Economy growing strongly on back of COVID-19 endgame

State-owned Vietnam Oil and Gas Group (PetroVietnam) last week reported that its total revenue in the first three months of the year is estimated to be over VND113 trillion ($4.91 billion), down 6 per cent on-year. However, the group’s revenue from industrial activities increased 2 per cent, and that from the service activities decreased 21 per cent on-year.

A number of the group’s products which were consumed in the first quarter witnessed an on-year rise, including fertiliser (7 per cent), liquefied petroleum gas (29 per cent), condensate (12 per cent), and assorted petrols (5 per cent).

Despite a reduction of $446.5 million or 18 per cent in export turnover, the total import turnover in the period hit $198.9 million, up 17 per cent on-year – in which liquefied natural gas imports climbed 296,700 tonnes, up 6 per cent on-year.

In the context of external demand decreasing due to negative impacts of the pandemic, these figures from PetroVietnam showed that its industrial activities are gradually bouncing back.

The situation can be seen clearer at Electricity of Vietnam (EVN), which last week also reported that all of its activities are ascending on-year in the first quarter of 2021.

Specifically, EVN’s total gross industrial output is estimated to stand at VND52.83 trillion ($2.3 billion), up 3.18 per cent on-year. The produced and purchased electricity volume is 55.45 million kilowatt hours, up 1.16 per cent. Commercial electricity totalled 50.79 million kWh, up 3.18 per cent.

In which, electricity for agro-forestry-fishery accounts for 3.97 per cent of total electricity consumed, while the rate is 56.01 per cent for construction and industrial activities, 31.46 per cent for households – all is up against the same period last year.

Notably, EVN’s total revenue from power sales is estimated to be over VND94 trillion (over $4 billion), up 4.11 per cent on-year.

Petrol and electricity are vital to production activities, especially manufacturing and processing which create 80 per cent of Vietnam’s industrial growth – the key growth pillar of the economy.

|

The government last week reported that despite numerous difficulties, the economy’s production and distribution of electricity increased 4.5 per cent on-year. Also, the first-quarter manufacturing and processing industry grew 9.45 per cent, higher than the on-year climb of 7.12 per cent in the same period last year.

“All of these figures showed that the first-quarter economy has been strongly bouncing back with the gradual popularity of vaccination against the COVID-19 pandemic,” said Prime Minister Nguyen Xuan Phuc at last week’s cabinet meeting, also the last one in the 2016-2020 tenure of the government. “The confidence of enterprises has continued climbing, with them gradually resuming their normal activities. This has contributed to our relatively impressive economic growth in the first three months.”

