Logistics sector a golden egg for progress across Vietnam

From a low starting point with a 1989 GDP per capita of $100, Vietnam has grown to become one of the most attractive investment destinations in Asia over the past 30 years, with GDP per capita increasing to $4,100 in 2022, according to the General Statistics Office.

|

| Trang Bui, country head of Cushman & Wakefield Vietnam |

Meanwhile, in the first eight months of 2023 alone, the total registered foreign direct investment capital in Vietnam reached nearly $18.15 billion, an increase of 8.2 per cent compared to the same period in 2022. This indicates that Vietnam is currently a shining star in Southeast Asia.

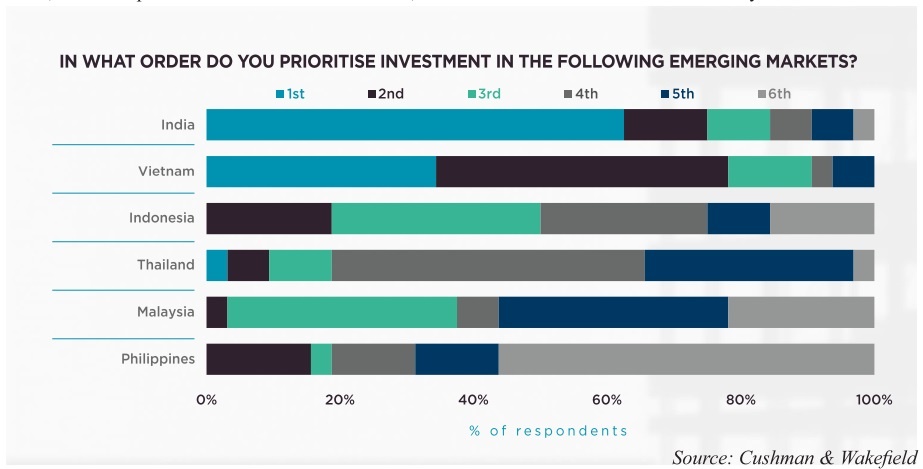

Our annual survey of top global clients in 2022 saw over 60 per cent of respondents rank India as their preferred emerging market (excluding mainland China) in which to invest. On a first- and second-place preferred basis, Vietnam was the emerging market of choice, taking almost 80 per cent of the votes, just ahead of India’s 75 per cent.

Notably, with a large market scale and a rapidly increasing number of online consumers, Vietnam’s e-commerce market also has a spectacular growth rate. Specifically, e-commerce revenue continues to record impressive growth in the first half of 2023, estimated to reach $10.3 billion, up about one-quarter over the same period, accounting for 7.7 per cent of goods and revenues in consumer services nationwide.

Anticipating demand

With the development of the e-commerce industry, Vietnam has become the go-to destination for many businesses in manufacturing and logistics. This goes hand-in-hand with increased demand for high-quality logistics real estate.

Especially in the last few months of the year, when demand from the retail market is forecast to double, the thirst for factory and warehouse supply becomes even more severe.

Currently, the total warehouse supply in Hanoi and Ho Chi Minh City only reaches more than 2 million sq.m and 5 million sq.m, respectively. High occupancy rates are recorded in industrial zones and warehouse logistics in major cities, especially Hanoi and Ho Chi Minh City, reaching nearly full capacity in some areas.

We forecast that this demand will become increasingly greater in the near future and our calculations show that supply might not be able to meet demand soon, which is why competitive pressure is increasing for retail and transportation businesses.

Regionally, Vietnam is connected to China’s southern economic corridor including many prominent regions such as Shanghai, Shenzhen, Fujian, and Guangdong. This is the economic region chosen as the headquarters of many giants in manufacturing, biochemistry, commerce, and electronic technology.

According to our estimations, this region accounted for more than 30 per cent of China’s total GDP in 2021, playing a significant role in attracting investment capital and economic development.

Early on in its development, Vietnam’s industrial sectors received a wave of investment from global electronics businesses, such as Panasonic (1971), LG Display (1995), Canon (2001), Foxconn (2007), Samsung (2008), and Fuji Xerox (2013), and more recently from corporations such as Pegatron, Goertek, and Jinko Solar. Right now is the golden period, as Vietnam is looking at the opportunity to increase the value of manufacturing supply chains and the region’s GDP.

Notably, US President Joe Biden’s recent state visit concluded with many agreements on comprehensive cooperation and development of high-tech and semiconductor manufacturing between the two countries.

