Corporate bond market poised for stronger growth cycle

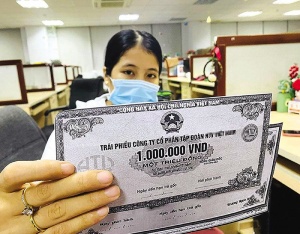

According to statistics from Vietcombank Securities (VCBS), there were 578 corporate bond issuances in 2025, with total issuance value reaching approximately $25.83 billion, up 45.6 per cent on-year.

Issuance volume was concentrated mainly in the banking sector. Funds raised were largely allocated to tenors of 3-5 years, accounting for 43.7 per cent of total issuance value.

Outstanding corporate bond value in 2025 reached an estimated $53.16 billion, approaching the peak recorded in 2021. Notably, alongside issuance growth, bond buyback activities also became more dynamic.

|

Early bond redemptions in 2025 increased significantly, with total value reaching about $12.58 billion, up 43.6 per cent compared to one year ago. Early redemption was concentrated primarily in the banking sector, mainly targeting bonds with original medium-term tenors of 3-5 years and remaining maturities of 1-3 years.

Most of these bond lots were issued in 2024, underscoring a proactive strategy to restructure funding sources and maturities, while easing refinancing pressure in the upcoming period.

Another positive development was the marked decline in delayed principal and interest payments in 2025. Cumulatively from the beginning of the year, the value of bonds with late payments fell by around 22 per cent compared to the previous year.

Several factors are expected to provide meaningful support to the corporate bond market. VCBS forecasts that corporate bond issuance yields in 2026 will gradually rise in line with the broader trend in capital costs, thereby enhancing their appeal relative to other investment channels.

At the same time, amid tighter bank credit conditions and expectations of a slight uptick in lending rates, businesses are expected to more actively diversify alternative funding channels, including bonds, to reduce reliance on bank credit.

However, growth is expected to be selective across companies and sectors, reflecting differences in credit quality, financial structure, and sensitivity to fluctuations in capital costs.

The banking sector is projected to continue dominating in terms of issuance scale and capacity. With system-wide liquidity pressure in 2026 expected to remain significant, and in order to comply with loan-to-deposit ratio caps while preserving room for credit growth, banks are likely to increase corporate bond issuance, particularly medium- and long-term bonds, which will continue to serve as a key funding instrument.

In the real estate sector, market transactions are expected to improve in 2026 as supply increases sharply. End-user demand and social housing projects are being actively promoted, helping developers generate cash flow from sales to meet bondholder repayment obligations.

Importantly, VCBS notes that on the regulatory front, state authorities are gradually reforming the legal framework and removing institutional bottlenecks, aiming to build a more transparent, in-depth, and sustainable corporate bond market.

Last September, the Ministry of Finance has approved the scheme for investor restructuring the investor base and development of securities investment fund industry.

Within this framework, restructuring the investor structure is identified as a key solution, with a roadmap to gradually expand the participation of long-term financial institutions- such as pension funds, social insurance funds, insurance companies, and commercial banks in the capital market, and corporate bond market in particular.

Accordingly, as proposals to ease barriers are implemented on schedule during 2026-2027- including expanding the scope and investment limits for insurance companies and pension funds in corporate bonds. These measures are expected not only to help form a more stable source of demand, but also to strengthen market discipline, promote information transparency, and improve issuance quality over the medium to long term.

Foundational improvements are expected to foster more sustainable market development. On this basis, VCBS forecasts that the 2026-2027 period will serve as an important stepping stone, laying the groundwork for a stronger growth cycle in the corporate bond market in the years ahead.

| Vietnam’s infrastructure expansion accelerates on bond market innovation Vietnam’s infrastructure ambitions, which are estimated to cost $245 billion through 2030, depend on unlocking long-term private capital. |

| Corporate bond issuances surge as firms accelerate capital restructuring Vietnam's corporate bond market saw a surge in new issuances and early redemptions in mid-October, signalling active capital restructuring by businesses amid stable interest rates and improved liquidity. |

| Japanese embassy marks 20 years of Japan-ASEAN bond market support Japan has reaffirmed its long-term support for Vietnam’s capital market development as the two sides marked two decades of financial technical cooperation in Hanoi. |

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Tag:

Tag:

Related Contents

Latest News

More News

- Private capital funds as cornerstone of IFC plans (February 20, 2026 | 14:38)

- Priorities for building credibility and momentum within Vietnamese IFCs (February 20, 2026 | 14:29)

- How Hong Kong can bridge critical financial centre gaps (February 20, 2026 | 14:22)

- All global experiences useful for Vietnam’s international financial hub (February 20, 2026 | 14:16)

- Raised ties reaffirm strategic trust (February 20, 2026 | 14:06)

- Sustained growth can translate into income gains (February 19, 2026 | 18:55)

- The vision to maintain a stable monetary policy (February 19, 2026 | 08:50)

- Banking sector faces data governance hurdles in AI transition (February 19, 2026 | 08:00)

- AI leading to shift in banking roles (February 18, 2026 | 19:54)

- Digital banking enters season of transformation (February 16, 2026 | 09:00)

Mobile Version

Mobile Version