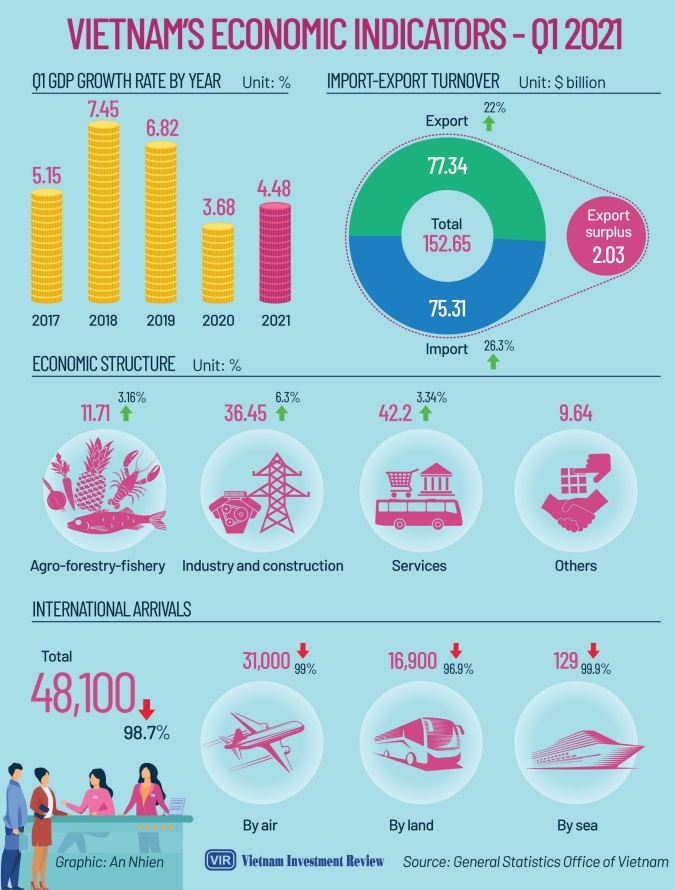

The economy grew 4.48 per cent on-year in the first quarter of this year, higher than the on-year rise of 3.68 per cent in the same period last year. In which the on-year growth rate was 3.16 per cent for the agro-forestry-fishery sector, 6.3 per cent for the construction and industrial sector, and 3.34 per cent for the service sector.

As of March 23, the total registered foreign investment hit $10.13 billion, up 18.5 per cent on-year. Total disbursement in the first quarter is estimated to be $4.1 billion, up 6.5 per cent on-year.

“Vietnam has become a safe destination for investment,” said Mai Tien Dung, Minister, Chairman of the Government Office at last week’s government press conference. “Many international organisations have applauded the great potential of the economy’s growth for 2021, such as HSBC (7 per cent), International Monetary Fund (6.5 per cent), International Finance Corporation (6.5 per cent in the 2021-2026 period), and Moody’s (changed Vietnam’s economic outlook to ‘positive’ from ‘negative’).” “According to their assessments, Vietnam’s economy will continue witnessing a brighter outlook as many nations are applying massive vaccination programmes against COVID-19,” he said.

According to global data analyst and provider FocusEconomics, this year, Vietnam’s industrial production should pick up pace from 2020’s slowdown as economic activity recovers in key international markets.

“Moreover, the underlying strength of Vietnam’s industrial sector remains intact despite COVID-19: Vietnam is an attractive low-cost base for manufacturing firms, including those looking to relocate from China due to the US-China trade tensions,” FocusEconomics told VIR in a statement.

FocusEconomics estimates that industrial output will grow 8.3 per cent in 2021 and 7.3 per cent next year. “Our panelists expect Vietnam’s GDP to expand 7.4 per cent in 2021, and 6.9 per cent in 2022.”

According to the ASEAN+3 Macroeconomic Research Office (AMRO), a regional macroeconomic surveillance organisation based in Singapore, Vietnam’s economic growth slowed to 2.91 per cent in 2020 due to the pandemic but is expected to rise to 7 per cent in 2021.

“The rebound is expected to be underpinned by a recovery in external demand, a resilient domestic economy, capital inflows, and increased production capacity,” said AMRO lead specialist Seung Hyun Luke Hong.

| Joseph A Perucca - Overseas operational director, GIVI Vietnam

We welcome the positive GDP figures and export growth figures in this first evaluation, but the impacts of COVID-19 may still hold some surprises. Being stuck inside the country without the possibility of starting any interpersonal relationship across the border, both of professional training and on a direct commercial level, would create a serious disadvantage and serious damage to companies hosted in Vietnam, especially towards other neighbouring Asian markets like China, which is already providing vaccinations to allow residents freedom of movement across the border. I hope that with the same wisdom in containing this pandemic, the Vietnamese government will make the most appropriate decisions based on the circumstances, and that in the next quarter Vietnam will continue to work on its objectives. Majo George - Lecturer and researcher, School of Business and Management, RMIT University

Many steps have been taken by the government to keep Vietnam’s GDP on track during this difficult time. Although some sectors such as smartphones, electronics, and agro-forestry-fishery has shown an increasing trend in the first quarter of 2021, many other sectors such as fashion and textiles, mining, tourism, and hospitality have declined due to the pandemic and the difficulties it brings. The government with the support of well-performing sectors has been able to maintain the status as a high growth rated country in the region. Looking to the far future, Vietnam should prioritise to scale up export opportunities and at the same time take measures to attract more foreign direct investment which will assist to gain the set target of 6.5 per cent in GDP growth. David Salt - COO, LOGIVAN Technologies

