Economic uncertainty weighs on Vietnamese businesses

|

| Grant Thornton looked into how Vietnamese businesses fared in the first half |

According to Grant Thornton International Business Report for the first half of 2021, despite the strong increase in business optimism, economic uncertainty remains an issue globally with 61 per cent of firms citing ongoing uncertainty as a constraint to business.

In Vietnam, economic uncertainty has risen to its highest level on record with 68 per cent of companies identifying this as a constraint to growth, whilst a shortage of orders has been cited as a concern by 65 per cent of the companies.

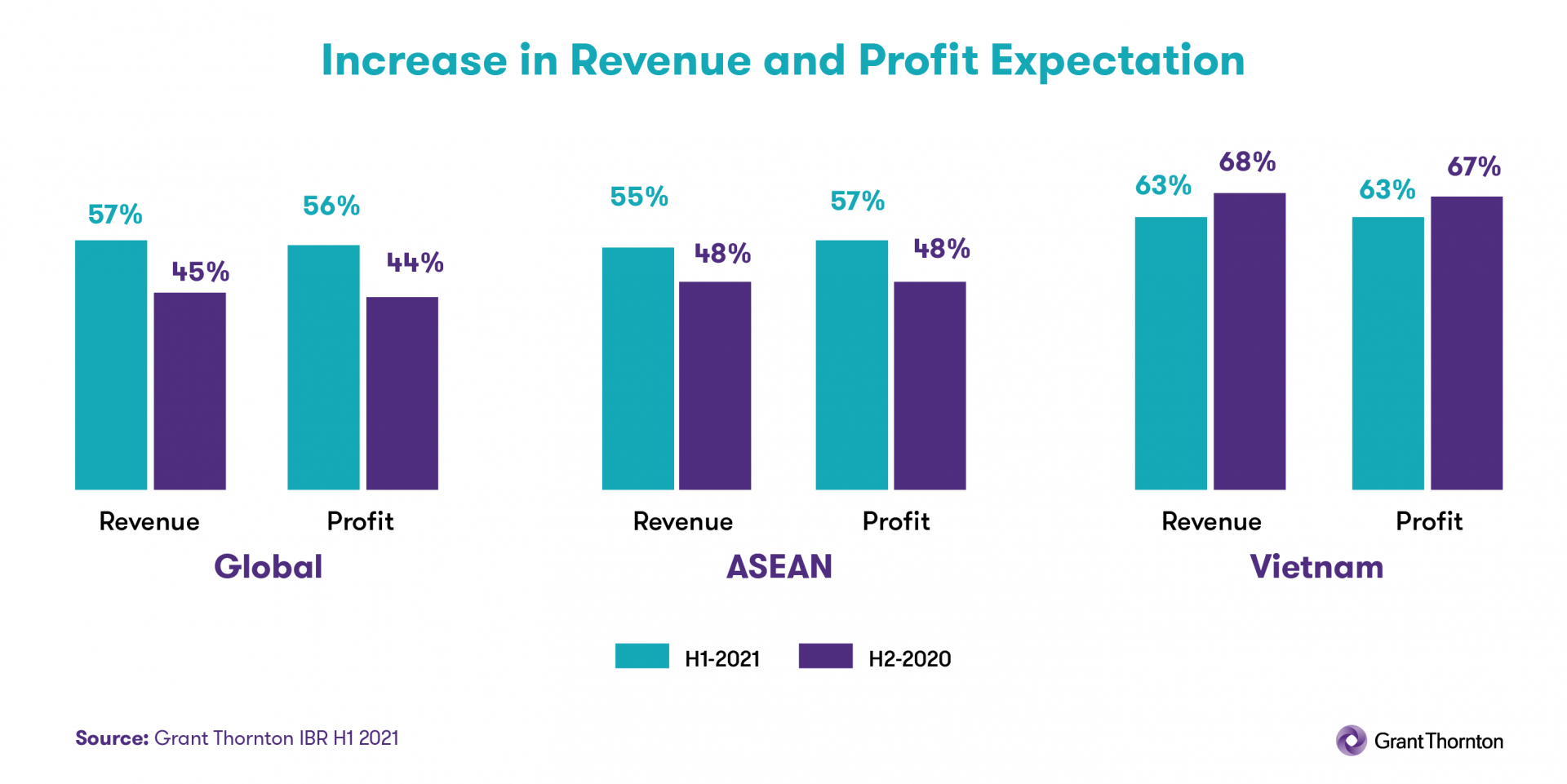

The report indicates that optimism is up 8 percentage points with 58 per cent of mid-market companies now feeling optimistic, which is lower than the 64 per cent in ASEAN. Whilst revenue and profit expectations have fallen by 5 and 4 percentage points, respectively, over 63 per cent of the companies expect yearly increases in both. Whilst a little disappointing, this is still above the ASEAN averages.

Kenneth Atkinson, founder and senior adviser of Grant Thornton Vietnam said: “In Vietnam, whilst mid-market companies displayed amazing levels of health, at the beginning of the pandemic compared to other countries in our survey this has been slowly deteriorating over the last 12 months. In the last six months companies have been impacted by worsening barriers to growth, primarily related to economic uncertainty and demand constraints, largely due to the continued outbreaks of COVID-19. There is some improvement in the general outlook but the elements are mixed with economic optimism and investment intentions strengthening and growth expectations weakening.”

|

Vietnam has shown historic strength in export expectations but the most recent results have shown growth expectations falling by 10 percentage points. This could be due to the timing of the survey which was conducted during the start of the most recent outbreak and the export expectations had increased by 7 percentage points in the second half of 2020.

