MoF proposes a 10 per cent special consumption tax on sugary drinks

|

The 10 per cent SCT will be levied on carbonated beverages, tea-based drinks, caffeinated drinks, drinks featuring fruit juice, energy drinks, electrolyte drinks, and sports drinks. It won't be applied to milk and dairy products, natural mineral water and bottled water, vegetable-fruit drinks and nectars, or cocoa-based products.

According to the management agency's assessment, the price of soft drinks may increase by 10 per cent when subject to the corresponding SCT. However, soft drink consumption will decrease as consumers switch to alternative products or less sugary drinks that are better for their health.

“The tax and price increase will contribute to reducing obesity, diabetes, and other non-communicable diseases in the future, especially among the younger generation. This will ease pressure on health systems and hospitals,” the MoF noted.

The MoF estimates collecting an additional tax revenue of VND2.4 trillion ($94.3 million) per year, assuming that taxed products account for 80 per cent and consumption decreases by 20 per cent due to price hikes. However, revenue will only increase in the first year of levying taxes on this item. Revenue will gradually decrease in the following years because consumers will switch to less sugary products, while manufacturers will change formulas and manufacture products with sugar content below the tax threshold.

Many associations and businesses oppose the imposition of SCT on sugary drinks because it would not solve the problem of obesity. They said it would create a discriminatory tax policy and cause undesirable consequences for other related industries, such as the sugar production, retail, and packaging industries.

Regarding this issue, the MoF cited data from the National Institute of Nutrition showing that sugary drink consumption per capita has increased nearly 1.5 times in seven years, reaching 70.56 litres per capita in 2020. Meanwhile, the rate of overweight and obese school-age children has more than doubled over the past 10 years. It had reached 19 per cent in 2020, higher than the average rate of Southeast Asia (17.3 per cent) and low- and middle-income countries in the region.

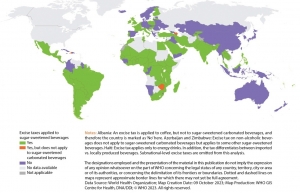

The MoF stated that the imposition of the excise tax has become a common global trend. Currently, about 85 countries impose this tax, an increase of nearly six times compared to 10 years ago.

| VIR to host talk show on tax amendments to promote business activities A talk show themed “Tax Amendments to Promote Business Activities” will be held by VIR on June 14 to provide insights into amended tax regulations. |

| Vietnam edges towards decision on sugary drink taxes Proposals to tax sugary drinks continue to receive mixed opinions in the country, with Vietnam planning to submit a special consumption tax law for debate in October. |

| Alcohol and beer could be subject to 100 per cent special consumption tax The Ministry of Finance (MoF) has proposed increasing the special consumption tax (SCT) for alcohol and beer to 100 per cent by 2030. |

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Tag:

Tag:

Related Contents

Latest News

More News

- Over 64,000 businesses enter market in first two months (March 07, 2026 | 10:00)

- Honda Vietnam marks 30-year milestone (March 07, 2026 | 08:00)

- Palm oil perspectives from nutrition experts (March 06, 2026 | 09:00)

- Global surge in critical minerals stockpiling: a strategic edge for Vietnam (March 05, 2026 | 17:21)

- Iran war to modestly impact Vietnam (March 05, 2026 | 08:00)

- Middle East tensions drive cost pressures for seafood exporters (March 04, 2026 | 13:56)

- PV Gas reduces LPG deliveries amid Middle East conflict disruptions (March 04, 2026 | 09:23)

- Government outlines solutions for economic growth (March 04, 2026 | 08:00)

- JAPEX withdraws from LNG terminal project in Haiphong (March 03, 2026 | 11:57)

- Agency of Foreign Trade warns of trade disruption due to Middle East conflict (March 02, 2026 | 17:11)

Mobile Version

Mobile Version