Drugmakers tackling disrupted supply chain

|

Late last month Traphaco JSC, the country’s second-largest publicly-traded drugmaker, held its 2020 stakeholders’ annual general meeting to review first quarter performance, discuss new development strategies, and set yearly targets.

The group performed well between January and March when its profit and revenue surpassed the quarterly target by 5 per cent. Traphaco now boasts three big shareholders – State Capital Investment Corporation (35.67 per cent), Magbi Fund Ltd. (24.99 per cent), and Super Delta Pte., Ltd (15.12 per cent).

Better performance in short-term

Along with Traphaco, other domestic drug giants including Imexpharm Pharmaceutical JSC (IMP), Vietnam’s fourth-biggest pharmaceutical firm, and Hau Giang Pharmaceutical JSC (DHG), the biggest, paved rosy paths during the period.

IMP’s total revenue reached VND304.3 billion ($13.23 million), up 10.1 per cent on-year, while total pre-tax profit hit VND51.4 billion ($2.23 million), up 13.2 per cent on-year. Impressively, the portions of its over-the-counter (OTC) and ethical drugs channel (ETC) all grew, with revenue structures up to 69.5 and 30.5 per cent, respectively.

Imexpharm’s foreign ownership limit currently remains set at 49 per cent, with Balestrand Ltd. (5.92 per cent), and Kwe Beteiligungen AG (14.26 per cent) as foreign shareholders.

Similarly, DHG is said to have made revenues of about VND1.2 trillion ($52.17 million) during the span, up from VND854.17 billion ($37.14 million) in the same period last year. DHG now has Taisho Pharmaceutical Holdings, one of the five biggest pharmaceuticals in Japan, as a major foreign shareholder, with a take of 50.78 per cent.

According to an April report from FPT Securities (FPTS), the coronavirus crisis created positive impacts on several OTC drugs from IMP due to increasing local demands for stockpiles. With EU-GMP certificates for its factories, IMP also gained competitiveness in the ETC channel thanks to a reduction of 25-30 per cent in price from foreign-made equivalents.

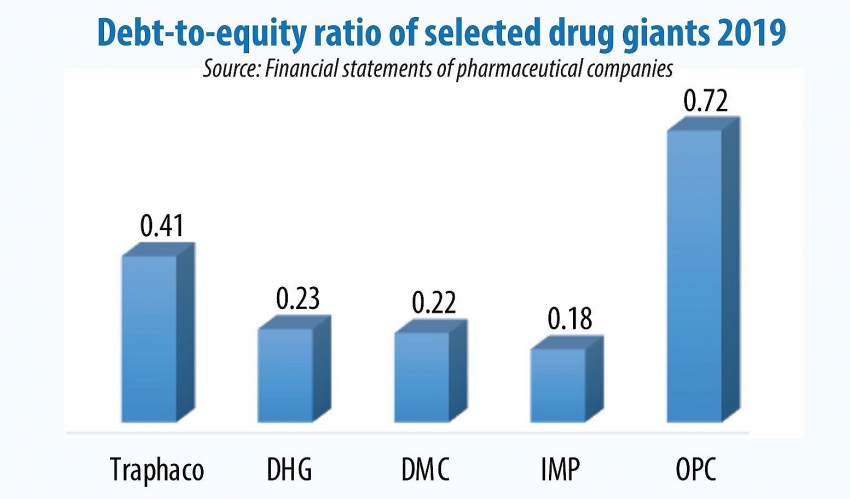

In addition, the giant drugmakers gained the advantage in safe financial structures thanks to a low debt ratio. “The ratio of liabilities to equity stands less than 0.8 times, of which debt on equity is less than 0.3 times, except for Ha Tay Pharmaceutical JSC (DHT). This helps them avoid pressure on debt payment in the economic slowdown,” said Nguyen Vu Cuong, an analyst at FPTS.

Vuong, however, said that COVID-19 did not make significant positive impacts on OTC sales of all domestic pharmaceutical companies in the first quarter, only some. Revenues of drugstores rose strongly during the course at 164 to 168 per cent, driven by a rise in sales of masks, hand gel, and products for immune system strength such as vitamins and groups of analgesic drugs. However, these drugs are not the advantages of all pharma firms.

With the first-quarter improvement, some drugmakers have set higher targets for 2020. For instance, Traphaco aims to make consolidated revenue of VND2 trillion ($86.95 million) and consolidated after-tax profit of VND180 billion ($7.8 million) this year, up 16 and 9 per cent on-year, respectively. Meanwhile, DHG aims to increase its pre-tax profit by a percentage point. IMP even set 25 and 28 per cent on-year rises in net revenue and pre-tax profit, respectively.

Industry insiders have raised concerns over the feasibility of the new targets, despite having the strategies, blaming the fact that the co-operation process between Vietnamese pharmaceutical firms and their partners are stagnant, and interruptions in the global ingredient supply chain due to the ongoing pandemic.

|

Long-term strategies

In 2019, Traphaco faced a challenging year due to stiffening competition from domestic and international rivals, as well as fake products. According to a company financial statement, its consolidated revenue fell 7.5 per cent from the target and nearly 5 per cent on-year to VND1.72 trillion ($74.8 million).

The group focused its efforts on five key solutions last year in a move to create a foundation for future growth in 2020-2025. They included renovating marketing activities, optimising cost, and developing ETC by establishing a hospital marketing division and appointing a deputy general director responsible.

To this end, Traphaco strengthened training, boosted technology co-operation and transfer, and improved investment in production of western drugs. In spite of the efforts, Traphaco’s business results were still lower than expected.

