No let-up in South Korean affiliation after three decades

At last week’s bilateral talks in Seoul, South Korean National Assembly Speaker Park Byeong-seug and his Vietnamese counterpart Vuong Dinh Hue agreed on a plan to upgrade the existing strategic partnership between South Korea and Vietnam to a comprehensive strategic one next year when the two countries will be celebrating 30 years of diplomatic ties.

The new cooperation framework will mean that more favourable mechanisms will be created for both nations to further beef up cooperation in all sectors, with a focus laid on trade and investment relationships.

Both leaders have agreed that more mechanisms will be used to help the two countries to raise bilateral trade to $100 billion in 2023 and $150 billion by 2030. They also encourage South Korean firms to expand investments in Vietnam, especially in the sectors of supporting industry, high technology, smart cities, and high-tech agriculture.

At last week’s South Korea-Vietnam Business Forum also in Seoul, leaders of five northern provinces of Vietnam granted 15 investment certificates and cooperation deals to South Korean businesses. Moreover, another 12 similar certificates and deals were signed and granted online to businesses.

Among these, Daewoo was licensed for its new $2 billion ventures in Vietnam, while Amkor Technology, Inc. was licensed by Vietnam’s northern province of Bac Ninh to implement a $1.6 billion semiconductor manufacturing scheme.

|

|

Fostering investment

A few weeks ago, Vietnam’s Viglacera Real Estate Company and Amkor Technology, one of the world’s largest providers of outsourced semiconductor packaging, design, and test services, signed a contract in principle to lease land to build a project for manufacturing, assembling, and testing semiconductor materials at Yen Phong II-C Industrial Park in Bac Ninh.

Amkor will pour in $1.6 billion before 2035 to build a plant on a site of 23 hectares in the park. Construction of the project is expected to begin in the next few months.

“This is a very big project with very high technology applied,” Hong Sun, vice chairman of the Korea Chamber of Business in Vietnam, told VIR. “This project is signalling South Korea’s investment in Vietnam in the semiconductor sector, whose products are now in serious shortage worldwide.”

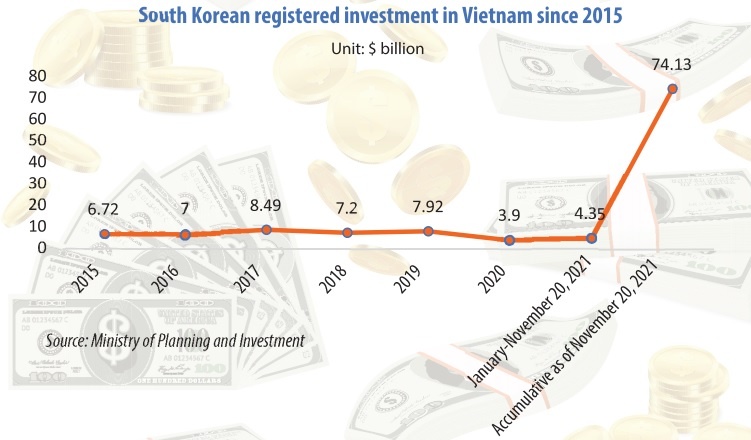

This year until mid-November, South Korea has poured $4.35 billion into Vietnam, making itself the second-largest foreign investor, following Singapore at $7.6 billion. The country’s accumulative investment in Vietnam as of November 20 hit $74.13 billion, making the northeastern Asian nation the largest foreign investor here.

Chairman Hue also met with leaders of many South Korean groups such as Hyosung, GS Engineering & Construction, Kyobo Life Insurance, Amore Pacific, and Dongwon, who stated that their groups will continue expanding investment in Vietnam.

While meeting with CEO of GS Engineering & Construction Lim Byeong-yong, the Vietnamese leader spoke highly of the corporation’s infrastructure development, reaffirming that Vietnam encourages foreign enterprises with technology, capacity and experience to invest in infrastructure projects, especially strategic infrastructure for transport, large cities, healthcare, energy, and digital infrastructure.

Meeting with general director of Kyobo Life Insurance Pyun Jung-bum, National Assembly Chairman Hue praised the firm’s plan to invest in Vietnam, saying that it has huge potential for the life insurance sector and that building and developing a safe, transparent, sustainable, and efficient insurance market towards digital transformation is one of Vietnam’s priorities.

As one of the three largest life insurance companies in South Korea with a strategy to expand business in Southeast Asia, Kyobo has been paying special attention to the Vietnamese market, Jung-bum said, stressing that the firm wishes to explore investment opportunities in the healthcare business and startups in order to contribute to Vietnam’s digital transformation process.

Receiving Suh Kyung-bae, chairman and CEO of cosmetic and healthcare manufacturer Amore Pacific, Hue said Vietnam supports the group’s plan to expand investment and business in the country in the near future. Kyung-bae said Amore Pacific plans to open a factory in Southeast Asia, in which it is leaning towards choosing Vietnam, as well as perhaps cooperating with Vietnamese businesses in this field. Meanwhile, Park In-ku, vice chairman of Dongwon, revealed that the group is planning to expand funding in other fields such as logistics, transportation, containers, cold storage, packaging materials and food, and is considering investing in Vietnamese businesses operating in related sectors.

