Govt rolls out interest-free loans for companies to pay salaries

|

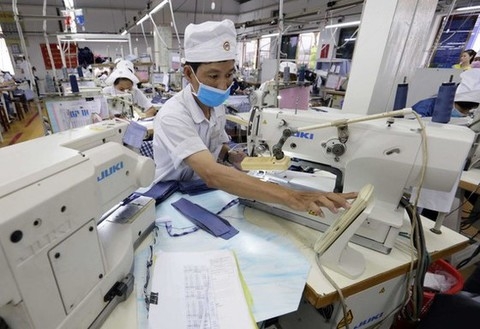

| A textile business in HCM City. Businesses have been applying for interest-free loans to make furlough and salary payments. – Photo sggp.org.vn |

The loans are part of the Government’s latest relief package worth VND26 trillion (US$1.13 billion) for supporting workers and employers struggling to cope with the pandemic.

Around VND7.5 trillion will be used for interest-free loans for businesses to pay salaries.

Businesses can obtain a loan to pay workers who have contracts with compulsory social security but are furloughed for 15 consecutive days between May 1, 2021 and March 31 next year.

They must not have any bad debts to qualify for the loans, but do not need guarantees.

They are also permitted to borrow to pay workers to resume business.

This includes businesses instructed to close down temporarily as a COVID-19 preventive measure in that period, those in transportation, aviation, tourism, and hospitality, and others that send guest workers abroad.

The loans are for up to 12 months.

Minister of Labour, War Invalids and Social Affairs Dao Ngoc Dung promised that procedures for the relief package would be simplified and abbreviated as much as possible.

While last year the VND62 trillion relief package took up to 40 days for businesses to get loans for work stoppage payment, now it should only take seven to 10 days, he assured.

Dr Vo Tri Thanh, a member of the National Financial and Monetary Policy Advisory Council, said the VND26 trillion package would help businesses that retain their staff or want them to return to work after the pandemic.

But Tran Minh Phi, director of An Phi Construction and Design Co., Ltd., said many businesses are struggling to repay their bank loans due to the nearly two-year-long pandemic, and so many might not be able to meet the requirement of having no bad debts.

Dr Nguyen Tri Hieu, an economist and financial expert, agreed with Phi, saying the requirement should be scrapped to better support people working for businesses with bad debts.

There could be policies to force businesses to prioritise repayment of this loan before others, and businesses with debts overdue for 90-180 days could be given the loan, he added.

A continuing drawback facing the programme is that like last time some businesses are not fully aware of the new relief package.

According to the General Department of Statistics, in the first six months of the year 70,200 businesses had to temporarily or permanently close down, a 22.1 per cent increase year-on-year.

There were nearly 1.2 million people of working age unemployed during the second quarter, up 7.8 per cent from the first quarter, according to the Ministry of Labourers, War Invalids and Social Affairs.

HCM City has become the COVID-19 epicentre of the country with more than 28,300 cases.

It has been under social distancing since May 31, affecting the livelihoods of many locals.

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Latest News

More News

- The generics industry: unlocking new growth drivers (February 04, 2026 | 17:39)

- Vietnam ready to increase purchases of US goods (February 04, 2026 | 15:55)

- Steel industry faces challenges in 2026 (February 03, 2026 | 17:20)

- State corporations poised to drive 2026 growth (February 03, 2026 | 13:58)

- Why high-tech talent will define Vietnam’s growth (February 02, 2026 | 10:47)

- FMCG resilience amid varying storms (February 02, 2026 | 10:00)

- Customs reforms strengthen business confidence, support trade growth (February 01, 2026 | 08:20)

- Vietnam and US to launch sixth trade negotiation round (January 30, 2026 | 15:19)

- Digital publishing emerges as key growth driver in Vietnam (January 30, 2026 | 10:59)

- EVN signs key contract for Tri An hydropower expansion (January 30, 2026 | 10:57)

Tag:

Tag:

Mobile Version

Mobile Version