Economic growth slows as GDP rate threatened

|

| Economic growth slows as GDP rate threatened |

| Nguyen Chi Dung - Minister of Planning and Investment

Currently, it is quite urgent to ensure social security for all people. However, it is also necessary to determine what needs to be done now to have timely policy responses, including the compilation of a new national development scenario which will be implemented after the pandemic ends. These are big issues to materialise the goals of minimising the aftermath of COVID-19 on the economy and people’s lives, assessing and forecasting new trends in the region and the wider world, and taking advantage of new opportunities and trends in order to prepare solutions and scenarios for rapid and sustainable economic development. We would need a new mindset and a new positive approach in the context of global economic decline and stagnant production and business, unemployment, and disruption in supply chains and production networks. Economic structures about production, trade, investment, and the world’s order will undergo profound changes. This is also an opportunity for Vietnam to accelerate its economic restructuring, with the supplementation of new sectors and supply chains so as to strengthen the economy’s resilience against global shocks and pandemic, and also to further perfect the country’s institution and regional and global collaboration mechanisms in tackling such shocks as COVID-19. It is also a chance for Vietnam to enact sound and timely policies in order to beef up the restructuring of sectors and the whole economy, and invest more in infrastructure, while increasing the economy’s competitiveness so that the country can be strong enough to engage in the world’s new standing after the pandemic ends. |

Never before has Singapore-invested Indo Trans Logistics Corporation (ITL) faced as great difficulties as it does now. In Vietnam, the coronavirus pandemic has sabotaged the firm’s opportunities to increase revenue and profit at least for this year, with its 200 tractor trailers and 110 trucks operating at 50 per cent capacity compared to normal.

“Demand for transporting goods has dramatically plummeted. After many years, this is the first time we foresee a reduction in revenue for a year,” a ITL representative told VIR. “We cannot talk about growth like we do every year, and we are now trying to keep revenue reduction to 20 per cent this year.”

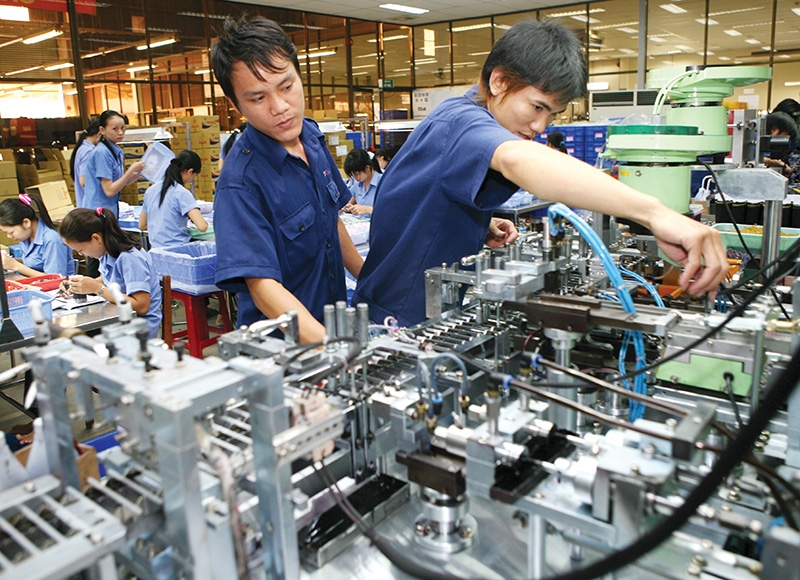

According to a senior official from the Ministry of Planning and Investment (MPI), ITL’s plight is becoming common in Vietnam where local production, especially industrial manufacturing, is badly affected by COVID-19.

“Vietnam’s industrial output has plunged at the fastest speed in six and a half years. The country’s Purchasing Managers’ Index has reduced to below 50 points in February – the first time in four years,” stated an MPI report released last week. “The economy’s index for industrial production in the first quarter of 2020 increased by only 5.8 per cent on-year, far lower than in the same period of 2019 (9.2 per cent), 2018 (12.7 per cent), or 2017 (7.4 per cent).”