With favourable geographical characteristics, as well as a strongly developed infrastructure and a series of investment promotion policies from the government, Vietnam possesses the necessary factors to attract a series of queen bees to further contribute to its GDP. The impressive numbers and promising forecasts we observe show that the potential of logistics in Vietnam is huge, it can become a golden egg for investors with strong vision and potential.

|

Offering priority

Infrastructure is an essential part needed for the country to achieve its full potential and successful development of the logistics market. According to PwC, Vietnam is the top country in Asia in infrastructure investment and is spending about 5.7 per cent of GDP in this field.

Nationwide, there is a total road length of less than 600,000km, of which national roads are more than 25,500km. The amount of highway network currently in operation is 1,240km, with construction underway for about 14 routes and sections, equivalent to 840km.

Major cities like Hanoi will focus on giving priority to the Ring Road 4 project, while Ho Chi Minh City will prioritise Ring Road 3 to strengthen connections to neighbouring localities, increase freight connections, and reduce logistics costs to seaports.

For railways, the national railway network has a total length of 3,143km and has 277 stations, with two lines connecting to China at Dong Dang and Lao Cai. In particular, the north has road, waterway, and railway routes connecting directly to Shenzhen, known as China’s Silicon Valley, creating new advantages for businesses wishing to expand and diversify production in the region.

Vietnam’s seaport system has received investment attention with its current scale and technology reaching the international level, especially the container port system (two major seaports of Vietnam are Haiphong and Ho Chi Minh City, which are in the top 50 major container ports in the world). The seaport system, meanwhile, boasts almost 290 ports and a total wharf length of nearly 100km.

According to the Vietnam Maritime Administration, the total volume of goods through the ports of Vietnam in 2022 is estimated to have reached more than 730 million tonnes, up 4 per cent compared to 2021. Of which, exports reached 180 million tonnes, down 3 per cent, and imported goods reached 209 million tonnes, down 2 per cent.

In addition, for the first time, ocean carriers were able to provide direct services from Vietnam to North America and Europe without the need for feeder vessels to connect to regional transit hubs such as Singapore or Hong Kong. It is estimated that containers can save about $150-300 per TEU going to and from Vietnam.

The government also set a goal that by 2030, Vietnam will be able to meet the needs of import and export of goods, trade between regions throughout the country, and transshipment and transit for countries in the region as well as cater to the internal transport demand from both local and international passengers. The seaport system will be able to serve a volume of goods of 1.4 billion tonnes (of which container goods are 47 million TEU) and 10.3 million passengers.

The manufacturing industry is the heart of a country’s economic development, and the health of an economy is directly proportional to the efficiency of its logistics system.

Therefore, improving efficiency will help manufacturers, transport and logistics service providers, and trade regulators minimise avoidable delays, thereby increasing production quality and reducing business costs.

With these attractive conditions, Vietnam is capable of competing with Dubai and Hong Kong, or even Singapore or Shanghai, not only striving to become a global goods transshipment centre, but also a supply chain link and extended arm of the world’s factory.

| Shipping firms eye rosier future Vietnam's import-export sector is showing signs of improvement amid rising demand from major markets such as the United States and Europe. Since early July, world markets have witnessed a recovery in sea freight prices, a signal to many that the shipping industry has overcome the challenging times of the previous eighteen months. |

| Logistics groups go green to add to net-zero goals Logistics enterprises are gradually participating in supporting the green production and circulation of goods in the country, as well as exporting and importing with more sustainable criteria. |

| Logistics investors heat up the market The race to expand logistics market share continues to heat up, as both domestic and foreign enterprises increase investments in this field. |

| The growth drivers for logistics arena Vietnam is attempting to boost its logistics efficiency in order to compete with others in the region. Head of Business Intelligence at Dezan Shira & Associates, Pritesh Samuel, analyses the drivers and hurdles in logistics development. |

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- Kurz Vietnam expands Gia Lai factory (February 27, 2026 | 16:37)

- SK Innovation-led consortium wins $2.3 billion LNG project in Nghe An (February 25, 2026 | 07:56)

- THACO opens $70 million manufacturing complex in Danang (February 25, 2026 | 07:54)

- Phu Quoc International Airport expansion approved to meet rising demand (February 24, 2026 | 10:00)

- Bac Giang International Logistics Centre faces land clearance barrier (February 24, 2026 | 08:00)

- Bright prospects abound in European investment (February 19, 2026 | 20:27)

- Internal strengths attest to commitment to progress (February 19, 2026 | 20:13)

- Vietnam, New Zealand seek level-up in ties (February 19, 2026 | 18:06)

- Untapped potential in relations with Indonesia (February 19, 2026 | 17:56)

- German strengths match Vietnamese aspirations (February 19, 2026 | 17:40)

Tag:

Tag:

Mobile Version

Mobile Version