In late August, LG Display Vietnam received an adjusted investment certificate for the $1.4 billion raised from the Haiphong Economic Zone Authority. This new investment has expanded its total investment in the country to $4.65 billion. Samsung is also investing over $17.5 billion in Vietnam in many projects.

Groups like these are taking the lead in Vietnam’s export of electronics items, including mobile phones, laptops, and others. In the first 11 months of 2021, the country earned $51.97 billion, up 11.6 per cent on-year, from exporting mobile phones and their spare parts. Vietnam also fetched $45.05 billion, up 11.9 per cent on-year, from exporting laptops, their spare parts, and other electronics items.

Facilitating trade

Both Park Byeong-seug and Vuong Dinh Hue have also agreed that the two countries will facilitate trade and investment thanks to advantages from the Regional Comprehensive Economic Partnership (RCEP) in which South Korea and Vietnam are members. On December 3, South Korea deposited its instrument of ratification of the RCEP to the secretary-general of ASEAN. With this, the RCEP will take effect in South Korea in February. The deal is entering into force on January 1 for Japan, Brunei, Cambodia, Laos, Singapore, Thailand, Vietnam, Australia, China, and New Zealand.

The combined amount of South Korea’s exports to the participants of the RCEP came to $254.3 billion in 2020, taking up around half of South Korea’s total outbound shipments, according to data provided by this nation’s Ministry of Trade, Industry and Energy.

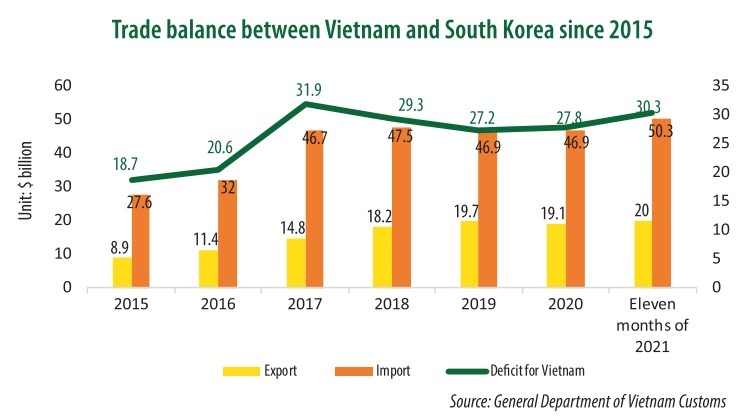

Figures from the General Department of Vietnam Customs showed that total trade between Vietnam and South Korea hit $66.01 billion last year, including $46.9 billion worth of South Korean exports, and $70.3 billion in the first 11 months of 2021, which included $50.3 billion worth of South Korean exports.

The RCEP seeks to eliminate 90 per cent of import tariffs between member states within 20 years of it coming into effect, as well as promote the flow of services and investment while setting out regulations around rules of origin and intellectual property.

“In addition to bilateral cooperation mechanisms, within the framework of the RCEP, Vietnam and South Korea are important partners and have finished the ratification procedures for the agreement to come into force at the beginning of 2022. This is an important groundwork for Vietnam and South Korea to strengthen our bilateral cooperation, consolidate our positions as each other’s leading trade and investment partner, and expand our strategic partnership,” said Chairman Hue.

With the implementation of preferential tariffs, harmonisation of commitments and standards, and reduction of export procedures, the RCEP will create favourable conditions for the business communities of both countries to strengthen cooperation, he continued. “We also hope that through the RCEP, Vietnamese exports can have greater access to South Korea’s market, thus increasing imports, and encouraging high-quality investments from South Korea to Vietnam.”

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- NAB Innovation Centre underscores Vietnam’s appeal for tech investment (January 30, 2026 | 11:16)

- Vietnam moves towards market-based fuel management with E10 rollout (January 30, 2026 | 11:10)

- Vietnam startup funding enters a period of capital reset (January 30, 2026 | 11:06)

- Vietnam strengthens public debt management with World Bank and IMF (January 30, 2026 | 11:00)

- PM inspects APEC 2027 project progress in An Giang province (January 29, 2026 | 09:00)

- Vietnam among the world’s top 15 trading nations (January 28, 2026 | 17:12)

- Vietnam accelerates preparations for arbitration centre linked to new financial hub (January 28, 2026 | 17:09)

- Vietnam's IPO market on recovery trajectory (January 28, 2026 | 17:04)

- Digital economy takes centre stage in Vietnam’s new growth model (January 28, 2026 | 11:43)

- EU Council president to visit Vietnam amid partnership upgrade (January 28, 2026 | 11:00)

Tag:

Tag:

Mobile Version

Mobile Version