The economy is now affected by great and unforeseeable risks, it added. “Thus, it is difficult to reach the growth target of 6.8 per cent this year. COVID-19 has had grave impacts on tourism, transport, and import-export activities. Production and investment activities have and will continue to be hurt. Domestic production activities pertaining to production and supply chains in China, South Korea, Japan, the US, and Europe – all Vietnam’s key trade partners – are expected to continue decreasing due to shortages of materials, labourers, and shrunken demands.”

Last week, Fitch Ratings projected Vietnam’s GDP growth to slow to 3.3 per cent in 2020 on account of COVID-19. This would be the lowest annual growth rate since the mid-1980s.

The Asian Development Bank (ADB) expects Vietnam’s economic growth rate to slow sharply in 2020 to 4.8 per cent from the initial supply shock to economic activity from COVID-19 and the subsequent and ongoing drop in demand from Vietnam’s principal trade and investment partners. The bank forecast that Vietnam’s economy will suffer from a loss of between $675 million and $3.7 billion, or 0.3-1.4 per cent of GDP, and some 750,000 jobs due to the spread of the epidemic.

The biggest sufferers will be the public trade-business and service sector (over $1 billion), the transportation sector ($922 million), and the production-construction sector ($836 million).

The Organisation for Economic Co-operation and Development has also warned that a rise in the outbreak could cause global GDP growth to plummet this year to as little as 1.5 per cent, almost half the 2.9 per cent rate it forecast before the crisis took hold.

Vietnam is quite a large, open economy, with GDP in 2019 of $260 billion and export turnover of $517 billion.

Many major economies that have great impacts on the global supply chains and on Vietnam’s economy are expected to suffer from lowered economic growth forecasts this year, such as Europe (0.8 per cent), Japan (0.2 per cent), South Korea (2 per cent), the US (1.9 per cent), and China (4.9 per cent).

Figures from Vietnam’s General Statistics Office showed that last year, these economies accounted for a large part of Vietnam’s exports, including the US ($60.7 billion), Europe ($41.7 billion), China ($41.5 billion), Japan ($20.3 billion), and South Korea ($19.8 billion).

These markets were also the main sources of import goods for Vietnam, including China ($75.3 billion), South Korea ($47.3 billion), Japan ($19.6 billion), Europe ($14.8 billion), and the US ($14.3 billion).

Vietnam’s trade largely depends on China, which purchased 15.75 per cent of the former’s total goods value last year and was responsible for 29.7 per cent of the former’s import value in 2019.

Meanwhile, VinaCapital last week released its report on COVID-19’s economic impact on Vietnam, expecting the pandemic to reduce the country’s GDP growth by 3 percentage points this year to 4 per cent, due to a -1.5 percentage points hit to growth from a 50 per cent drop in tourist arrivals, -1 percentage point from slower manufacturing output growth, and -0.5 percentage points from slower domestic consumption growth.

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- VNPAY and NAPAS deepen cooperation on digital payments (February 11, 2026 | 18:21)

- Vietnam financial markets on the rise amid tailwinds (February 11, 2026 | 11:41)

- New tax incentives to benefit startups and SMEs (February 09, 2026 | 17:27)

- VIFC launches aviation finance hub to tap regional market growth (February 06, 2026 | 13:27)

- Vietnam records solid FDI performance in January (February 05, 2026 | 17:11)

- Manufacturing growth remains solid in early 2026 (February 02, 2026 | 15:28)

- EU and Vietnam elevate relations to a comprehensive strategic partnership (January 29, 2026 | 15:22)

- Vietnam to lead trade growth in ASEAN (January 29, 2026 | 15:08)

- Japanese business outlook in Vietnam turns more optimistic (January 28, 2026 | 09:54)

- Foreign leaders extend congratulations to Party General Secretary To Lam (January 25, 2026 | 10:01)

Tag:

Tag:

Mobile Version

Mobile Version