Vietnam edges towards decision on sugary drink taxes

The Ministry of Finance said that the World Health Organization (WHO) recommended that the government take action to encourage people to access healthy food through taxation on food, and guides on sugary drink consumption.

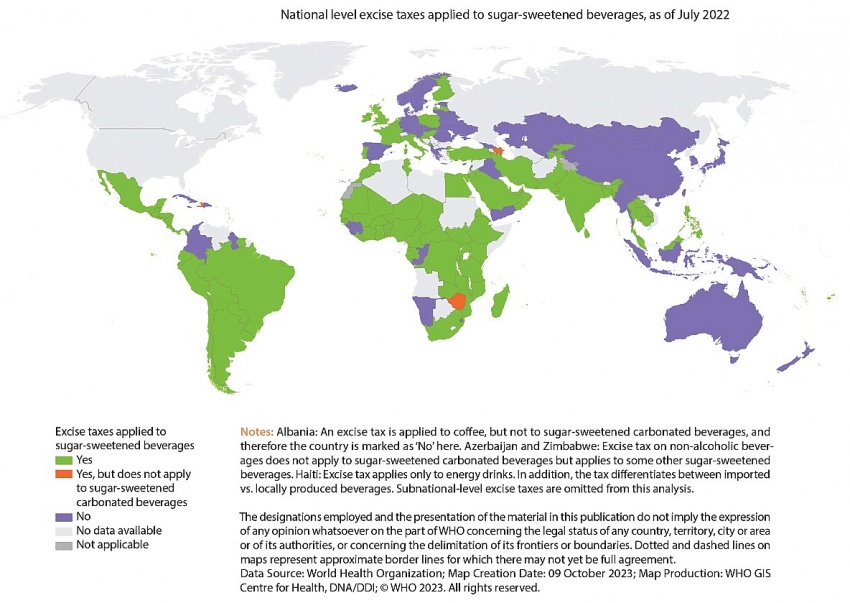

Other nations have gradually added sugary drinks to special consumption taxes (SCT). While only around 15 countries collected such taxes on sugary drinks in 2012, last year national taxes were in effect in 106 markets, equal to 52 per cent of the global population, according to the World Bank.

|

In ASEAN, six out of 10 countries collect a SCT on sugary drinks, and Indonesia and Vietnam are considering it.

Nguyen Thi Cuc, chairwoman of the Vietnam Tax Consultants Association, said, “The issue of needing to levy tax on sugary products has been raised, but we have to consider the time of application. Up to now, public health has changed with an emphasis on nutrition, which aims to limit foods and drinks that are harmful to health, ensuring healthy and safe health. Therefore, the issue of limiting products that have negative impacts on health, including sugary drinks, continues to be mentioned.”

The WHO’s global report on the use of sugar-sweetened beverage taxes report released in 2023 said the use of excise taxes on non-alcoholic beverages, while previously applied primarily as a revenue raising tool, has seen growing momentum to leverage them on sugar-sweetened beverages as a public health policy. However, countries implement the policy with varying designs and levels, and not all excise taxes on such beverages have the same degree of effectivity in their design from a public health perspective.

“It is important to adequately monitor excise taxes on sugar-sweetened beverages with standardised indicators to characterise tax designs and tax levels to inform policymaking,” the report said.

To reduce unreasonable sugar consumption and the harmful effects of sugary drinks, the WHO recommends that countries deploy a combination of imposing taxes, education, and limiting advertising to children.

Dr. Angela Pratt, chief representative of the WHO in Vietnam, said, “What we want to see are strategies to reduce consumption of sugary drinks such as raising awareness of the risks, and monitoring consumption at schools. We want the government to consider the imposition of a tax to increase the price of these drinks. This is a strategy implemented in many countries, which has an effective impact on reducing consumption of such drinks.”

However, the Ministry of Finance has not clearly stated what “sugar-sweetened beverages” are. Many drinking products contain sugar, and some are concerned that juice products from natural fruits or essential products such as milk will be taxed, which would in turn increase costs for businesses.

Tran Quang Trung, chairman of the Vietnam Dairy Association, said, “The addition of an SCT for sugary beverage products does not currently exclude health-beneficial products such as milk and nutritional products. Dairy businesses recommend excluding dairy products and nutritional drinks.”

The American Chamber of Commerce in Vietnam said that new taxes and fees may be needed in the future, but their impact should be considered carefully to ensure they support business recovery and do not undermine economic growth. For example, the government should study the potential impact of the proposed tax increase on businesses and consumers to avoid unintentional discrimination between sugar-sweetened beverages and other beverages or food containing sugar, it said.

| Careful consideration required for sugary drink tax In addition to increasing the excise tax on beer, wine, and tobacco, the Ministry of Finance has once again proposed to put sugary drinks into taxable status. Adam Sitkoff, executive director of the American Chamber of Commerce in Hanoi, spoke to VIR’s Nguyen Thu about the latest proposal. |

| Players take sides in drink tax discussion The beverage sector has called for a delay in Vietnam’s proposed tax increase on alcohol as the industry is at risk from high inflation, increased material costs, and low demand. |

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- The generics industry: unlocking new growth drivers (February 04, 2026 | 17:39)

- Vietnam ready to increase purchases of US goods (February 04, 2026 | 15:55)

- Steel industry faces challenges in 2026 (February 03, 2026 | 17:20)

- State corporations poised to drive 2026 growth (February 03, 2026 | 13:58)

- Why high-tech talent will define Vietnam’s growth (February 02, 2026 | 10:47)

- FMCG resilience amid varying storms (February 02, 2026 | 10:00)

- Customs reforms strengthen business confidence, support trade growth (February 01, 2026 | 08:20)

- Vietnam and US to launch sixth trade negotiation round (January 30, 2026 | 15:19)

- Digital publishing emerges as key growth driver in Vietnam (January 30, 2026 | 10:59)

- EVN signs key contract for Tri An hydropower expansion (January 30, 2026 | 10:57)

Tag:

Tag:

Mobile Version

Mobile Version