Invested in the future of corporate bond market

|

| Tran Thap Kieu Quan, CFA Head of Fixed Income, Eastspring Vietnam |

Eastspring has since built an unparalleled on-the-ground presence in 11 Asian markets as well as distribution offices in North America and Europe.

Eastspring Vietnam, formerly known as Prudential Vietnam Fund Management Company, was established in 2005 and re-branded in 2011.

Eastspring Vietnam applies a long-term value-oriented investment philosophy to its investment funds and portfolios for both institutional and retail clients who are domiciled both offshore and onshore in Vietnam, with total assets under management currently exceeding around VND100 trillion ($4.34 billion).

Promising corporate debt market

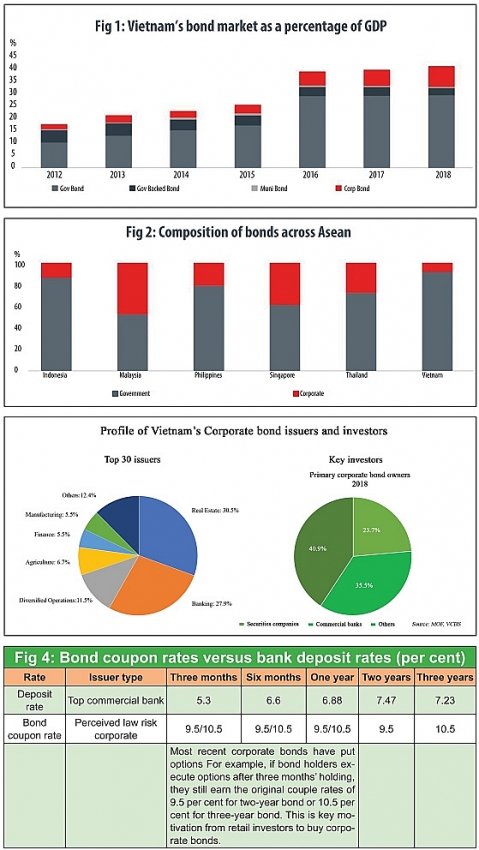

Vietnam’s domestic bond market has grown substantially since 2012. By 2018, its size had more than doubled, equalling 39 per cent of the country’s GDP. The corporate bond market has also expanded almost five-fold in this time, hitting $6.2 billion by 2018. This expansion has not only been driven by Vietnam’s growth, economic stability, low inflation, and accommodative policies but also a growing awareness by domestic issuers to diversify their funding sources.

In our previous write-up “Vietnam: One of Asia’s Best Proxies to Emerging Market Growth”, we stated that Vietnam has made huge strides in its development and that its transformation had not gone unnoticed. In 2017, the country was Asia’s top-performing stock market. In 2018, it was one of the only two stock markets (besides China) in Asia to enjoy net foreign portfolio inflows. And the equity market is not the only evidence of this transformation. Vietnam’s corporate dong-denominated debt market is one of the fastest growing amongst ASEAN’s six corporate bond markets peers, albeit the smallest. (see Figure 1). The roadmap to broaden and deepen the bond market further was set out in 2017. One of the goals is to increase the market’s size to 45 and 60 per cent of GDP by 2020 and 2030 respectively. Priority will also be given to developing the government bond market which in turn will underpin the growth in the corporate segment.

Although government bonds already have the dominant share of the total debt market (see Figure 2), the corporate debt market is expected to become an important channel to fund the economy, supplementing the traditional bank loans.

Bonds gain momentum

The corporate debt market has continued expanding, and in the first half of 2019 has thus far seen an increase of 34 per cent compared to the same period last year. Apart from historically stable low government bond yields which encourage investors to search for higher yield instruments, new policies set out by the State Bank of Vietnam also force issuers to raise capital from the corporate bond market.

The new minimum capital safety and capital adequacy ratios rules have forced banks to issue bonds to meet these new requirements. Equally, real estate companies have switched to raising funds from the corporate debt market instead of borrowing from banks. Two thirds of all the corporate bonds are issued by banks and real estate companies.

