Coworking trends rumble on

|

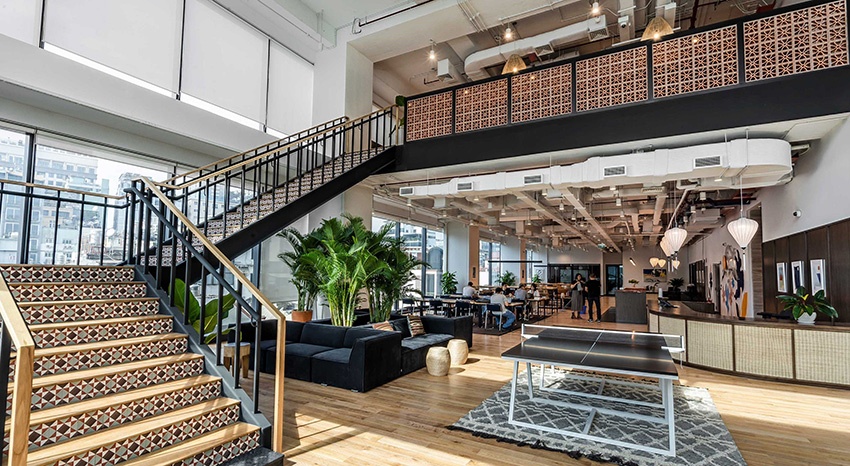

| The Sentry CONNECT at Sonatus |

According to Greg Ohan, CEO and Co-Pioneer of The Sentry, which operates a 6,300 square meter space in central Ho Chi Minh City, and will soon cut-the-ribbons on three further locations in the southern metropolis, comments: “We are seeing a huge drive toward flexible and affordable workspaces from organisations nationwide. Companies are looking for spaces that can scale up with them, and do not want to commit to long leases and significant cap-ex for renovations and fit-outs. Enterprises are also focused spaces they regularly use – they don’t want to be carrying rental costs on rarely used meeting and function and training spaces, for example. They are looking to use those only when they need them, and not carry them month-to-month.”

Entrepreneurs and start-ups as key sectors finding themselves drawn toward co-working, a finding that Ohan’s experience mirrors, citing larger, regional companies with local operations of up to 50 staff, notably in the tech sector – as a sweet-spot for The Sentry.

Meanwhile Hoang Linh, co-founder and CEO of CirCO, said that when the market changes continuously, renting a traditional office will cause many challenges in renewing and renegotiating the lease, thus coworking spaces offer greater flexibility on such issues. The demand for short-term office rentals is increasing.

As both large corporations and small businesses prioritise the use of scalable resources, coworking spaces will thrive and become the norm, according to Linh. This approach will not only benefit employees, but will also allow businesses to limit spending.

Workspace business strategies need to be constantly updated with new policies to ensure the safety of members when coming to the shared workspace. According to CoworkingResources, Vietnam is in the top 50 countries worldwide by coworking growth per capita, and is the 20th largest market globally in terms of the number of coworking spaces.

The country has secured 0.1 new spaces annually for every one million inhabitants. Compared with Singapore, which has almost five new spaces per million inhabitants, Vietnam has a long way ahead.

“This is actually good news for investors entering the market, as sustained development and internationalisation are the underlying foundation for the sector’s growth,” cited a recent report by Acclime Vietnam. “Furthermore, Ho Chi Minh City ranked 41 of 50 cities worldwide in 2019/2020, where every 47 days a new coworking space was established.”

International and local operators are expected to boost the scalability of the industry, by engaging in competitive strategies, partnership agreements, or business consolidation models. From the user’s perspective, these are all beneficial outcomes as market diversity and healthy rivalry creates more added value and flexibility, bringing down the overall office prices as well.

Buoyed by a seismic shift in the way Vietnam works, according to Acclime Vietnam’s managing partner Matthew Lourey, the coworking industry is leading one of the greatest workplace transformations of a lifetime. “How we work, learn, and communicate has changed forever,” said Lourey.

The impact of the pandemic on the way in which people view their workplaces and workspaces has proven a shot in the arm for an already booming sector. While the rate of new entrants to the market has slowed from the pre-pandemic purple patch, the industry’s record occupancy rates reflect a broader change in company culture.

According to Knight Frank Vietnam’s managing director Alex Crane, the terms of traditional office spaces have long been a cause of stress for early startups and entrepreneurs navigating their business operations in their first few years.

“Flexible offices offer timely solutions by allowing occupiers to move straight in, scale their space according to their headcount, budget accordingly, and stay flexible with much shorter contracts than typical traditional office leases. Especially for startups that may not know what their headcount is going to be in a year’s time, having that level of flexibility is imperative for their ability to either grow or downsize if needed,” Crane noted.

However, a lack of a brand ID for occupiers, the possibility of shared facilities being occupied or unavailable at peak times, the risk of distractions in open spaces, as well as some privacy concerns were all highlighted by a recent McKinsey report as problem areas.

Crane cited that flexible space in Vietnam is not only an important tool for corporate occupiers looking at more hybrid-driven workplace models, but also crucial for the growth of Vietnam’s impressive startup scene.

“Five months into 2022 alone, Vietnam recorded nearly 63,000 newly-established companies. Many will register their companies at a coworking space, which they then come to occupy for their fledgling enterprises. We expect the entrepreneurial nature of the Vietnamese population to continue to underpin the need for greater flexible space and this, of course, will be supplemented by multinationals that are continuing to arrive or expand as new market entrants to Vietnam,” he added.

Most coworking spaces and serviced offices in Vietnam are located in metropolitan areas such as Hanoi with 64 locations, Danang with 18 locations, and Ho Chi Minh City with 97 locations, according to Knight Frank Vietnam.

Apart from large, global players such as Regus, which has operated in this sector in Vietnam for over 15 years, Wework and The Executive Center have entered the Vietnamese market in the last three years, while smaller but popular and reliable local coworking brands such as The Sentry, UpGen, CirCO, Toong, and W Business Center are becoming a strong force.

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- An Phat 5 Industrial Park targets ESG-driven investors in Hai Phong (January 26, 2026 | 08:30)

- Decree opens incentives for green urban development (January 24, 2026 | 11:18)

- Public investment is reshaping real estate’s role in Vietnam (January 21, 2026 | 10:04)

- Ho Chi Minh City seeks investor to revive Binh Quoi–Thanh Da project (January 19, 2026 | 11:58)

- Sun Group launches construction of Rach Chiec sports complex (January 16, 2026 | 16:17)

- CEO Group breaks ground on first industrial park in Haiphong Free Trade Zone (January 15, 2026 | 15:47)

- BRIGHTPARK Entertainment Complex opens in Ninh Binh (January 12, 2026 | 14:27)

- Ho Chi Minh City's industrial parks top $5.3 billion investment in 2025 (January 06, 2026 | 08:38)

- Why Vietnam must build a global strategy for its construction industry (December 31, 2025 | 18:57)

- Housing operations must be effective (December 29, 2025 | 10:00)

Tag:

Tag:

Mobile Version

Mobile Version