Whilst the pandemic’s effects continue to cause disruption in localised areas, the overall economy is strong and the percentage of people and businesses that are directly affected is small. There is strong investment activity in the industrial sector. Many of our clients are scaling up their operations, constructing new factories and warehouses, and making capacity upgrades to their facilities. Regional investors are looking to Vietnam as a country that has withstood the pandemic well and has an increasingly safe and attractive business environment. But I feel Vietnam’s excellent reputation is limited to the Southeast Asian region. The UK and European news surrounding COVID-19 typically centres on countries that have controlled the virus poorly, especially in the Americas and Europe. Linda Liu - Economist, Maybank Kim Eng

Vietnam’s economic recovery this year remains intact. While the most recent wave of the pandemic outbreak briefly dampened growth momentum in the first quarter, it had not derailed the recovery. We remain positive on the exports outlook this year. Vietnam’s exports have been largely unperturbed by new coronavirus cases and lockdowns in both domestically and across major trading partners. We expect exports to continue to remain robust amid the global demand recovery. Growth will be further supported by a revival in foreign investment. Vietnam’s participation in recently-concluded free trade agreements will further strengthen its position as an attractive production base. The slow procurement and rollout of vaccines however is a challenge and poses a key risk, especially for the services sector. Alain Cany - Chairman, European Chamber of Commerce in Vietnam

Growth such as this in the midst of a global pandemic is a remarkable achievement. It is testament to the government’s effective handling of COVID-19, safeguarding both lives and livelihoods with effective public health measures. Strong economic growth in the last quarter builds on this success, and suggests that both companies and consumers should be optimistic about the prospects for trade in 2021. Our members are positive about Vietnam’s trade and investment environment. Each quarter, we ask business leaders about the performance of their companies and their perceptions of Vietnam’s economic outlook in our Business Climate Index (BCI). Our most recent data, from the fourth quarter of 2020, shows that confidence has rebounded after dipping during the initial outbreak of COVID-19. Hong Sun - Vice chairman, Korea Chamber of Business in Vietnam

Vietnam’s economic growth in the first quarter is a successful result, and many countries still report lower growth. With this result, we expect better prospects in the second, third, and fourth quarters. South Korean businesses in Vietnam are now in stable operation after suffering serious impacts in 2020. Aviation, tourism, and hospitality were among the areas that South Korean investors have strong interest in and have made much investment in, and are so still facing difficulties. We expect the resumption of international flights as it is important to attract investment from South Korea and other countries. This enables investors to make the next steps. To make an investment, financiers want to make fact-finding trips to the potential location and directly meet partners to discuss potential issues. |

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Tag:

Tag:

Related Contents

Latest News

More News

- Japanese business outlook in Vietnam turns more optimistic (January 28, 2026 | 09:54)

- Foreign leaders extend congratulations to Party General Secretary To Lam (January 25, 2026 | 10:01)

- 14th National Party Congress wraps up with success (January 25, 2026 | 09:49)

- Congratulations from VFF Central Committee's int’l partners to 14th National Party Congress (January 25, 2026 | 09:46)

- 14th Party Central Committee unanimously elects To Lam as General Secretary (January 23, 2026 | 16:22)

- Worldwide congratulations underscore confidence in Vietnam’s 14th Party Congress (January 23, 2026 | 09:02)

- Political parties, organisations, int’l friends send congratulations to 14th National Party Congress (January 22, 2026 | 09:33)

- Press release on second working day of 14th National Party Congress (January 22, 2026 | 09:19)

- 14th National Party Congress: Japanese media highlight Vietnam’s growth targets (January 21, 2026 | 09:46)

- 14th National Party Congress: Driving force for Vietnam to continue renewal, innovation, breakthroughs (January 21, 2026 | 09:42)

Mobile Version

Mobile Version