The statistics of primary issuance show that the top two investors are securities firms and banks. But estimates indicate banks are still the main bondholders. Securities firms function as a warehouse and redistribute bonds to other investors like banks, retailers, and corporates (see pie charts). Insurance companies only hold a small portion of corporate bonds as they prefer high quality long-term corporate bonds or long-term corporate bonds that are guaranteed by credit rating guarantors.

The popular tenors for corporate bonds are still two to three years while the longer tenor is usually seen for bank bonds. Nevertheless, the availability of longer tenor has opened up opportunities for more insurance monies.

More recently, individual investors have been making a presence and sharing an important part of the total corporate bond market. Estimates indicate they may account for 10-15 per cent or more of the total corporate debt market.

The lure has been the significant yield enhancement as many bonds are issued with put options. In such instances, retail investors can sell back the bonds to the issuer after a few months and still earn the original bond coupon.

This is a much more attractive option than a savings deposit scheme (see Figure 4).

|

Ongoing challenges

Liquidity is a key risk. There is limited liquidity in the secondary market trading for corporate bonds. To improve the liquidity for bond holders, especially retail investors, there are more corporate bonds issued with put option as a proxy for the liquidity for bondholders. Retail investors can sell back the bond to the issuer when they need liquidity. However, for those corporate bonds with longer tenors, the put option is often not available.

Default risk is another. Lack of a proper risk assessment framework could lead to potential defaults. Typically, problems arise if the market infrastructure development does not keep pace with the rapid growth.

For a start, there is no local credit rating agency. Further, the credit ratings by international rating agencies are not available for most corporate bond issuers in Vietnam, except for local banks which have ratings by Moody’s. Moreover, most corporate bonds are unsecured, except for corporate bonds with collaterals issued to the local banks.

The credit rating of an issuer is also a relatively new concept with most investors placing more importance on the coupon rate and familiarity with the issuer name. Hence there is no available benchmark for investors to consider.

Promising outlook

Despite the concerns, the corporate debt market is expected to continue expanding strongly this year on the back of the low inflation, economic stability, and accommodative growth policies. The yield enhancement over deposit rates makes it attractive for retail investors while the low government bond yields will keep institutional demand intact. The high volatility in equity markets is another reason some investors prefer bonds.

Vietnam is not immune to trade issues, being one of the most open economies in the region. The effects are being seen in the lower growth numbers. First-half 2019 growth was 6.6 per cent versus the previous years’ 7.1 per cent for the period. Still, the full year GDP estimated at 6.7-6.8 per cent is relatively high compared to the region. The long-term outlook remains positive, underpinned by resilient domestic demand, robust foreign direct investment growth and stable inflation.

In April, Standard & Poor’s raised Vietnam’s long-term sovereign credit rating to BB from BB– with a stable outlook. The rating agency cited the country’s strong economic growth and improved government institutional environment as the reason for the upgrade. This should further underpin investor confidence in the country’s corporate debt market.

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- New rules ease foreign access to Vietnam equities (February 05, 2026 | 17:29)

- 0.1 per cent tax proposed on each transfer of digital assets (February 05, 2026 | 17:27)

- Ministry of Finance tightens policy delivery at start of year (February 05, 2026 | 17:26)

- Vietnam steps up market reforms as FTSE Russell reviews upgrade progress (February 05, 2026 | 17:20)

- 2025 profits mixed amid strong energy and farming results (February 05, 2026 | 17:18)

- Cashless payments hit 28 times GDP in 2025 (February 04, 2026 | 18:09)

- SSIAM and DBJ launch Japan Vietnam Capital Fund (February 04, 2026 | 15:57)

- Banks target stronger profits, credit growth in 2026 (February 04, 2026 | 15:43)

- Vietnam on path to investment-grade rating (February 03, 2026 | 13:07)

- Consumer finance sector posts sharp profit growth (February 03, 2026 | 13:05)

Tag:

Tag:

Mobile Version

Mobile Version