese market, while their traditional interests remain real estate, education, manufacturing, and healthcare.

“Singaporean enterprises are keen to partner Vietnamese companies in the country’s growth and transformation due to its strong economic growth and economic fundamentals,” explained Kim. “These include its favourable demographics, cost competitiveness and pro-foreign investment environment.”

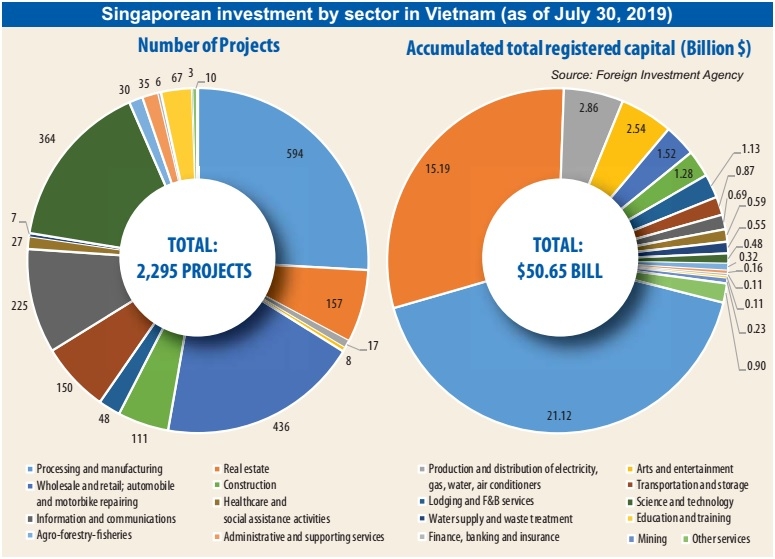

According to statistics from Vietnam’s Ministry of Planning and Investment (MPI), Singapore invested $942.9 million in Vietnam in the first seven months of this year, ranking fifth among foreign investors. So far, the city-state has pumped total accumulated registered capital of over $50.65 billion in about 2,295 projects in Vietnam, ranking third behind South Korea and Japan.

Manufacturing still holds the majority of Singaporean investment in Vietnam, with accumulative total registered capital of $21.12 billion as of July 30. Singaporean enterprises still see potential for investment and collaboration in manufacturing, due to Vietnam’s connectivity to consumption hubs in Asia and beyond. Major Singaporean players in Vietnamese manufacturing currently include Armstrong S.E. Clean Energy Fund, SHS Holdings Ltd., Sinenergy Holdings Pte., Ltd., and The Blue Circle.

Also on the July business trip for Singaporean groups, Sunseap Group Pte., Ltd. – the leading solar energy system developer, owner, and operator in Singapore – showed its ambition in developing rooftop solar farms, ground-mounted solar farms, and off-grid energy solutions in the Vietnamese market.

Meanwhile, furniture manufacturer Koda also wants to expand facilities in the country. In addition to manufacturing, infrastructure and urban solutions are among other major interests, driven by Vietnam’s rapid urbanisation.

In real estate, key Singaporean developers of residential, commercial, and hospitality projects in Vietnam include Keppel Land, CapitaLand and Mapletree, which provide urban solutions in key cities such as Hanoi and Ho Chi Minh City. With Vietnam’s young population, growing middle class, and sustainably increasing foreign direct investment, they plan to expand in the country.

Keppel Land Vietnam is aggressively pursuing the launch of residential projects in Ho Chi Minh City, as well as commence development of Saigon Sports City and commence development the final phase of Saigon Centre.

Sembcorp has for years been a prototypical story of Singaporean investment in Vietnam in general and in the realty sector in particular, with over 20 years of local experience behind it.

In financial services, United Overseas Bank, the first Singaporean bank to set up in Ho Chi Minh City in 1995, will be launching a digital bank and also extend its operations to Hanoi by opening a branch in the capital.

Besides direct investment, Singapore was also among the biggest mergers and acquisition (M&A) investors in Vietnam with value of $1.2 billion in 2018. Looking ahead, Singapore is expected to continue to be a major M&A investor in the country.

Since 2005, when the Vietnam-Singapore Economic Connectivity Agreement was signed, the two countries have fostered the important co-operation mechanism which over the years has strengthened ties in investment, trade and services, finance, ICT, education, and transport. It also helped facilitate the implementation of bilateral agreements, with transparent and favourable investment policies included, further supporting Singaporean investment in Vietnam.

Industry insiders forecast that Singaporean investment in Vietnam will continue to thrive in the near future and beyond, through the establishment of new projects as well as increased capital to existing projects.

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- Kurz Vietnam expands Gia Lai factory (February 27, 2026 | 16:37)

- SK Innovation-led consortium wins $2.3 billion LNG project in Nghe An (February 25, 2026 | 07:56)

- THACO opens $70 million manufacturing complex in Danang (February 25, 2026 | 07:54)

- Phu Quoc International Airport expansion approved to meet rising demand (February 24, 2026 | 10:00)

- Bac Giang International Logistics Centre faces land clearance barrier (February 24, 2026 | 08:00)

- Bright prospects abound in European investment (February 19, 2026 | 20:27)

- Internal strengths attest to commitment to progress (February 19, 2026 | 20:13)

- Vietnam, New Zealand seek level-up in ties (February 19, 2026 | 18:06)

- Untapped potential in relations with Indonesia (February 19, 2026 | 17:56)

- German strengths match Vietnamese aspirations (February 19, 2026 | 17:40)

Tag:

Tag:

Mobile Version

Mobile Version