Market upgrade prospects favourable

|

| Mirae Asset Securities and other market watchdogs forecast a bright 2021 for the VN-Index. Photo: Le Toan |

|

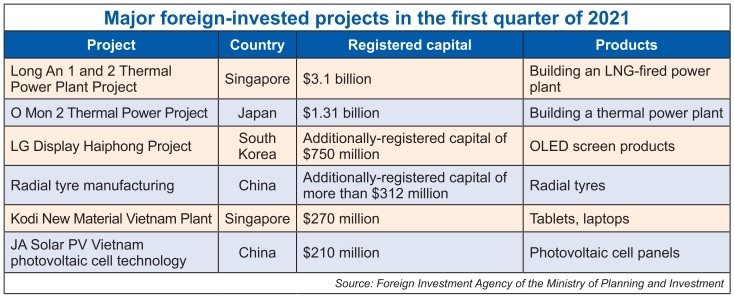

In the first quarter of this year, total newly- and additionally-registered capital recorded an impressive recovery of 41.4 per cent on-year to reach $9.3 billion. Specifically, there were a total of 234 newly-licensed projects, down 69.1 per on-year, with registered foreign direct investment (FDI) of $7.2 billion, up 30.6 per cent on-year.

Notably, additionally-registered FDI rocketed upward by 97.4 per cent on-year to reach $2.1 billion in the first quarter of 2021. Asia continued to be the largest FDI source in 2020 and this year’s first quarter, led by Singapore, Japan, China, Hong Kong, and South Korea. This reflects ongoing supply chain restructuring, with Vietnam continuing to benefit.

Compared with the start of the year, the VND/USD exchange rate decreased by a modest 0.1 per cent as of the end-March, marking a slight appreciation of the VND against the US dollar. Most other Asian currencies depreciated against the US dollar in the first quarter, with the Dollar Index reaching 92.8 at the end of March 2021 – the highest level in four months.

The VND/USD exchange rate is expected to remain relatively stable, thanks to trade surplus remaining at a high level, alongside a continued rise in foreign exchange reserves and the continued positive FDI inflows into Vietnam due to production shifts. Moreover, the State Bank of Vietnam’s flexible mechanism for regulating the supply and demand of foreign currencies also helps stabilise the exchange rate. Expectations for a minimal appreciation of the US dollar in 2021, due to large-scale economic stimulus packages and Fed support policies, also keep the VND/USD stable.

Meanwhile, we expect the VND to continue to appreciate within a range of around 0.5 per cent against the US dollar in 2021, due to Vietnam’s solid economic fundamentals and increasing pressure from the placing of Vietnam on the list of currency manipulation countries by the US.

The strong correction triggered by the third wave of COVID-19 in late-January was short-lived, with the VN-Index finding a temporary bottom at 998 points. Thanks to COVID-19 containment efforts, Vietnam returned from the Lunar New Year holiday in a positive fashion. However, stocks succumbed to profit-taking after the VN- Index reached the 1,200-point threshold – an all-time high. Banks, real estate, and materials were the main drivers of the market in March, as well in the first quarter.

The global stock market enjoyed a strong rally amid a wave of monetary and fiscal stimulus policies, as well as expectations for a post-pandemic improvement in economic growth. Vietnam was among the best performers in the Asian market.

On the other hand, foreign investors have continued to pull their money out of the local stock market, as they did in other emerging ones. In Vietnam alone, international investors sold a net amount of around $532 million in March, cumulating the year-to-date net outflow to nearly $809 million.

We see that offshore investors continued to withdraw from Asian markets in 2021 year-to-date (Taiwan: -$12.1 billion, South Korea: -$8.3 billion, Thailand: -$986 million, the Philippines: -$947 million, and Malaysia: -$429 million), following a dismal 2020. Bucking the trend, the Indian and Indonesian markets recorded net inflows of $7.6 billion and $847 million, respectively.

In our opinion, the appreciation of the US dollar, unprecedented fiscal and monetary stimulus in the US, and strong rallies in the US stock market, driven by tech stocks (perceived as a pandemic-immune sector), have diverted offshore money flows to the US since 2020. Furthermore, increasing US Treasury yields also boosted this trend.