In terms of the impact of COVID-19 on Vietnamese companies, 59 per cent reported a decrease in sales, whilst 54 per cent cited a loss of business opportunities probably due to the continuing barriers to travel. 41 per cent of companies had faced difficulties because of supply chain interruptions and 40 per cent had experienced work force issues. Another popular challenge citied by 45 per cent of the companies was challenges managing stakeholders.

When looking at COVID-19 impact on earnings before interest, taxes, depreciation, and amortisation (EBITDA), 39 per cent of companies had experienced no change or an increase in 2020. A decrease of 1-9 per cent in EBITDA was reported by 23 per cent of the companies and 18 per cent reported a decrease of 10-19 per cent. 15 per cent reported a negative impact of 20 per cent or greater.

Approximately 90 per cent of companies stated that they would be making major new investments in the coming 12 months. The top four categories for operating system investment were IT security management (55 per cent), companywide IT infrastructure (49 per cent), supply chain (46 per cent), and sales optimisation and accuracy (44 per cent). Interestingly, 33 per cent of companies were going to make investments into enterprise resource planning (ERP) systems.

Vietnam saw a record number of mergers and acquisitions (M&A) transactions last year and 53 per cent of the companies stated that they were considering M&A as a way of strengthening their business whilst 26 per cent were considering M&A as a means of exiting the business.

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- Kurz Vietnam expands Gia Lai factory (February 27, 2026 | 16:37)

- SK Innovation-led consortium wins $2.3 billion LNG project in Nghe An (February 25, 2026 | 07:56)

- THACO opens $70 million manufacturing complex in Danang (February 25, 2026 | 07:54)

- Phu Quoc International Airport expansion approved to meet rising demand (February 24, 2026 | 10:00)

- Bac Giang International Logistics Centre faces land clearance barrier (February 24, 2026 | 08:00)

- Bright prospects abound in European investment (February 19, 2026 | 20:27)

- Internal strengths attest to commitment to progress (February 19, 2026 | 20:13)

- Vietnam, New Zealand seek level-up in ties (February 19, 2026 | 18:06)

- Untapped potential in relations with Indonesia (February 19, 2026 | 17:56)

- German strengths match Vietnamese aspirations (February 19, 2026 | 17:40)

Tag:

Tag:

Mobile Version

Mobile Version