This year, the drugmaker is still concentrating on these business strategies. It aims to get technology transfer for 10-15 drugs from its South Korean partner Daewoong, while seeking new strategic partners to diversify its product portfolio to serve its ETC channel development. At present, the ETC makes up just 8 per cent of sales revenue among top brands of Traphaco’s investment portfolio.

Meanwhile, DHG is taking up some strategies to help the company maintain its OTC market share including expanding its distribution network; boosting co-operation with supermarkets and drugstore chains such AEON Mall, Big C, An Khang, Medicare, Pharmacity, and VinFa; and embracing the e-commerce trend and joining distribution channels such as Lazada, Tiki, TV Homeshopping, and others. Meanwhile, IMP will concentrate on the ETC segment.

Concerns persist

Of course, it is not easy for Traphaco, DHG, and others to obtain the new targets as the coronavirus emergency is somewhat preventing their strategies from developing as planned. “The pandemic is limiting the travel of experts and their partners in virus-hit areas, thus preventing the approval of technology transfer process for production of drugs from EU and South Korean partners among others,” one expert elaborated.

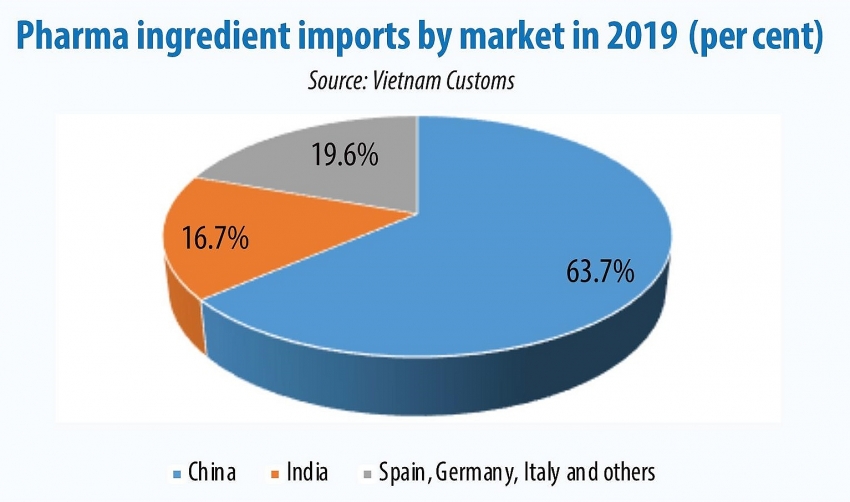

Moreover, many domestic drugmakers are facing a shortfall of ingredients due to the interruption in the ingredient supply chain. At present, Vietnam’s pharmaceutical production relies much on imported ingredients which make up 80-90 per cent of local demands, with which China and India accounted for over 80 per cent.

Since late 2019 due to the coronavirus outbreak, many active pharmaceutical ingredients (API) factories in China are suspended, while India is restricting exports of necessary API. Currently, China is the world’s biggest API manufacturer, accounting for 40-60 per cent. This is proved by Vietnam’s on-year fall of 30.8 per cent in pharmaceutical ingredient imports in February.

According to FPTS, Domesco Medical Import – Export JSC (DMC) and DHG are among those hardest-hit because of the supply chain break. If the pandemic develops more seriously until the second quarter of 2020, DMC, DHG and others will see the shortfall becoming more serious, forcing them to find other sources of supplies outside China and India, thus resulting in a possible reduction in the margin of profit. At present, over 80 per cent of DHG’s ingredients are from imports.

IMP, Traphaco, and OPC Pharmaceutical JSC might have fewer impacts than DHG, DMC, and others as they rely less on ingredients from China and India. IMP is producing western medicines with ingredients coming from the EU, while oriental medicine manufacturers like Traphaco and OPC are able to grow and ensure the supply by themselves. However, to some extent, IMP will still suffer if the virus continues to spread in the long term. The firm’s ingredient imports from China and India makes up 50 per cent of total, while its ingredient stockpile is said to be enough for it to maintain its production capacity by the end of April. For Traphaco, ingredient stockpiles for western medicine production is sufficient until the end of the second quarter.

Industry insiders hope that with the number of COVID-19 infected cases tending to fall globally, and several positive factors (such as resumption in operation of API factories in China since late February and expectation of India to lift restrictions shortly), the pharmaceutical ingredient supply chain will be affected in the short-term only.

“We rate ‘positive’ for IMP, ‘monitoring’ for Traphaco, and ‘negative’ for those lacking ingredients in storage to serve first-quarter production such as DMC, DHG, and others with high debt payment pressures such as DHT,” said Cuong at FPTS.

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- Masan Consumer names new deputy CEO to drive foods and beverages growth (February 23, 2026 | 20:52)

- Myriad risks ahead, but ones Vietnam can confront (February 20, 2026 | 15:02)

- Vietnam making the leap into AI and semiconductors (February 20, 2026 | 09:37)

- Funding must be activated for semiconductor success (February 20, 2026 | 09:20)

- Resilience as new benchmark for smarter infrastructure (February 19, 2026 | 20:35)

- A golden time to shine within ASEAN (February 19, 2026 | 20:22)

- Vietnam’s pivotal year for advancing sustainability (February 19, 2026 | 08:44)

- Strengthening the core role of industry and trade (February 19, 2026 | 08:35)

- Future orientations for healthcare improvements (February 19, 2026 | 08:29)

- Infrastructure orientations suitable for a new chapter (February 19, 2026 | 08:15)

Tag:

Tag:

Mobile Version

Mobile Version