Excelsior Capital Vietnam Partners to invest in 30Shine

|

Excelsior Capital Vietnam Partners aims to make a substantial investment into 30Shine, a chain of men's grooming salons backed by STI Holdings. It is estimated that the size of the investment could be as much as $15 million. An inside source for DealStreetAsia has suggested that the deal is close to concluding all requisite formalities. 30Shine has declined to offer any comment on these developments.

Founded in May 2015, 30Shine is the largest chain of male grooming salons in Vietnam. By 2018, the company was serving over two million customers a year, with an impressive customer retention rate of nearly 80 per cent. The following year, it had expanded to 66 stores nationwide, employing a workforce of 2,300. The chain currently boasts over 80 branches across the country and nearly 100 including its expansion into Thailand.

In contrast, the Filipino brand Bruno, which commenced operations in 1990, currently operates 40 outlets, while Thailand's Never Say Cutz has established just over 20 modestly sized establishments in Bangkok.

Excelsior Capital Vietnam Partners, known for its investment acumen, primarily directs its financial resources towards nurturing small- and medium-sized enterprises operating in sectors with significant growth potential and developmental opportunities.

These sectors encompass healthcare, pharmaceuticals, medical services, education, and consumer-oriented industries such as manufacturing, distribution, retail, and logistics.

Excelsior Capital Vietnam Partners has previously invested in SIS Group, which operates the SIS International General Hospital in Can Tho, as well as Khoi Nguyen Education Group.

In February, Excelsior Capital Asia became a strategic partner of Blue Circle, which owns bicycle retail chain Xedap.vn. The funding was utilised for the expansion of Xedap.vn’s retail chain and build up a product portfolio to meet the growing demand for green transport in Vietnam, while developing a technology platform to build a nationwide cycling community and connect various sporting activities.

| HSBC Vietnam partners with Dragon Capital on voluntary retirement programme HSBC Vietnam and Dragon Capital Vietfund Management (Dragon Capital) have announced their cooperation to implement the Huu tri an vui pension programme, a voluntary supplementary retirement scheme for all HSBC employees in Vietnam. |

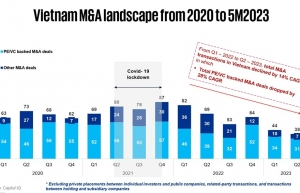

| Fundraising challenges must be navigated in uncertain M&A market Warnings about a slowdown in the Vietnam merger and acquisition market, particularly for investment from private equity and venture capital (PE/VC), were raised in late 2022. As of now, we are experiencing one of the toughest downturns. |

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- Cool Japan Fund transfers shares of CLK Cold Storage (January 28, 2026 | 17:16)

- Nissha acquires majority stake in Vietnam medical device maker (January 26, 2026 | 15:40)

- BJC to spend $723 million acquiring MM Mega Market Vietnam (January 22, 2026 | 20:29)

- NamiTech raises $4 million in funding (January 20, 2026 | 16:33)

- Livzon subsidiary seeks control of Imexpharm (January 17, 2026 | 15:54)

- Consumer deals drive Vietnam’s M&A rebound in December (January 16, 2026 | 16:08)

- Southeast Asia tech funding rebounds on late-stage deals (January 08, 2026 | 10:35)

- DKSH to acquire Vietnamese healthcare distributor Biomedic (December 24, 2025 | 15:46)

- Central Retail refocuses Vietnam strategy with Nguyen Kim exit (December 24, 2025 | 15:01)

- RongViet Securities wins sixth consecutive M&A advisory award (December 22, 2025 | 17:30)

Tag:

Tag:

Mobile Version

Mobile Version