Stock market prospects

The world is entering the recovery stage, with vaccine rollouts and fiscal and monetary policies remaining very supportive. Under this favourable backdrop, fuelled by solid FDI inflows, multiple trade deals, and accelerated public investment, we expect the pace of economic recovery to remain strong. Therefore, we project the VN-Index’s earnings per share (EPS) growth to accelerate to around 20 per cent in 2021, from an estimated negative 0.6 per cent in 2020. Consensus forecasts also express similar expectations.

Furthermore, the current price-to-earnings ratio (P/E) of the VN-Index is 18.5x, which is 29 per cent higher than the 10-year average of 14.3x. Amid a wave of stimulus monetary and fiscal policies, the global stock market enjoyed a strong rally in 2020, with the valuations of many stock markets at or over their 10-year P/E average plus two standards.

Meanwhile, the VN-Index is trading under that threshold. In other words, Vietnam’s market valuation remains reasonable when compared with its own historical P/E band chart.

In terms of relative valuation, the Vietnamese market is attractive compared with other markets, with high return on equity and low P/E. Looking forward, valuations continue to be attractive for long-term investors in terms of economic growth, and corporate earnings prospects which are forecast to outperform other markets.

With the strong momentum in the pace of economic recovery, we project the VN-Index’s EPS growth to accelerate to around 20 per cent in 2021, from an estimated negative 0.6 per cent in 2020. Consensus forecasts also express similar expectations. Market watchers expect broad-based recovery in corporate earnings in 2021. According to the Bloomberg consensus, the EPS of VN-Index members is expected to grow about 23.7 per cent on-year in 2021 and 23.5 per cent on-year in 2022.

The prospects of technology hardware and equipment, software and services, banks, diversified financials, and materials remain intact, following impressive growth in 2020.

By contrast, consumer services and transportation are expected to bounce back significantly, thanks to the rollout of vaccination and resuming normalcy. That said, both will still see incomplete recoveries in 2021, when compared with 2019 EPS levels.

High EPS growth expectations will propel the market in the long term. Based on historical precedent, we expect a reasonable P/E range of 14x-18x. In other words, we expect the VN-Index to fluctuate in the range of 1,050-1,400 points, with a base-case target of 1,227 points. The market’s main drivers are as follows:

- The COVID-19 pandemic is effectively controlled domestically and globally, along with the rollout of vaccinations;

- Fiscal and monetary policies remain very supportive. A lower policy rate means a lower cost of capital, which will play an important role in investment and consumption;

- Buoyant market liquidity will remain intact, thanks to emerging new accounts of retail investors in the era of low interest rates;

- Vietnam could be a potential candidate for an emerging market upgrade by 2022 or as late as 2023. According to our calculation, if entering the MSCI EM Index, the proportion of Vietnam’s stock portfolio would be 0.47-0.67 per cent, equivalent to a disbursement rate of $144-205 million; if entering the FTSE EM Index, the proportion of Vietnam’s stock portfolio is expected to be at 0.46-0.66 per cent, equivalent to a disbursement rate of $499-716 million; and

- Others: A wave of initial public offerings or transfers to the main bourse by banks; equitisation of state-owned enterprises.

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- Cashless payments hit 28 times GDP in 2025 (February 04, 2026 | 18:09)

- SSIAM and DBJ launch Japan Vietnam Capital Fund (February 04, 2026 | 15:57)

- Banks target stronger profits, credit growth in 2026 (February 04, 2026 | 15:43)

- Vietnam on path to investment-grade rating (February 03, 2026 | 13:07)

- Consumer finance sector posts sharp profit growth (February 03, 2026 | 13:05)

- Insurance market building the next chapter of protection (February 02, 2026 | 11:16)

- NAB Innovation Centre underscores Vietnam’s appeal for tech investment (January 30, 2026 | 11:16)

- Vietnam strengthens public debt management with World Bank and IMF (January 30, 2026 | 11:00)

- Corporate bond market poised for stronger growth cycle (January 28, 2026 | 17:13)

- Vietnam's IPO market on recovery trajectory (January 28, 2026 | 17:04)

Tag:

Tag:

Mobile Version

Mobile Version