Masan Consumer reveals IPO roadmap

At the meeting with investors in early May, Danny Le, CEO of Masan Group, unveiled the plan to mobilise capital this year. With an average annual growth rate of 15 per cent over the past 6-7 years, it is the right time for Masan Consumer to consider the implementation of its initial public offering (IPO) plan, he said.

Double-digit growth for seven consecutive years

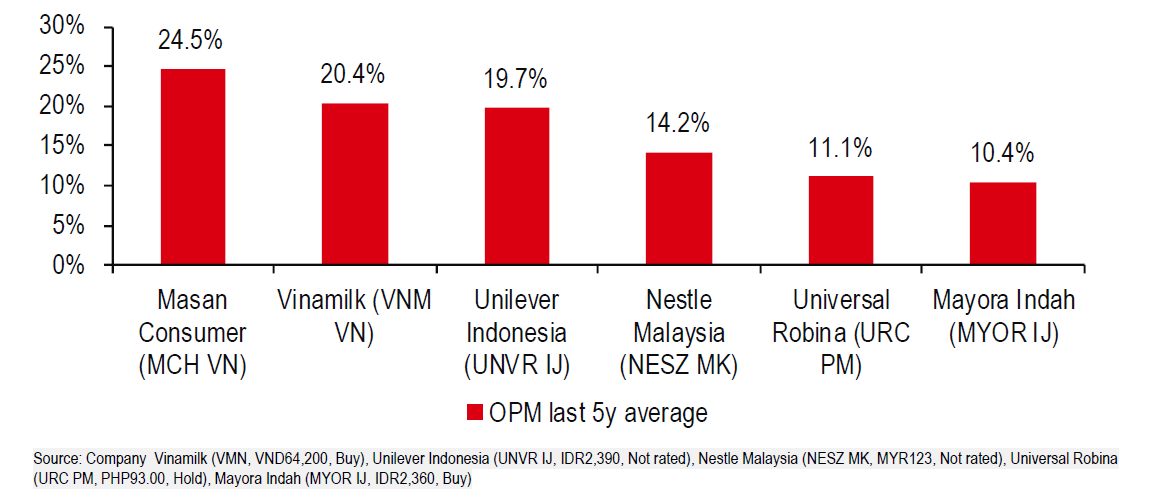

Masan Consumer has a stable track record of high growth. The company significantly outperforms other companies in the fast-moving consumer goods (FMCG) and packaged food industry in the region. According to an HSBC report, from 2017 to 2023, Masan Consumer grew at a rate 2.2x faster than the market average. The report also emphasised Masan Consumer's plan to list MCH shares on the HoSE. HSBC believes that listing on the HoSE can help MCH shares improve liquidity in line with the outstanding capacity that the company has achieved over the years.

|

In addition, a successful IPO would help increase the valuation of Masan stocks such as MCH and MSN. This roadmap is becoming clearer with positive information from both the company and the market.

Serving 98 per cent of Vietnamese households

Masan Consumer's starting point and core product line is seasonings. As of present, Masan Consumer has eight main consumer goods industries in Vietnam. The company owns five brands with annual revenue ranging from $150 million to $250 million. These consumer goods brands are popular in Vietnam, such as CHIN-SU, Nam Ngu, Omachi, Kokomi, and Wake-Up Coffee. The five flagship brands account for 80 per cent of Masan Consumer’s revenue in the Vietnamese market.

According to Kantar, over 98 per cent of Vietnamese households own at least one Masan Consumer product. Among them, CHIN-SU and Nam Ngu are the most popular brands in urban areas. Meanwhile, the most chosen brands in rural areas are CHIN-SU, Kokomi, and Tam Thai Tu, according to a report by securities company HSC.

In both rural and urban areas, Masan Consumer has established a loyal customer base, which is ready to experience new products and contribute to increasing sales across multiple categories.

According to the company's latest report, Masan Consumer continued its record growth momentum in 2023 with positive business results in the second quarter of 2024. The company posted revenue growth of 14 per cent and maintained a high gross profit margin of 46.3 per cent. In the second quarter of 2024, the convenience food, beverage, and coffee industries led the growth, recording increases of 20.7 per cent, 17.6 per cent and 16 per cent, respectively, on-year. In addition, the company's Go Global strategy also recorded positive figures, with export revenue registering an increase of 17 per cent over the same period last year.

|

| Photo: Masan Consumer |

Major boost from market upgrade

On September 18, the Ministry of Finance approved Circular 68/2024/TT-BTC. Under the new circular, stock purchases transactions do not require sufficient funds when placing orders by foreign institutional investors. Listed organisations and public companies will also disclose information in English. This circular comes into force on November 2, 2024.

This is a step closer for the Vietnamese stock market to meet the requirements for an upgrade to emerging market status by FTSE Russell.

SSI Research forecasts that Vietnam will be upgraded in an assessment scheduled for September 2025. With the upgrade to emerging market status, preliminary estimates suggest that capital inflows from exchange-traded funds (ETF) could reach up to $1.7 billion, not including capital from active funds (FTSE Russell estimates that total assets from active funds are five times greater than those from ETF funds). This could be a catalyst for companies with IPO plans in 2025, like Masan Consumer.

Foreign investors are keen on the FMCG industry and the long-term investment opportunities in businesses with a stable track record of high growth and huge dividend payments. Thus, Masan Consumer's MCH stock will be a potential option.

With its outstanding growth rate, Masan Consumer has attracted the attention of many large domestic and foreign investors. The board of directors revealed a series of large investment funds holding shares in Masan Consumer. Among them, Albizia Asean Tenggara Fund owns 3,891,258 MCH shares, and Vietcap Securities JSC owns 2,700,800. The Bill & Melinda Gates Foundation Trust owns 1,041,100 MCH shares.

In 2024, Masan Consumer aims to continue its double-digit revenue and profit growth. Net revenue is expected to reach between VND32.5 trillion ($1.32 billion) and VND36 trillion ($1.86 billion). The company has plans to own $6 billion brands and achieve 10-20 per cent revenue from the global market, premiumise products, and expand product ranges for each brand, increasing market accessibility from 100 million consumers in Vietnam to 8 billion people globally.

| Major food makers strive to increase revenue from instant noodle As instant noodle sales bounce back in Vietnam, major food makers continue to employ different strategies to diversify income and capture new growth. |

| Masan's next wave consumer portfolio scaling-up Masan Group Corporation (HSX: MSN) today reported its management accounts for the first nine months of 2019. |

| Masan Consumer shares sensory science insight at SPISE 2024 On July 27, Masan Consumer presented at SPISE 2024, sharing insights in sensory and consumer science. |

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Tag:

Tag:

Related Contents

Latest News

More News

- Masan Consumer names new deputy CEO to drive foods and beverages growth (February 23, 2026 | 20:52)

- Myriad risks ahead, but ones Vietnam can confront (February 20, 2026 | 15:02)

- Vietnam making the leap into AI and semiconductors (February 20, 2026 | 09:37)

- Funding must be activated for semiconductor success (February 20, 2026 | 09:20)

- Resilience as new benchmark for smarter infrastructure (February 19, 2026 | 20:35)

- A golden time to shine within ASEAN (February 19, 2026 | 20:22)

- Vietnam’s pivotal year for advancing sustainability (February 19, 2026 | 08:44)

- Strengthening the core role of industry and trade (February 19, 2026 | 08:35)

- Future orientations for healthcare improvements (February 19, 2026 | 08:29)

- Infrastructure orientations suitable for a new chapter (February 19, 2026 | 08:15)

Mobile Version

Mobile Version