Foreign trade flourishes with tailwind from AEC

|

| Businesses in Vietnam have greatly been cashing on trade liberalisation within the regional economic integration, Photo: Le Toan |

|

After the New Year holiday, vice director of Hoang Ngoc Trade JSC in Hanoi, Phan Dang Tu, is now preparing for his flight to Indonesia in mid-January to meet with two partners. They will ink two large contracts to export coffee, which Indonesia has long been coveting.

In 2018, the company earned a coffee export turnover of about $18 million from Indonesia, and about $20 million from exporting other farm products to Malaysia and regional markets like Singapore and the Philippines. Overall, the total export turnover of farm produce from the regional market in 2018 increased by 15-20 per cent on-year.

“One of the main reasons behind this climb is lower import tariffs from the importing nations. For example, the import tariffs for products from Indonesia, Malaysia, the Philippines, and Singapore have been reduced to 0 per cent,” Tu told VIR.

According to the General Statistics Office (GSO), agricultural products are one of the many types of Vietnamese exports that have received a boost in Southeast Asian markets from the establishment of the ASEAN Economic Community (AEC) in late 2015. This has also contributed to an overall climb in the country’s exports to the region.

The Ministry of Agriculture and Rural Development reported that in 2018, the total agro-forestry-aquatic export turnover from regional markets reached $3.2 billion, up 11 per cent on-year, and holding 10.64 per cent of the country’s total agro-forestry-aquatic export turnover, largely due to tariff cuts under the AEC. According to the Vietnam Association of Seafood Exporters and Producers, as of late November 2018, the total export of tra fish products to regional markets was valued at $183.5 million, up 43.7 per cent on-year.

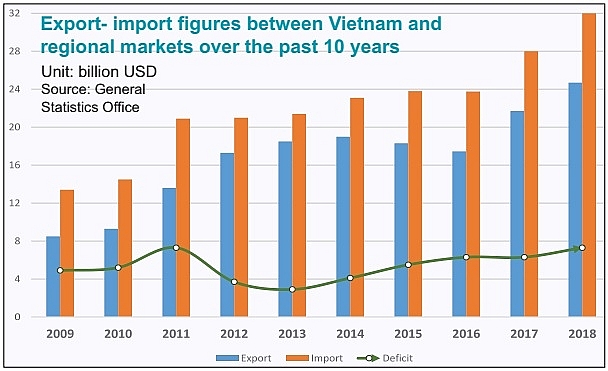

On an uptrend

According to the GSO, Southeast Asia is now Vietnam’s fourth-largest export market, behind the US ($47.5 billion), the EU ($42.5 billion), and China ($41.9 billion). Export turnover to the region soared from less than $1 billion in 1995 to $18.23 billion in 2015. The figure dropped to $17.45 billion in 2016, before rebounding strongly to $21.7 billion in 2017 and exceeding $24.7 billion in 2018, when some goods witnessed a very high on-year turnover growth, such as rice (105 per cent), steel (39.1 per cent), and garment and textiles (37.4 per cent).

In recent years, Vietnam-based enterprises have been boosting exports to regional markets, thanks to trade liberalisation, in addition to their increased awareness of these markets, according to the Ministry of Industry and Trade.

Key exports to Southeast Asia include agricultural products such as coffee, pepper, cashew nuts, mobile phones, computers, electronics, machinery and equipment, steel, textiles and garments, vehicles, and crude oil.

Tax cuts

Officially established on December 31, 2015 as a milestone of the regional integration process, the AEC was aimed to create a single regional market and production base via facilitating a freer flow of goods, services, investment, capital, and skilled labour among member nations. Six nations which are the region’s most developed economies – Brunei, Indonesia, Malaysia, the Philippines, Singapore, and Thailand – have all erased import tariff lines since 2010. Meanwhile, the remaining nations – Cambodia, Laos, Myanmar, and Vietnam – have removed 90 per cent of their import tariff lines since 2015.

In 2018, Vietnam removed almost all tariff lines for imported goods from regional markets. The goods include automobiles, motorbikes, and bikes, steel, wine, beer, paper, and plastics. The remaining 3 per cent, including sensitive items like poultry, eggs, sectioned fruit, rice, processed meat, and sugar, must be reduced to 0 per cent after 2018.

|

|

Trade deficit

However, in order to benefit from such tariff reductions, goods are required to meet certain conditions. For example, they have to have at least 40 per cent of their materials sourced from within the ASEAN.

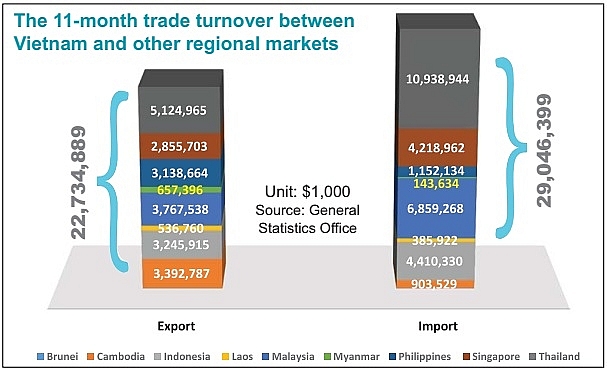

Moreover, in recent years, Vietnam has suffered from a trade deficit from Southeast Asia. In 2018, the country earned over $24.7 billion from exporting to the region, up 13.7 per cent on-year, while spending $32 billion importing goods, up 13 per cent. This brought the total trade deficit to $7.3 billion. The deficit was $6.3 billion last year and in 2016, and $5.5 billion in 2015.

A trade deficit also exists with the majority of ASEAN markets, including Brunei, Indonesia, Malaysia, Singapore, and Thailand.

Vietnam also imports many items indispensable for local production from regional markets, such as petrol, plastics, and components for computers, electronics, machinery, and steel. In 2018, imports in many categories increased, such as equipment and machinery (14.1 per cent) and petrol (6.8 per cent). However, according to the GSO, these items are imported for local production and then exported as finished products to the world. Thus, the trade deficit between Vietnam and the ASEAN is not so worrysome.

Likewise, Hoang Ngoc Trade also imports many types of agricultural products from regional and global markets to then export them as processed goods. “We enjoyed a 20 per cent increase in export turnover in 2018, and the same rate is expected for 2019,” Tu said.

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- Hermes joins Long Thanh cargo terminal development (February 04, 2026 | 15:59)

- SCG enhances production and distribution in Vietnam (February 04, 2026 | 08:00)

- UNIVACCO strengthens Asia expansion with Vietnam facility (February 03, 2026 | 08:00)

- Cai Mep Ha Port project wins approval with $1.95bn investment (February 02, 2026 | 16:17)

- Repositioning Vietnam in Asia’s manufacturing race (February 02, 2026 | 16:00)

- Manufacturing growth remains solid in early 2026 (February 02, 2026 | 15:28)

- Navigating venture capital trends across the continent (February 02, 2026 | 14:00)

- Motivations to achieve high growth (February 02, 2026 | 11:00)

- Capacity and regulations among British areas of expertise in IFCs (February 02, 2026 | 09:09)

- Transition underway in German investment across Vietnam (February 02, 2026 | 08:00)

Tag:

Tag:

Mobile Version

Mobile Version