Banks massively embrace bond buy-backs

December 28, 2023 | 17:13

Banks are buying back corporate bonds at a significant rate.

Corporate bond registration fall below expectations

October 09, 2023 | 17:00

Less than 10 per cent of corporate bonds have been registered on the Hanoi Stock Exchange’s trading platform, falling behind schedule and prompting discussions on extending trading regulations.

Corporate bond market reform adds safety net for investors

September 29, 2022 | 10:03

The fresh and stringent legislative framework for the corporate bond market is slated to pave the way for a better debt sector in Vietnam, while the interests of issuers and investors could be safeguarded.

Corporate bond market has ample room for improvement

September 14, 2022 | 14:48

The corporate bond market still has ample room for improvement, according to Nguyen Tu Anh, Director of the General Economic Affairs Department, Communist Party Economic Commission.

Taking appropriate actions to strengthen bond market

April 19, 2022 | 09:00

With more than 40 years of experience in Vietnam’s financial market, Dr. Nguyen Tri Hieu, independent banking and financial expert, discussed with VIR’s Minh Nguyet what legal regulations would be suitable for a self-regulating secondary corporate bond market to operate healthily.

Steady pace in bond market despite persistent legal barriers

April 01, 2022 | 09:38

An economic resurgence and elevating appetite for capital mobilisation would factor in a more buoyant corporate bond market this year, despite an increasingly rigid legal corridor.

Corporate bond market forecast to be robust this year

February 02, 2021 | 11:35

The corporate bond market in Vietnam is expected to be robust this year as the Government has issued regulations to untie the market but still aimed to ensure transparency and healthy market development.

Corporate bond market still holds risks for investors: SSI

November 03, 2020 | 16:08

The corporate bond market cooled in September and risks still persist for investors, according to securities companies.

Corporate bonds lure individual investors

May 01, 2020 | 22:38

The corporate bond market attracted double the number of individual investors in the first quarter of this year compared to 2019.

Invested in the future of corporate bond market

December 12, 2019 | 10:36

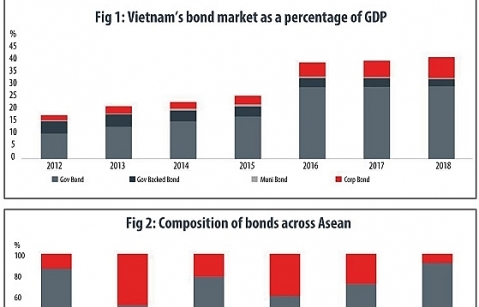

Eastspring Investments is a global asset manager with Asia at its core, offering innovative investment solutions to meet the financial needs of clients. It manages a total of over $215 billion across equity, fixed income, multi asset, quantitative, and alternative strategies on behalf of institutional and individual investors globally.

Mobile Version

Mobile Version